- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 25, 2024 at 3:12 pm #8100June 25, 2024 at 3:00 pm #8099June 25, 2024 at 2:12 pm #8098June 25, 2024 at 1:31 pm #8097June 25, 2024 at 1:27 pm #8096

Yields up, commodities are not happy post-data (see commodity currencies for trade opps). With Usd bid I have a comment on UsdJpy.

If you look at the tail end of last Friday, the market tried 3 times to breach an hours long high and gave up for fear of BoJ. At the last minute it bolted upward to close higher. They simply were running stops. Those were larger entities already riding longs from far below with nothing to lose but a very small % of gains. Last night in Asia no one showed up to challenge and all that were left were mid-size entities with a lot to lose if BoJ intervened, so they coughed up yardage and I was in already and made money. That pair is a spec game right now akin to Roulette. I believe they will likely challenge the BoJ higher than 160 but not much and if you are thinking of being long, good luck.

June 25, 2024 at 1:09 pm #8095June 25, 2024 at 1:00 pm #8094EURUSD 1.0705 after failure to test 1.0748

This time I will creadit The Amasing Trader and its trading levels

EURUSD BULLS 0

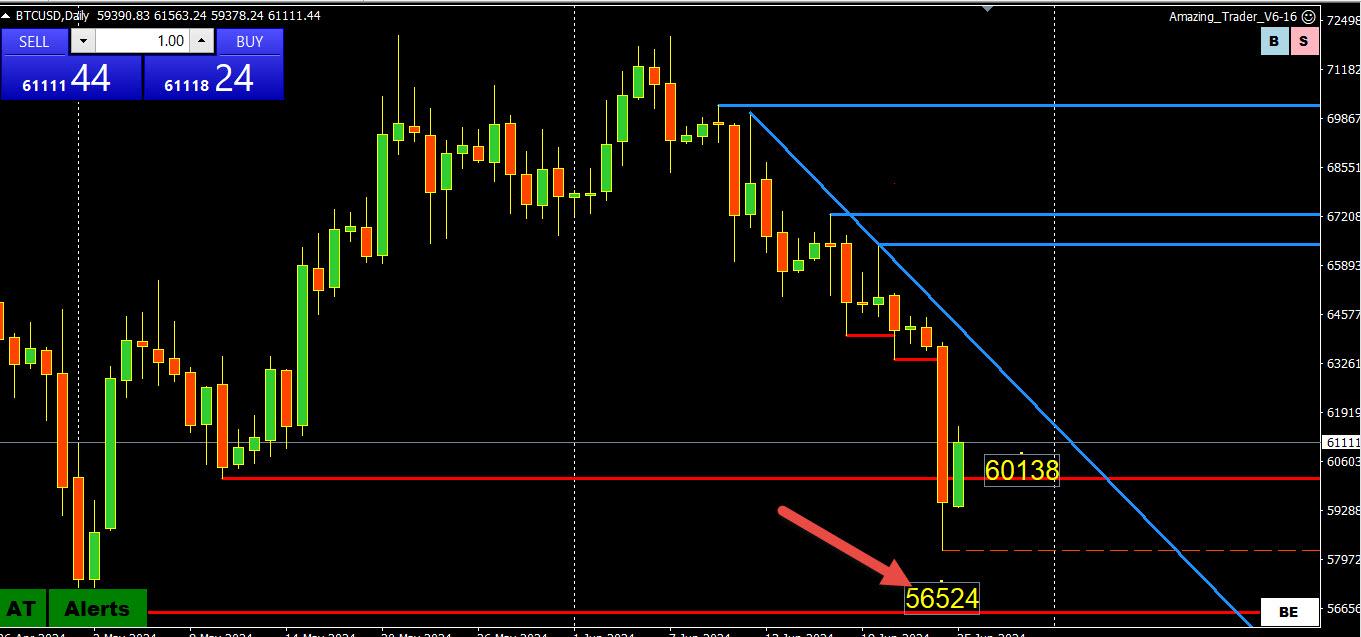

June 25, 2024 at 12:55 pm #8093June 25, 2024 at 12:20 pm #8092June 25, 2024 at 12:17 pm #8091BTC DAILY CHART – Fakeout?

–

– Is this a one day fakeout with BTC back above 60K after a 7% plunge yesterday?

– Did someone defend the key 55-56+k levels to prevent a meltdown?

– It seems to be more questions than answers So watch the 60K level as it will gice you the answer going forward in what could be a lower 55-65K range.

–

June 25, 2024 at 12:06 pm #8090Pre-data risk comment (It is 5am here). After some conversation over the subject of a middle east war possibly widening to include Iran due to Hezbollah attacking Israel, my position is Iran will not risk going to full out war with Israel because the US-Britain-Canada et al would become fully engaged and the Mullah’s do not want to lose their Rolls Royce’s. It comes down to the Rolls.

June 25, 2024 at 11:55 am #8089June 25, 2024 at 11:35 am #8088A look at the day ahead in U.S. and global markets from Mike Dolan

In an glimpse at how megacap tails wag the dog, a near half-trillion dollar shakeout in AI-bellwether Nvidia’s (.NVDA), opens new tab market cap in just a week continued to drag on the entire market even though most S&P500 (.SPX), opens new tab stocks ended higher on Monday.

