- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

August 23, 2024 at 2:21 pm #10869

I have been voicing for days my preference for the buy side of US Dollar which some people very understandably felt was not a good idea. I have been on fire on the long side of UsdJpy. I win this time again.

I was short the pair just prior to Powell opening his mouth with DX hitting 101.50 and hit big again. But my position on the pair further out has not changed. Still prefer the buy side overall.

Due in part to major banks ranging in recession projections from between 15% to as high as 35%, if they are correct then if there is a recession it should not be expected to be dramatic barring the occurrence of dramatic scenarios.

The hyperbolic sentiments of 50 to 100bps cuts is ridiculous one might think. Hyperbolic statements create liquidity.

The smile curve in USD is right in the middle at present and so there is plenty of room for risk appetite or doom and gloom since the Dollar appreciates in either scenario.

After all the con-artistry, lies and false claims in the Democratic National Convention and the false figures one thing must be paid attention to –_–

EMPLOYMENT

One has to wonder if these facts surface from Powell today:

The last three BLS quarterly job data revisions:

Minus 612,000

Minus 735,000

Minus 915,000 (actual is more than 818k reported).

Net Job Losses:

Two Million Two Hundred Sixty Two Thousand

· The hire to job openings ratio between 2018-2020 was 0.85 on average.

· The ratio has since fallen to its current rate of roughly 0.35, which is a 500% decrease.

· This equates to hirings having fallen from 8 hires per 10 job postings to 4 out of 10.

For consideration regarding real economics according to the respected source Resume Builder:

1. 4 out of 10 jobs posted in the US in 2024 were “fake.”

2. 3 out of every 10 jobs in 2024 had roles that were not “real.”

August 23, 2024 at 2:20 pm #10868August 23, 2024 at 2:04 pm #10867August 23, 2024 at 2:01 pm #10866August 23, 2024 at 2:00 pm #10865August 23, 2024 at 1:58 pm #10864August 23, 2024 at 1:55 pm #10863August 23, 2024 at 1:08 pm #10859August 23, 2024 at 1:00 pm #10858August 23, 2024 at 12:52 pm #10857August 23, 2024 at 12:48 pm #10856August 23, 2024 at 12:37 pm #10855August 23, 2024 at 12:29 pm #10853August 23, 2024 at 12:25 pm #10852US 10-YR 3.848%

Stock futures inch up with all eyes on Powell’s key Jackson Hole speech – CNBC

Expecting dovish yakking from powell, eh ?Player expectations are pricing rate cuts over the next three meetings, at least one of them being 50pts.

What are the odds of powell being bigger dove than he is currently perceived ?

How about powell wanting it both ways, i.e talk “caution” ?Yakker Deck is expecting a profusion

– Bostic (on TV 2x this morn before powell)

– Goolsbee practically everywhere and nearly all the time in the afternoonAfter powell BoE bailey grabs the microphone

August 23, 2024 at 12:11 pm #10851Highest Trade Profit Opportunity Economic Calendar Events

Volatility comes from the higher the spread between expectation and the announcement

1 – FOMC (The Federal Open Market Committee)

Effect on Bonds and USD pairs; sometimes equity market1b) = FED chair post-fomc announcement Press Conference

Sometimes the chair digs a hole with their tonque and gum-flapping2 – NFP (Non-farm Payrolls

3 – CPI (Consumer Price Index)

4 – ECB rate announcement

5 – PCE Inflation (Personal Consumption Expenditures)

6 – Retail Sales (Dollar Sales and NOT unit sales)

7 – GDP (Gross Domestic Product) Quartely Release

8 – PMI (Manufacturing Purchasing Managers’ Index)

9 – FED Chair Speeches

Magnitude and direction of market reaction is typically conditional on how far data deviates from market expectations.

Traders need to stay in tune with latest market themes for gaging potential trading opportunities.Trading risk management and trading tactics are individual trader responsibility.

August 23, 2024 at 11:46 am #10849A look at the day ahead in U.S. and global markets from Mike Dolan

Jerome Powell takes centre stage at the Federal Reserve’s Jackson Hole jamboree on Friday but the Fed chair would have to sound super hawkish to stop the dollar (.DXY), opens new tab recording one of its worst weeks of the year.

August 23, 2024 at 11:32 am #10847Gold related stocks I view and/or participate in have option/futures/forward/counter/other metrics dominant on the buy side entering the NY session.

