- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

July 20, 2024 at 11:03 pm #9404

Click below for detailed previews

Newsquawk Week Ahead: Highlights include US PCE, BoC, PBoC LPR, PMI’s and Tokyo CPI\\

July 20, 2024 at 10:58 pm #9403NEW YORK, July 19 (Reuters) – As earnings season goes into full swing, bullish investors hope solid corporate results will stem a tumble in technology shares that has cooled this year’s U.S. stock rally.

Wall St Week Ahead: Investors count on earnings to calm $900 billion US tech rout

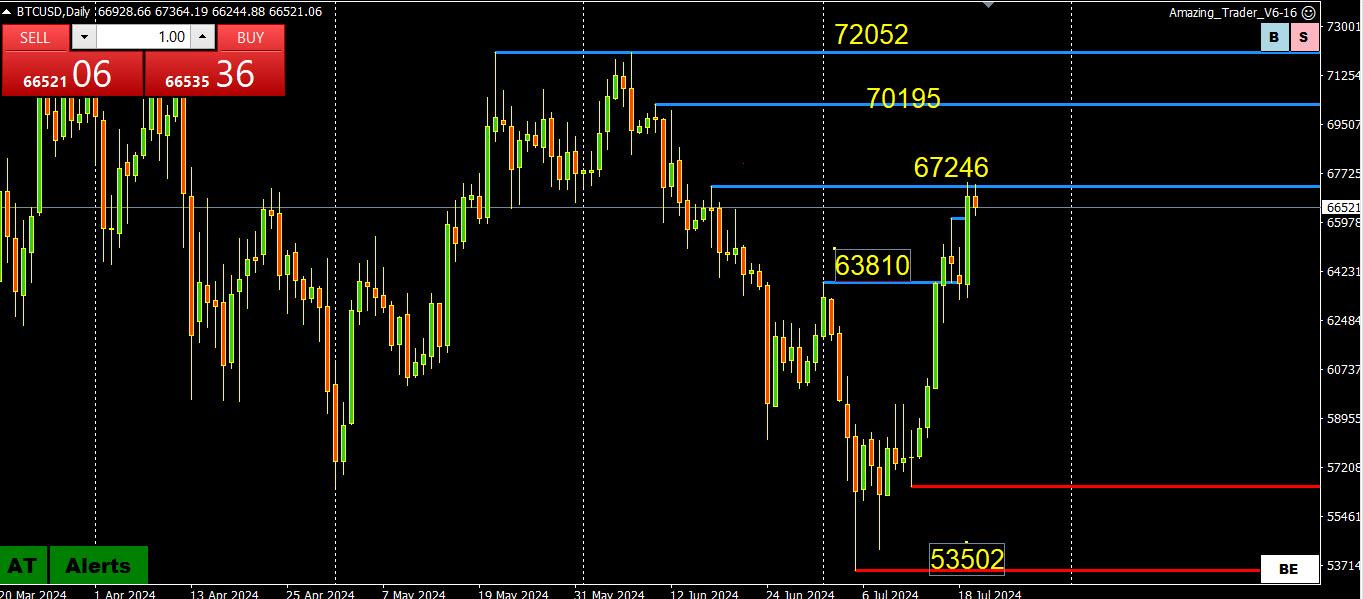

July 20, 2024 at 6:36 pm #9402July 20, 2024 at 11:21 am #9400BTC DAILY CHART – A run at the record high?

BTC bucking the trend on Friday by rising sharply has some talking about a run at the record high above 73K.

This is not something I can predict. Chart shows layers of resistance above 70K/

To keep it simple watch 65k and 70K. Above 65k needs to hold to keep pressure on the upside.

Technical levels are shown on the chart.

July 20, 2024 at 2:02 am #9398July 19, 2024 at 11:07 pm #9397Who wants to bet good ol’ joe is in it to win it

OR

Who wants to bet good ol’ joe is pulling out his nomination candidacy by Sunday eve ?Memo – reprinted on CNBC

Biden won’t drop out, campaign insists in a new memoAnd nevermind any trade musing: lets just load up on popcorn or some vegies and dip and …

watch the attempted figurative (?) personal injury of ol’ joe, with prejudice.July 19, 2024 at 8:23 pm #9396July 19, 2024 at 8:13 pm #9395Noting the Nasdaq Bank Index is only peeling a little gains off of the table from the tremendously strong gains of the month. This, along with some other things, has me not at all satisfied that a risk off environment is deep enough to result in hyperbolic prognostications of crashes and tops and bubbles and the see I told you so crowd. It makes perfect sense to me that institutions would be simply maneuvering in response to the geopolitical conditions of the past two weeks. That does not mean we won’t have some sell cycles along the way. The very strong gains immediately following Trump seemingly taking over in some sectors was another counter-argument to the “if he is elected the end of the world is near” crowd. The one sector that has me concerned is real estate, followed by retail, followed by the automotive sector, and then the energy sector.

That said, bears who celebrate could get what is called a “haircut” when the intermediate pre-election re-allocation/hedge phase starts to run dry.

July 19, 2024 at 5:39 pm #9392Since technology is an obvious major topic today and there is chatter about AI making rounds, why not produce prudent material for consideration.

What if AI were to ultimately arrive to become authorized to run the FED and monetary policy? What would the climate and the outcome be? It will happen, at least to some extent. And who will be influencing that AI? AI, at this stage of development, only responds to the input given to it by the individuals providing their input. What surprised everyone, however, is that AI is learning to make its own decisions and investigating without being asked to, much faster than people estimated would happen. My estimation, in considerable conversation with very savvy technologists and others, is the timeline appears to be around 5 years before we see the first elements of that condition present and possible deployed, albeit on a very small and limited scale for a while. Major executives in some industries are voicing concerns over projections of up to 60% of workers jobs being replaced by AI and technology, including robots, within FIVE years.

Perhaps it is a thought to tailor one’s trading approach with those elements in mind looking forward.

July 19, 2024 at 3:48 pm #9377July 19, 2024 at 3:15 pm #9375USDCAD 15 MINUTE CHART – DO YOU BELIEVE?

Another example of the Power of 50 as the pause below 1.3750 was followed by some book squaring that sent USDCAD back to pre-retail sales levels.

So, do you believe? This is just one indicator but it raised a yellow flag earlier this week after GBPUSD stalled below 1.3050 and EURUSD below 1.0950.

Otherwise, no change to what I posted earlier, which intra-day says expect support as long as it trades above 1.3707.

My Favorite Trading Secret: The Power of the 50 Level

July 19, 2024 at 2:35 pm #9374July 19, 2024 at 2:04 pm #9373There will certainly be trades stricken from the record at exchanges due to the technical outages. Those firms regulated by the NFA are required to have “disaster plan” in place where another entity can take over portfolios due to incapacity but even they are effected by this outage in some cases. This is not a Microsoft issue as much as it is largely a cloud issue I am told.

July 19, 2024 at 1:25 pm #9372July 19, 2024 at 1:22 pm #9371July 19, 2024 at 12:59 pm #9369July 19, 2024 at 12:48 pm #9368July 19, 2024 at 12:40 pm #9367USDCAD WEEKLY – BOC RATE CUT

Retail sales just reported missed on the downside but were for May so limited reaction.

‘

Key focus ahead is on next Wed’s BoC rate decision where a cut is widely expected.This suggests support on dips ahead of it.

Intra-day expect support as long as it trades above 1.3707.

July 19, 2024 at 12:29 pm #9366July 19, 2024 at 12:18 pm #9364 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View