- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

July 30, 2024 at 2:27 pm #9796July 30, 2024 at 2:24 pm #9795July 30, 2024 at 2:17 pm #9794July 30, 2024 at 2:05 pm #9793July 30, 2024 at 1:57 pm #9792July 30, 2024 at 1:12 pm #9791July 30, 2024 at 1:03 pm #9790July 30, 2024 at 12:43 pm #9789

USDCHF 5 Min Chart – 15.01.2015.

This should make you think and get some perspective when there is an Important Data/News/Central Bank decision

Almost 2.000 pips in 10 minutes, with over 1.400 Pips GAP .

This kind of development will Kill not only your margin, but yours kids college fund, take your home and your panties….

So start thinking and learning NOW.

July 30, 2024 at 12:36 pm #9786

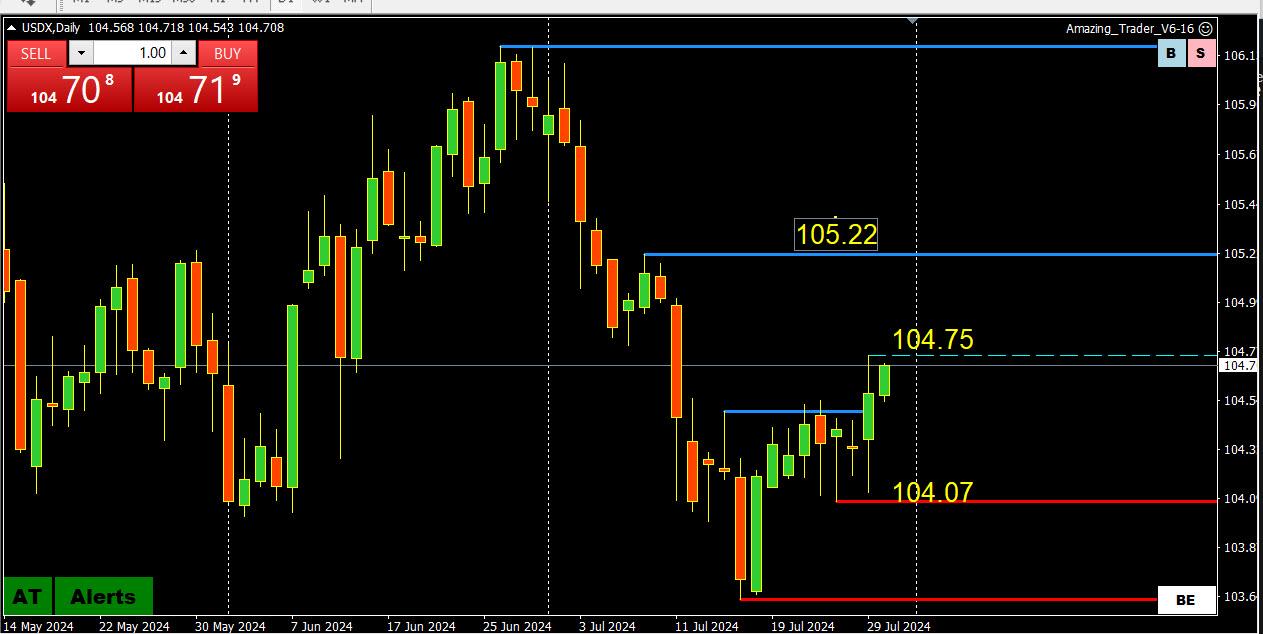

July 30, 2024 at 12:36 pm #9786USDX DAILY CHART – EURUSD PROXY (57.6% of the index)

Using USDX as a EURUSD proxy, 104.76 equates to eurusd 1.0800-14 support.

Note, EURUSD appears it will break a 5 day pivot around 1.0850, which is a bearish sign and contrary to what one would expect ahead of the FOMC meeting tomorow.

Read Bobby’s eqrlier posts. He summed it up well.

July 30, 2024 at 12:32 pm #9785July 30, 2024 at 11:58 am #9784July 30, 2024 at 11:09 am #9783A look at the day ahead in U.S. and global markets from Mike Dolan

To the extent that worries about pricey tech stocks and rising AI capex spending were partly behind last week’s market shakeout, Microsoft’s quarterly update should prove a key moment later on Tuesday, just as the Federal Reserve’s latest policy meeting gets under way.

Morning Bid: Microsoft and job openings to hit pre-Fed vigil

July 30, 2024 at 10:51 am #9782THIS WEEK’S MARKET-MOVING EVENTS (all days local)

US focus in the July 29 week will be narrowly fixed on two times: 14:00 ET on Wednesday when the FOMC releases its policy announcement and 8:30 ET on Friday when the Bureau of Labor Statistics publishes the July employment numbers. Markets are anticipating that the FOMC statement will set the stage for a rate cut in the near future, presumably the September 17-18 meeting. For payrolls, healthy moderate growth of 180,000 is the call.