Morning Bid: Nvidia’s half trillion hiccup; Bitcoin, China slide

June 25, 2024 at 11:25 am #8087EURUSD 4 HOUR CHART – IF IT WASN’T FOR…

If it wasn’t for the US PCE and quarter end on Friday trading the EURUSD would be easy, at some point ahead of the weekend it wouLd turn defensive ahead of Sunday’s vote.

So let’s look at the chart.

– Failed to test 1.0748, keeps the bounce a correction.

– 1.0720 (just broken) expooses 1.0700 if the break holds with key levels at 1.0685 and 1.0667.

June 25, 2024 at 10:43 am #8084June 25, 2024 at 9:51 am #8082USDJPY 4 HOUR CHART – THE BATTLE FOR 160

Let’s take a longer-term view as the battle for 160 and the 160.16 high continues.

So far, there is a lower top (159.92).

Looking farther ahead, scroll down to see the post with a link to an article about the next BoJ meeting at the end of July and a possible double whammy of monetary policy tightening.

This suggests the longer the 160 level caps the upside the closer JPY bears would get to turning defensive ahead of the meeting.

With that said, 1+ months ahead is an eternity in the trading world but it pays to keep the above in mind if 160 continues to cap the upside.

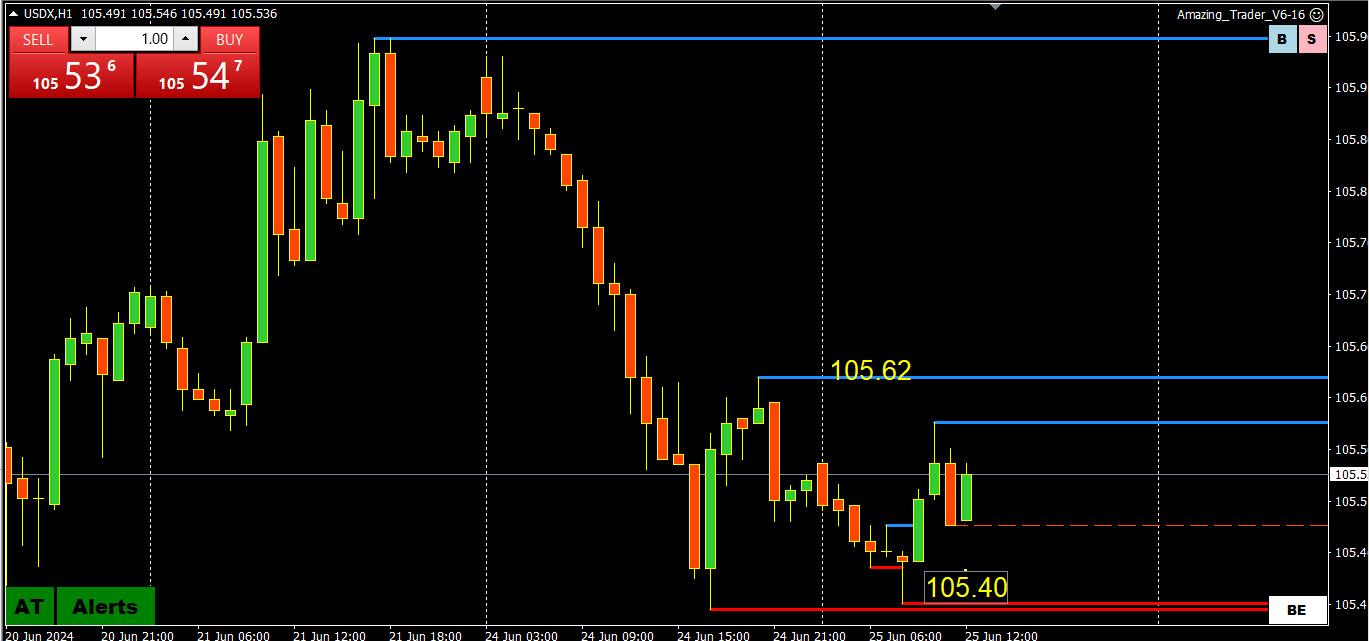

June 25, 2024 at 9:29 am #8081USDX ONE HOUR CHART – EURUSD PROXY (57.6% of the index)

What caught my eye today walking is that all major currencies are about unchanged on the day, USDX has a near double bottom mirrored by a EURUSD near 2-day double top.

So it is a matter of looking at your cup as half empty of half filled but for the EURUSD, the move up could not test 1.0748-61. It is now dependent on 1.0720 (also the day low) holding or risk a return to 1.07.

June 25, 2024 at 8:09 am #8080TOKYO, June 25 (Reuters) – The Bank of Japan is dropping signals its quantitative tightening (QT) plan in July could be bigger than markets think, and may even be accompanied by an interest rate hike, as it steps up a steady retreat from its still-huge monetary stimulus.

June 24, 2024 at 10:55 pm #8079Finally Everything You Expect From a Broker in a Prop Firm

Click for more information (and a 10% discount)

\

June 24, 2024 at 10:55 pm #8078Finally Everything You Expect From a Broker in a Prop Firm

Click for more information (and a 10% discount)

\

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View