- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 26, 2024 at 7:57 pm #8144June 26, 2024 at 7:50 pm #8143June 26, 2024 at 7:45 pm #8142June 26, 2024 at 7:38 pm #8141June 26, 2024 at 7:37 pm #8140

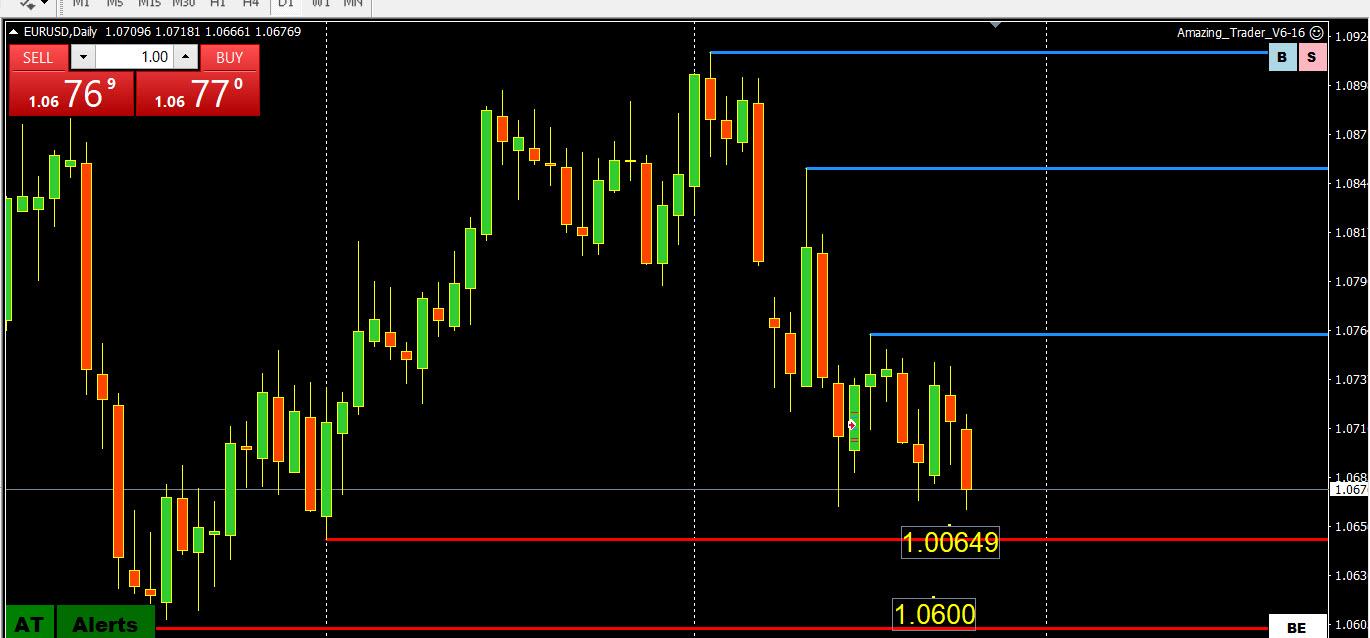

EURUSD DAILY CHART = PAUSE OR BREAKDOWN?

With the exception of the AUDUSD, which gave back its post-CPI gains, it has been a USD day with the highlight the USDJPY breakout SMASHING through 160.16.

EURUSD joined in the party and although the was low just 1 pip below 1.0667, it is probably only a pause unless 1.0700+ is renewed.

Should 1.0666-67 be firmly broken, 1.0649 and 1.0600 become the targets.

June 26, 2024 at 7:34 pm #8139June 26, 2024 at 7:28 pm #8138USDJPY Daily

Supports at : 160.350, 159.900 & 158.850

Resistance – what resistance ??

Unless Ninjas from BoJ comes in overnight ( or whenever they feel like it ) , we are facing 164.000 +

In my opinion, that is the level that BoJ has to protect as once above, it opens the way all the way to 175.000….

June 26, 2024 at 4:30 pm #8137June 26, 2024 at 3:31 pm #8135June 26, 2024 at 2:44 pm #8134

June 26, 2024 at 4:30 pm #8137June 26, 2024 at 3:31 pm #8135June 26, 2024 at 2:44 pm #8134One final note and I will stop obnoxiously clogging the forum. My opinion carries a little weight. It is important to remember I know what it is like to run a national bank program at a headquarters with 726 employees covering $16 billion in assets and was the star of the show in some respects eventually. Have seen a thing or two. Also, I have found a few of you “youtube gurus and forex guru’s out their claiming to have backgrounds stealing my commentary from this and other places. Please do so with care and responsibility, and your own input as well, thank you.

June 26, 2024 at 2:34 pm #8133MoF/BoJ are likely waiting for this week’s pivotal US data to conclude and resulting price activity to answer the question of whether to intervene or not. The bottom line, if I were a bank VP, is the Yen simply must begin to appreciate for the good of the Japan economy. I believe it will see 150 region inevitably but that is months down the road, so then if you are on the trade the problem to solve becomes efficient scaling in and out along the way (your boss is happy and the bills are paid if you are taking profits). That is where the endless intra-day battles you endured sharpened your skill levels and you can be pretty good at it.

With reference to the Euro comment and where to position, that is for longs (closer to the low end of a big figure). If going short, you want to make the throw closer to the high end of a big figure. Same for Intra-day (.8 vs .2 or just go .5 to make sure you are in the trade). I am only so confident in the Euro economic performance looking out, and the US is beginning to breathe heavy a little, so being long Euro/stocks is a bit dicey from here but barring something profound the train should keep rolling.

Precision and an awareness of fundamentals both matter.

June 26, 2024 at 1:56 pm #8132The one I am having issue with is the Euro long due to the price taken. Ordinarily it is preferable to take a price closer to a lower level of a figure not a higher level. Then there are those times you don’t want to be late on the throw and risk it if you see the receiver breaking and take the hit while the ball is in the air (US quarterback talk). Jay was a sportsman and on occasion refers to such analogies. Well, ball is in the air. If you are new to this in forex, especially in spot Forex, it really is like that a lot of the time. This business is not picking daisies.

June 26, 2024 at 1:40 pm #8131June 26, 2024 at 1:36 pm #8130Shorting UsdYen 106.50 to hold and the buy side of Euro from 0665 to hold with the understanding, especially with Euro there could be a bit of a delay and a bit of a grind that causes one to be patient. Looking for the 156 region for UsdJpy. See stocks staying bid overall despite a bit of economic slowing and recent outflows.

June 26, 2024 at 1:35 pm #8129June 26, 2024 at 1:32 pm #8128June 26, 2024 at 1:22 pm #8127June 26, 2024 at 1:07 pm #8126June 26, 2024 at 12:56 pm #8125June 26, 2024 at 12:52 pm #8124 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View