- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

August 20, 2024 at 10:26 pm #10749

HOW WRONG is Justin Lahart ?

Kamala Harris Wants to Ban Price Gouging. What Do Economists Say? The line between gouging and normal market forces can be pretty thin. And stopping it is no easy feat either. – By Justin Lahart in WSJ

Lets see…

Price gouging solves itself when 1) the first gouger runs out of supply and when “me too” opportunists arrive with new supply.2) price gouging, in its pure certified form, gets solved when the gouger gets either shot by pissed gougee or by govt price-control enforcement forces.

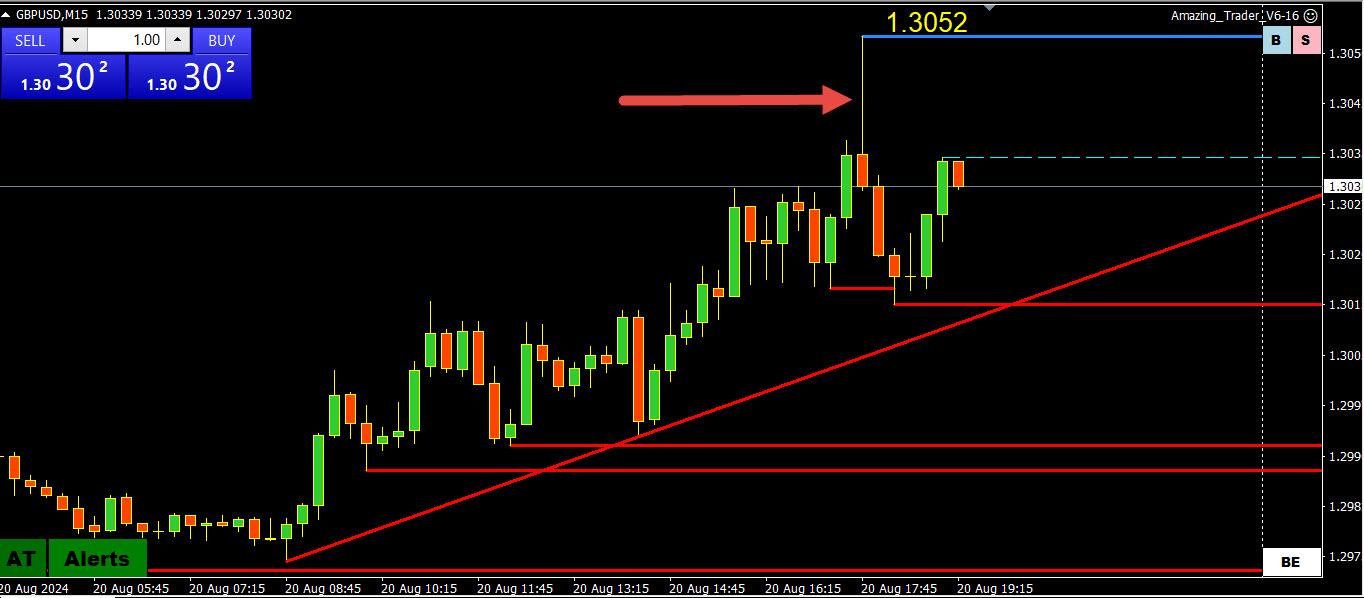

August 20, 2024 at 9:47 pm #10748August 20, 2024 at 9:28 pm #10747August 20, 2024 at 8:50 pm #10746August 20, 2024 at 7:22 pm #10743TRADER ALERT

A downward revision of 1 million jobs would reduce employment creation to 1.6 million jobs for the year, from 2.6 million, said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

“That’s why I think that the market is still pricing in about a 25% chance of a 50-basis-point cut in September,” Chandler said. “People thought the Fed was behind the curve in raising rates, and now many people think the Fed is behind the curve in cutting rates.”

August 20, 2024 at 5:57 pm #10742August 20, 2024 at 4:38 pm #10741Greta … where tfk ARE you ?!

August 20, 2024 at 4:30 pm #10740August 20, 2024 at 4:28 pm #10739August 20, 2024 at 4:23 pm #10738August 20, 2024 at 4:22 pm #10737August 20, 2024 at 4:15 pm #10736August 20, 2024 at 3:17 pm #10733August 20, 2024 at 2:49 pm #10732Yesterday I posted (factually per Reuters) that hundreds of millions of individual social security and sensitive data had been hacked and sold on the black market in the dark web in recent weeks. Almost a billion actually. The place to go to see if your data has indeed been hacked and sold is https://npd.pentester.com/.

August 20, 2024 at 2:38 pm #10731August 20, 2024 at 2:37 pm #10730August 20, 2024 at 2:32 pm #10729Reuters poll: S&P 500 to end 2024 at 5600 (May poll 5302, currently 5600); sees 5900 be end-2025

Source: Newsquawk.com

August 20, 2024 at 2:10 pm #10727I could say something egomaniacal like “Euro is now officially a sell” but that would be an absurdly arrogant means of verbiage. I wonder how many of them said something almost verbatim this morning in other forums. When a CTA, I learned to be more realistic and responsible than that with one’s language.

August 20, 2024 at 2:02 pm #10726There is zero reason to be long UsdJpy today unless some unusual dominant fundamental or market activity condition suddenly arises. Eu metrics are dominant on the buy side in some metrics but there is clear positioning in other metrics on outside months which shows sell side interest building so current levels are producing a pivot level as I type. When this happens usually a sustained shift takes place lasting for one week minimum.

August 20, 2024 at 1:53 pm #10725Bloomberg – Goldman Sachs Group Inc. and Wells Fargo & Co. economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated — about 50,000 a month.

Has the FED has become a veiled political arm and not a FED? Many are more than satisfied that is the case. Regardless, the hidden figures alters the interest rate outlook and the presents the likelihood they are behind the curve in reducing rates which ultimately will cause highly chaotic economic results for quite some time.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View