- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

July 16, 2024 at 10:08 am #9178

USDCAD 4 HOUR CHART – CPI ON DECK

Next focus is on CPI at 12:30 GMT amid talk of a risk of a July rate cut

As this chart shows, USDCAD is trading with a bid ahead of cpi but there is little until 1.3755 so no key stops nearby.

On the downside, 1.3610-30 is support ahead of 1.3589 low.

This makes 1.3589-1.3755 the key range on this chart.

July 16, 2024 at 10:06 am #9177July 16, 2024 at 10:00 am #9176July 16, 2024 at 9:48 am #9174July 16, 2024 at 9:34 am #9173USDJPY 4 HOUR CHART – INTERVENTION THREAT LOOMS

USDJPY rebound from yesterday’s brief break to 157.15 has renewed 158+ (high 158.79) before backing off as the intervention threat looms (reports indicate the BoJ intervened in July 12).

Only a break of 159.45 would put 160 in play again, suggesting the current range may be 157-159.

Ignored has been a drop in US yields which have given back yesterday;s Truno Trade gains.(4.18% 10 year)

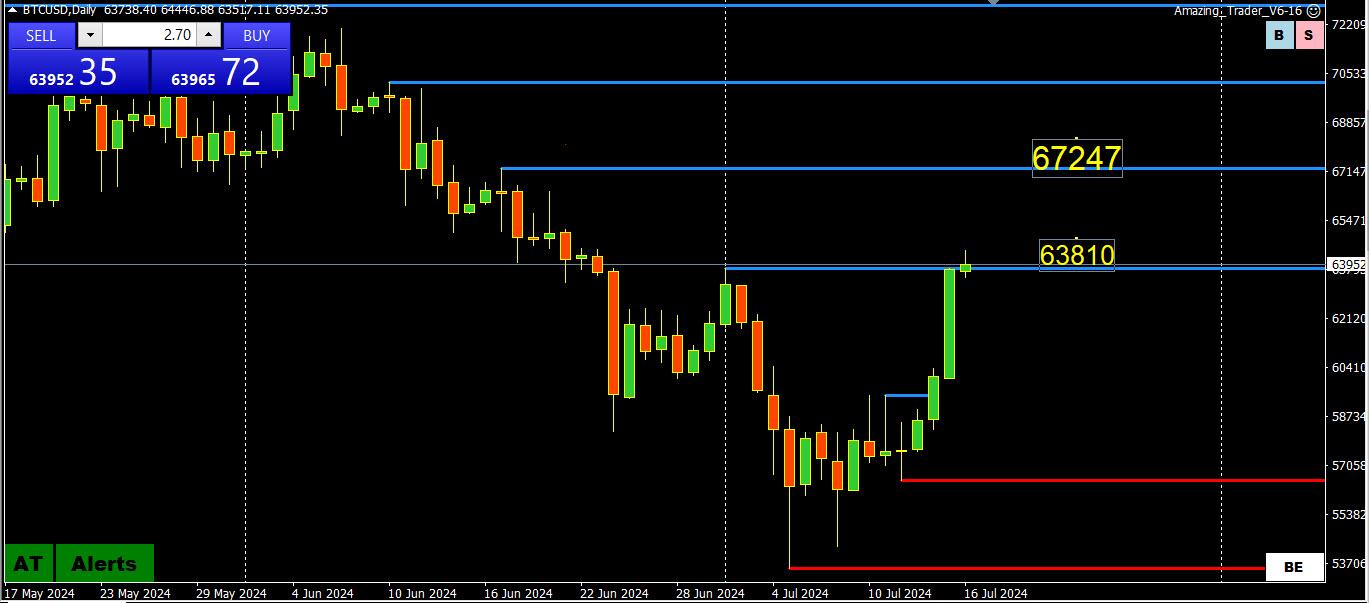

July 15, 2024 at 10:56 pm #9171July 15, 2024 at 10:27 pm #9170BTC DAILY CHART – PART OF THE TRUMP TRADE?

BTC sharp rise on Monday could be part of the Trump Trade as it is assumed he would be more favorable to cryptos if he wins the election.

Using this chart, if 63810 is firmly broken, it would confirm an uptrend.

To keep it simple, if 65k+ is established then 70k would be back on the radar with the record high looming above it.