Eu metrics are heavily weighted to the sell side.

U/Y metrics are balanced and flattening with one exception which is heavily dominant on the buy side.

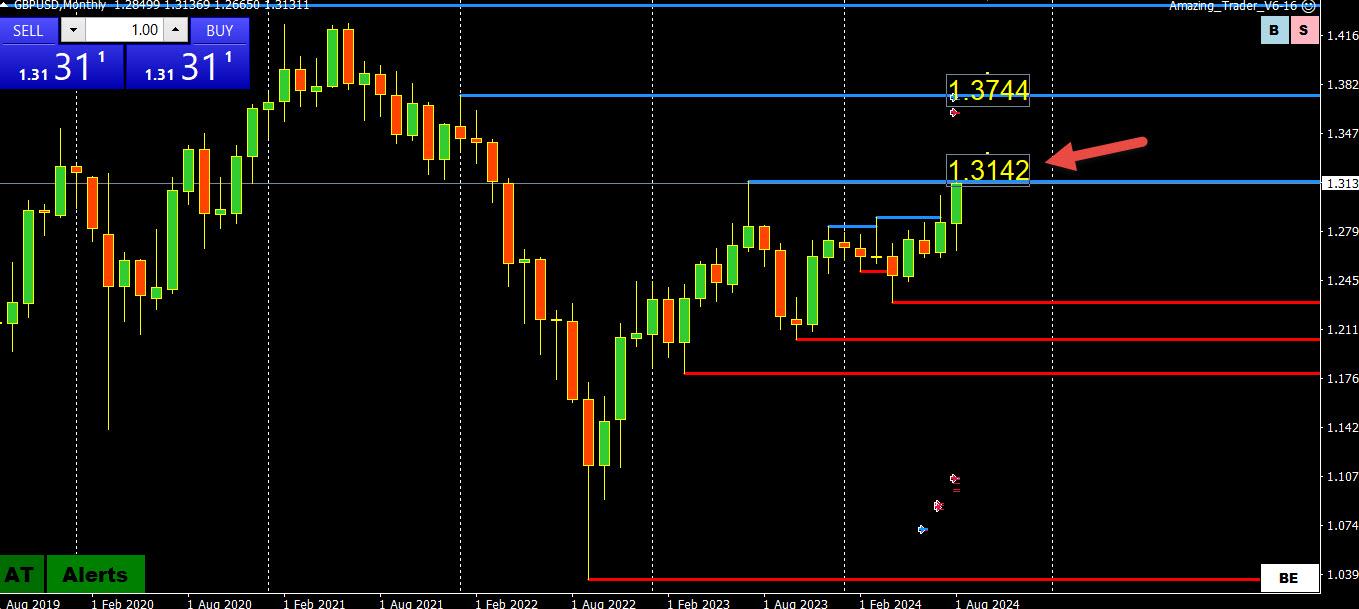

August 23, 2024 at 9:52 am #10845GBPUSD MONTHLY CHART – 2023 HIGH STILL LOOMS

Major level remains at the 1.3142 = 2023 high

Should it be broken, I would use 1.3150 as well to confirm.

A failure to take out 1.3142 would be glaring.

On the downside, a break of 1.3076 would be needed to dent the upside risk and suggest a top is in..

Note, a weaker EURGBP (last .8469) continues to BE A Source of GBPUSD demand while EURUSD is up (slightly) on the day but lagging due to cross offsets so keep an eye on this cross.

Otherwise, a long wait until Powell’s speech.

August 23, 2024 at 8:52 am #10844Summary

Fed expected to cut rates at September meeting

Powell telegraphed policy easing in July remarks

Jackson Hole speech begins at 10 a.m. EDT (1400 GMT)JACKSON HOLE, Wyoming, Aug 23 (Reuters) – U.S. economic data is giving the Federal Reserve the green light to cut interest rates, financial markets are aligned for the first move, and the central bank all but gave the game away on Wednesday when a readout of its July meeting showed a “vast majority” of policymakers agreed the policy easing likely would begin next month.

With Fed rate cut set, Powell may focus on explaining US economic conditions at Jackson Hole

August 23, 2024 at 12:38 am #10843IF I were the FED chair ( hihihi)

–

you would do well (for your own welfare and wellbeing) to remember that the FED’s first job is to protect the Banking System befoare the peasant population. In fact IF the peasants in aggregate bshould somehow threaten the Banking System, the gloves are to be taken off.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View