The Bank of England will announce what is expected to be a rate cut on Thursday, while the Bank of Japan is expected to hold rates steady on Wednesday but announce its reduction schedule for bond purchases. National CPI’s in Europe begin on Tuesday and will followed by Eurozone harmonised inflation data on Wednesday.

GDP’s unfold on Tuesday with first estimates for the second quarter to open with France then Germany followed by Italy and finally the Eurozone. Marginal to modest growth is generally expected.

Japanese industrial production on Wednesday is expected to fall steeply reflecting new safety test issues in the auto industry. A sleeper in the week but a report that should never be overlooked because of its policy implications is the quarterly US employment cost index on Wednesday. A sharp fall in this index, however unlikely, could raise talk for a rate cut at that afternoon’s FOMC announcement.

Econoday

July 30, 2024 at 10:16 am #9781July 30, 2024 at 10:15 am #9780July 30, 2024 at 10:00 am #9779This Week

Aside the Summer Holidays that slowed down everything , this week’s data makes it even worse…

Drawing lines on Charts is kind of a waste of time and empty expectations.

Being exclusively a Technical Trader, this is Hell for me….

It is difficult for me to explain it fully, but those of you who are long in this know – way how market moves ( or not move for that matter) is just wrong….Bars on smaller time frames are way too small, so even when right you won’t make much…but if they come for your stop it can be doubled…just like that…

Market is very light and all eyes are now locked on the Data.