July 15, 2024 at 9:53 pm #9169July 15, 2024 at 8:10 pm #9165July 15, 2024 at 7:24 pm #9163Nasdaq – NDX

Wall Street set to rise as investors bet on second Trump term

U.S. stock indexes were set to open higher on Monday, as traders priced in a greater chance of presidential candidate Donald Trump winning a second term after surviving an assassination attempt, while rate cut hopes further boosted sentiment.Under Trump, markets expect a hawkish trade policy and looser regulations over issues from climate change to cryptocurrency.

July 15, 2024 at 7:19 pm #9162

July 15, 2024 at 7:19 pm #9162EURUSD Monthly

When in doubt, go for a Bigger picture…and this is the biggest one.

I’ll skip on usual Supp/Res – look for it on smaller time frames like Daily

What is emerging here is a Bullish Pattern , that might lead the pair through both of resistances – Downtrend lines.

If taken out, we’ll be facing a drastic change – Downtrend from Mid 2008. will turn into Uptrend.

We have to be aware that big fundamental news can screw it all up….and we are in the middle of some serious political upheaval – both in Europe and USA.

1.30 would be the first target .

July 15, 2024 at 7:09 pm #9161

July 15, 2024 at 7:09 pm #9161XAUUSD – Gold – Weekly

An interesting situation developed on Gold :

We are facing possible triple top, but 2295.00 Support held – what makes it interesting is the fact that the support is a previous Resistance of a Channel ( so now support ).

Seems as interest in Gold is not slowing down…

If this is the case, we might see 2.600.00 after all .

July 15, 2024 at 7:02 pm #9159July 15, 2024 at 6:50 pm #9158

July 15, 2024 at 7:02 pm #9159July 15, 2024 at 6:50 pm #9158Amazon – AMZN

Amazon Set To Top Last Year’s Prime Day Results Due To Early Deals, Analysts Say

Amazon.com, Inc. AMZN should beat last year’s Prime Day results due to “early access deals,” analysts say.Bank of America BAC expects sales for this year’s 48-hour sales spree to jump 7% to $13 billion, beating the 6.1% sales leap to $12.7 billion posted during last year’s Prime Day

July 15, 2024 at 6:44 pm #9157

July 15, 2024 at 6:44 pm #9157Tesla – TSLA

Tesla surges as Musk’s Trump endorsement boosts hope for self-driving tech approval

Electric automaker Tesla’s shares TSLA rise 5.2% to $261.22** TSLA fell 1.3% in the week ended July 12 after rising over 27% in the prior seven-day period

** Company’s CEO Elon Musk publicly endorsed Donald Trump on X for the U.S. presidential race

** Endorsement came after assassination attempt on Trump at a rally in Pennsylvania on Saturday

July 15, 2024 at 6:40 pm #9156

July 15, 2024 at 6:40 pm #9156Nvidia – NVDA

Nvidia’s Stock Surge Raises Concentration Risks For Investors, Warns Analyst: Not ‘Smart…To Have That Many Eggs In One Basket”

Asset managers have increased their holdings of Nvidia as its stock price has surged. Data from Morningstar reveals that 355 actively managed funds held Nvidia positions that accounted for 5% or more of their assets at the end of the first quarter of 2024, a significant increase from 108 funds in the same period last year.

July 15, 2024 at 4:55 pm #9151July 15, 2024 at 4:48 pm #9150July 15, 2024 at 3:01 pm #9147

July 15, 2024 at 4:55 pm #9151July 15, 2024 at 4:48 pm #9150July 15, 2024 at 3:01 pm #9147holding riski assets eh ?

Goldman challenges Fed’s demand it hold more capital after stress test, FT reports

July 14 (Reuters) – Goldman Sachs (GS.N), opens new tab has lodged an appeal with the U.S. Federal Reserve challenging its result in the regulator’s most recent “stress test,” which is set to force the bank to hold a greater amount of capital, the Financial Times reported on Sunday, citing people familiar with the matter.

The Federal Reserve’s annual “stress test” exercise showed last month that the biggest U.S. banks would have enough capital to withstand severe economic and market turmoil but firms faced steeper hypothetical losses this year due to riskier portfolios.

The tested banks overall saw losses of 17.6% to existing loan balances on credit cards and among them Goldman Sachs recorded 25.4% in losses.July 15, 2024 at 2:24 pm #9146My enemies at Black Rock just hit a $10.6 Trillion asset valuation, but my friends at Goldman hit a 150% profit gain on some really smooth trading acumen. Always loved Goldman. Hate BlackRock, bad people.

US Dollar has legs on the attack on Trump, and judging by the mood of people who have called me about it even the somewhat liberal one’s are angry at the current establishment. I think there will be a lot of pre-election pricing which will become quite muted about 3 weeks prior.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View