- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

July 3, 2024 at 2:03 pm #8529July 3, 2024 at 1:36 pm #8528

Weeks ago a highly skilled trader and genuinely good person asked me which entities I thought are behind most of the rate, currency, and alternative flows of late. I track a lot of information on a daily basis to the point you would think I run a bank. There is no question that UBS, Goldman, Barclays, and Morgan Stanley are considerably aggressive in testing new markets and participating in staples. Considering the logistics of the firms, one could argue a weighty portion of market activity is from somewhat politically neutral sources regarding US politics and market allocations. Ultimately their primary function is to produce solidity and return for investors is it not? I like that aspect of the current markets-wide participation climate.

Outward US bond shorts are increasing after the 1st debate in the US, indicating higher yields for longer in the eyes of those institutions should Trump be elected. Should Biden or a different candidate be elected from the democrat party one might argue that dynamic is likely to completely be the opposite, which is why those banks are taking those rate oriented positions in strategies which allow them to maneuver if so. Significant market players are doing a very good job of forecast positioning. Major institutions also heartily passed recent stress tests, which test their ability to withstand sudden market shocks. Something to consider looking forward.

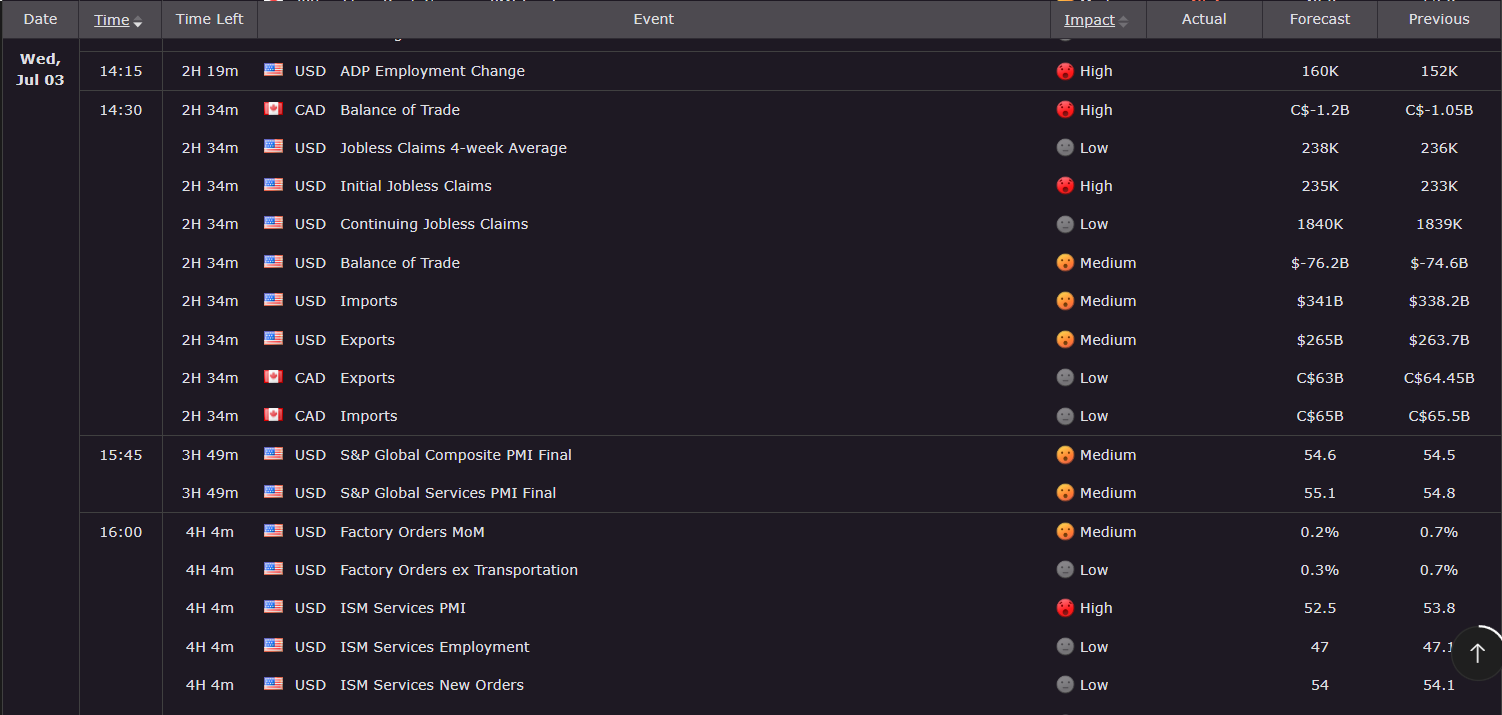

July 3, 2024 at 1:19 pm #8527July 3, 2024 at 1:08 pm #8513The US trade deficit widened 0.8% to $75.1 Billion. That is the highest level since October 2022. Both imports and exports fell. The US also has that little thing called spending at a rate resulting in an added $1 Trillion every 100 days since 2020. This raises the question, at what point will the repercussions of US policy begin to take an almost unfixable toll on the US population by the heroin addicts taking bribes from the likes of Soros who are running the show?

July 3, 2024 at 12:12 pm #8511July 3, 2024 at 10:58 am #8510July 3, 2024 at 10:43 am #8509July 3 (Reuters) – A look at the day ahead in U.S. and global markets from Mike Dolan

Federal Reserve chair Jerome Powell managed to smooth some election-ruffled feathers in bond markets on Tuesday, helping Wall St stocks back to all-time highs as a sweep of labor market soundings are due ahead of the July 4 break.

July 3, 2024 at 10:36 am #8508July 3, 2024 at 10:22 am #8507USDJPY 4 HOUR CHART – IN UNCHARTERED WATERS

When USDJPY established above 160 into 38 year highs and unchartered waters I point ot:

In the absence of any key levels, the most recent new high becomes key resistance.

While above 160, targets are 162-163.50-165.00.

Also, if looming for a MOF/BOJ lime in the sand, it would either be 162 or 165.

While you have t be aware of an intervention surprise when markets turn thin as over the US holiday, it would be a verydifficult task to change the mood as pressure is coming not inly vs the dollar but from various crosses,

July 3, 2024 at 10:09 am #8506July 3, 2024 at 10:05 am #8505July 3, 2024 at 9:57 am #8504July 3, 2024 at 9:53 am #8503July 3, 2024 at 9:46 am #8502July 3, 2024 at 9:38 am #8501July 3, 2024 at 9:31 am #8499July 3, 2024 at 1:00 am #8496July 3, 2024 at 12:14 am #8495Bank of Japan bought Y 150 billion in Japanese GB with a 10-25 year maturity, which is the same a last time and so it is a reflection that they are not panicking with Yen approaching 162, although it is a 38 year low if I am correct and so one might think caution is prudent with Yen pairs. Trail it with sell stop(s).

July 2, 2024 at 11:59 pm #8494July 2, 2024 at 10:43 pm #8493POLITICS

for who does the bell toll

when it is a question about the good (read survival) of the party

–

CNN

Some top Democrats want Biden to quit race this week

A growing number of Democratic leaders are saying they want him to step aside for the good of the party

and ever mind egg on their face

boyz n girls u r witnessing the finesse of brutality in politics:

no-one is bigger than the matter of life of a party

biden s a gonner. matter of even maybe only hours now

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View