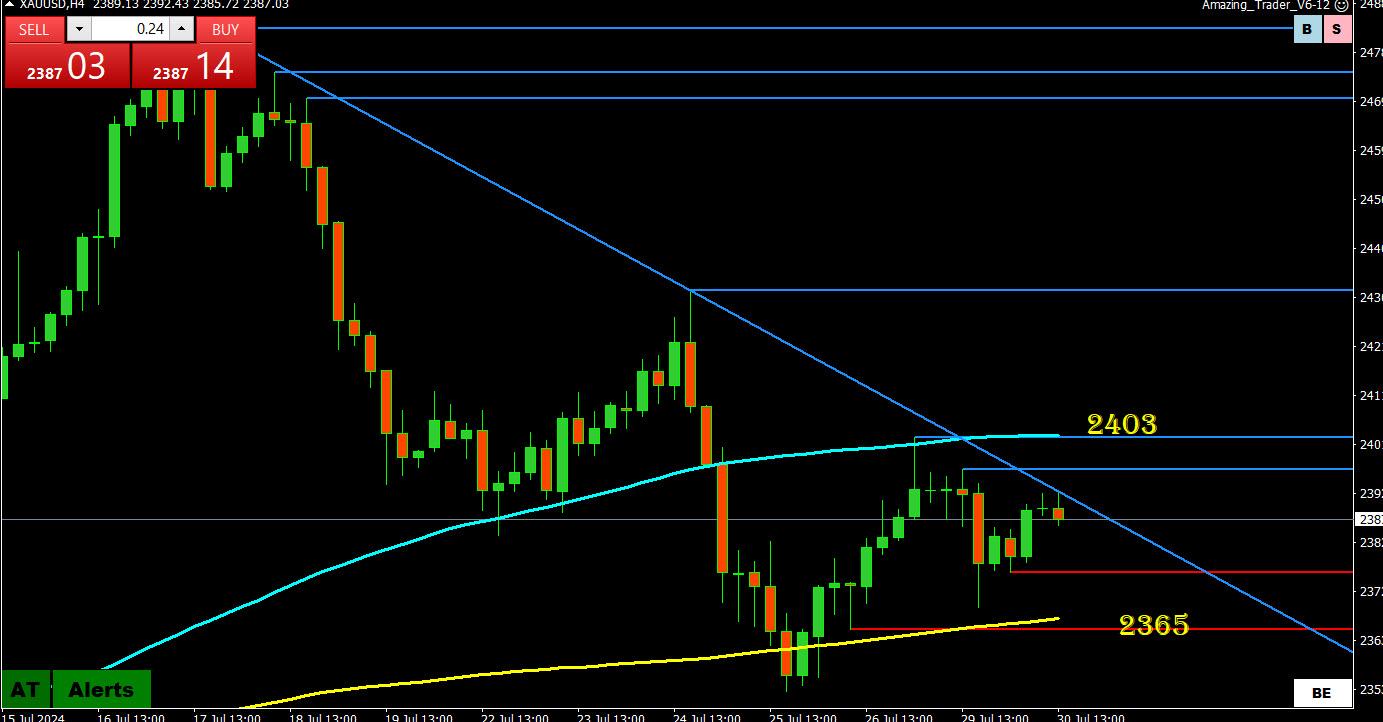

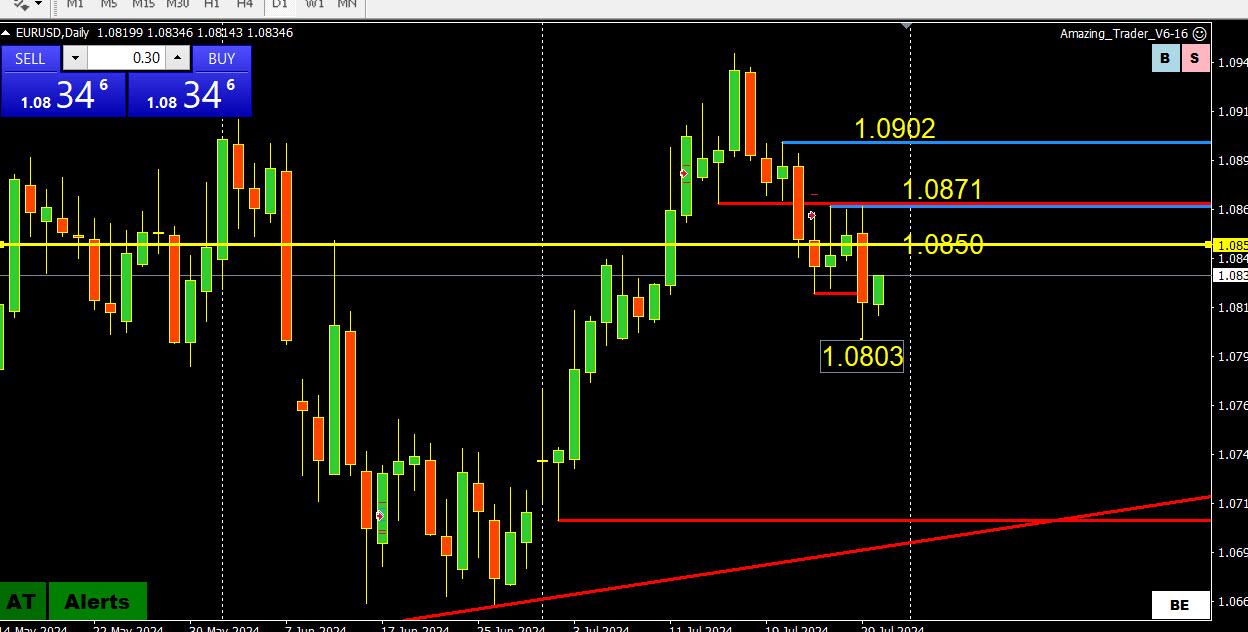

July 30, 2024 at 9:47 am #9778EURUSD DAILY CHART – WAITING FOR THE FOMC

Having paused above 1.08 yesterday EURUSD has bounced but would need to trade at 1.0850 to extend a 5-day pattern where this level has traded.

Whatever the case, logic says the dollar should have a limited upside once the focus shifts to Wednesday’s FOMC meeting but first has to get past the BOJ decision.

For day traders, little to go for unless either side of 1.08 or 1.0871 is taken out.

Otherwise, watch to see if 1.0850 can trade.

July 30, 2024 at 9:39 am #9777WASHINGTON, July 29 (Reuters) – The Federal Reserve is expected to hold interest rates steady at a two-day policy meeting this week but open the door to interest rate cuts as soon as September by acknowledging inflation has edged nearer to the U.S. central bank’s 2% target.

Fed likely to hold rates steady one last time as inflation fight finale unfolds

July 30, 2024 at 9:30 am #9776USDCAD WEEKLY CHART – NEW 2024 HIGH

Having traded to a new 2024 high (1.38653, I went to a weekly chart to fimd

1.3896 – 2023 high

1.3977 = 2022 high

as the next key levels on the upside.

For day traders, 1.3850 will likely set its tone with support on deep dips as long as it trades above 1.38 but no stops left unless a new high is made..

Next key even is the US FOMC deision on Wednesday.

July 30, 2024 at 9:22 am #9775USDJPY DAILY CHART – WAITING FOR THR BOJ

It will be a new ball game tomorrow when the BOJ announces its monetary policy decision.

In the meantime, the brief move above 155 overnight suggests this will be the focal point after the decision within a broad range of 150-152/158-160

The BOJ will likely be lurking in anY case

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View