- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 26, 2024 at 11:59 am #8123

In a year supposedly filled with central bank interest rate cuts around the world, the prospect of another G10 policy tightening amid fresh strains of stubborn inflation is just a bit jarring.

With U.S. markets anxiously awaiting Friday’s update on the Federal Reserve’s favored PCE inflation gauge, Australia’s dollar jumped 0.5% overnight after inflation there unexpectedly accelerated to a six-month high of 4% in May with core price up for a fourth month.

June 26, 2024 at 11:57 am #8122USDX DAILY CHART – USD PROXY

Normally I loon at the USDX as a EURUSD proxy (57.6% of the index) but this time it is moving up because of USD strength with the currency up vs. all majors except the AUD (which is off its post-CPI high).

Looking at the chart, major resistane is 106.60 and for it to be seriously challengerd, EURUSD would probably need to at least take out 1.0667 and 1.0650.

June 26, 2024 at 11:21 am #8121June 26, 2024 at 11:13 am #8120June 26, 2024 at 10:29 am #8119USDJPY DAILY CHART – LAST LINE OF DEFENSE

What can I say?

Will the MoF/NoJ defend 160.16 or not?

As I have noted, if I was in the BoJ’s shoes, I would let stops get run above 160.16 and then come I hard with intervention but my feet are too small to fit into its shoes.

AboVe 160.16 there is a black hole that goes back over 34 years.

June 26, 2024 at 10:14 am #8117June 26, 2024 at 9:49 am #8115GBPUSD 4 HOUR CHART – WINNING STREAK BROKEN

With the GBPUSD 9 candle winning streak broken after a failure to regain 1.27+, attention shifts to the 1.2621 low, but only if it can establish below 1.2669.

With that said, GBPUSD is a laggard as it gets support from various crosses, (EURGBP lower, GBPJPY higher).

This comes in the year of elections where the UK vote is so far not having much impact. Here is an article in this regard

June 26, 2024 at 9:36 am #8114AUDNZD DAILY CHART – ANTHERTWINNER IS…

How do we know when a cross flow is driving the spot market?

One clue is when two related currencies move in opposite direction.

This is the case with the AUDUSD (higher) and NZDUSD (lower)

Key resistance next at 1.0944, blocks a move to the maor 1.0997-1.1030.

Expect support on dips while above 1.0840-90, stronger if above the top of this band.

June 26, 2024 at 9:26 am #8113AUDJPY DAILY CHART – A WINNER IS…

AUD up after hotter CPI (scroll down to see an AUDUSD chart posted pre-CPI).

AUDJPY has been a winner, extending its winnig streak to 9 days and trading in unchartered waters with no clear resistance other than the new high.

Cross offsets are one reason USDJPY is pressing towards 160.

Expect a buy the dip on any decent retracement unless 103.58 is broken..

June 26, 2024 at 8:59 am #8112June 26, 2024 at 8:27 am #8111Nvidia NVDA

Not my style to go with stocks early Europe, but Pre market price and current situation called for it..

Monday Nvidia hit low at 118.00 , support held and now it is Up at 128.75

Look at previous pattern on Feb. 21st-22nd – is this the same ? Might be , taking into account huge jump in volume and volatility.

June 26, 2024 at 8:19 am #8110

June 26, 2024 at 8:19 am #8110EURUSD 4h

Supports at 1.0675 & 1.06550

Resistances at 1.07000 , 1.07150 & 1.07250

Moving lower right now, but I don’t like the pattern – these two supports can underpin the pair to 1.08500 area.

So if selling it, take your profits just above the first support.

If buying it, wait for approach to the first support, and place stop bellow the second ( lower) one.

As I said previously, if they break below 1.06500 , road is open….but now timing comes into play….wasting time is going to help EUR.

June 26, 2024 at 7:34 am #8109June 25, 2024 at 11:35 pm #8108

June 26, 2024 at 7:34 am #8109June 25, 2024 at 11:35 pm #8108Finally Everything You Expect From a Broker in a Prop Firm

Click for more information (and a 10% discount)

\

June 25, 2024 at 11:15 pm #8107EYE ON YELLEN

–

Yellen telling Yahoo finance Jennifer Schonberger Senior Reporter on Jun 24 that“They (The FED) certainly do not want to cause a recession when it is unnecessary.”

But janet does not explain the circumstances that would make the FED want to cause a recession, sly as she may be

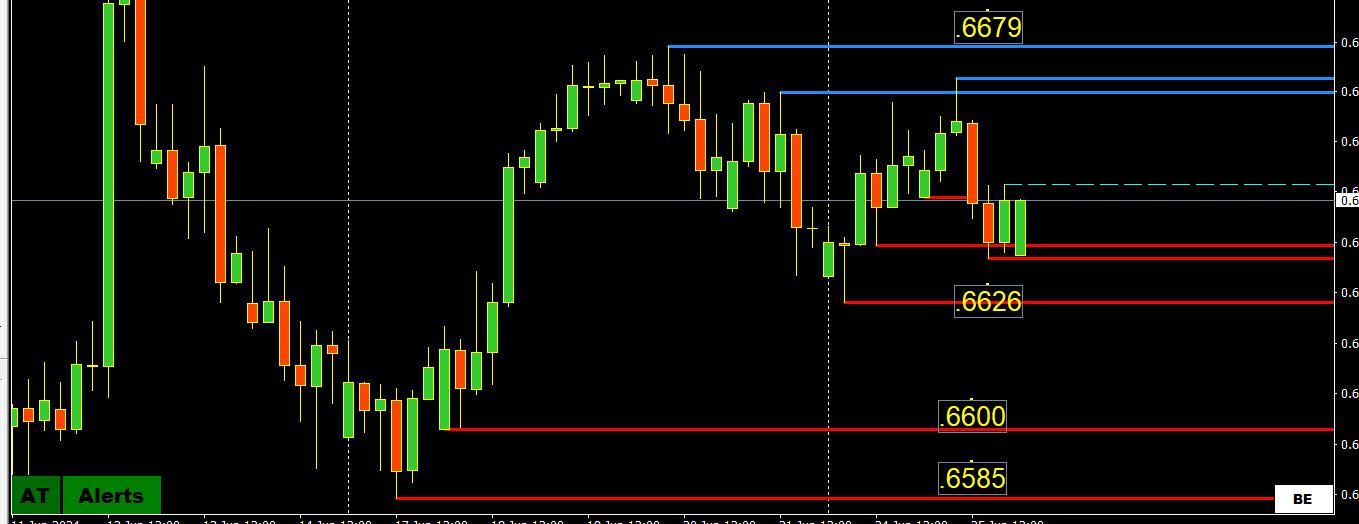

June 25, 2024 at 9:48 pm #8106AUDUSD 4 HOUR CHART – WAITING FOR CPI

Chart shows key levels on both sides in a market that remains hyper sensitive to inflation data.

See a detail preview in Newsquawk’s Week Ahead

June 25, 2024 at 8:47 pm #8105June 25, 2024 at 6:34 pm #8104June 25, 2024 at 6:27 pm #8103Earlier today

–

“Should the incoming data indicate that inflation is moving sustainably toward our 2 percent goal, it will eventually become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive,” Bowman said in prepared remarks for a speech in London. “However, we are still not yet at the point where it is appropriate to lower the policy rate.” – jeff cox, cnbcJune 25, 2024 at 5:44 pm #8102 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View