- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

August 26, 2024 at 2:09 pm #10950August 26, 2024 at 1:38 pm #10949August 26, 2024 at 1:30 pm #10948August 26, 2024 at 12:55 pm #10947August 26, 2024 at 12:45 pm #10946

GBPUSD 4H

Supports : 1.31800, 1.31450 & 1.31300

Resistances : 1.32100, 1.32250 & 1.32600

Close of this bar below 1.31900 would signal some kind of a correction to the downside – or sideways to down.

However close above 1.32050 would hint a possibility of breaking above the resistance channel line at 1.32250 and continuation of this sharp Up trend.

Cable is in the Up Trend, and even deeper corrections ( 1.30 area) wouldn’t change it.

August 26, 2024 at 12:04 pm #10945August 26, 2024 at 11:57 am #10944August 26, 2024 at 11:52 am #10943August 26, 2024 at 10:27 am #10941

August 26, 2024 at 12:04 pm #10945August 26, 2024 at 11:57 am #10944August 26, 2024 at 11:52 am #10943August 26, 2024 at 10:27 am #10941A look at the day ahead in U.S. and global markets by Dhara Ranasinghe.

Not for the first time, financial markets are reminded why it’s never a good idea to get too far ahead.

So, while Federal Reserve chief Jerome Powell’s much-awaited Jackson Hole speech on Friday fueled the rate-cut optimism that has aided stocks’ recovery from the early-August rout, the latest Middle East news highlights the need for caution.

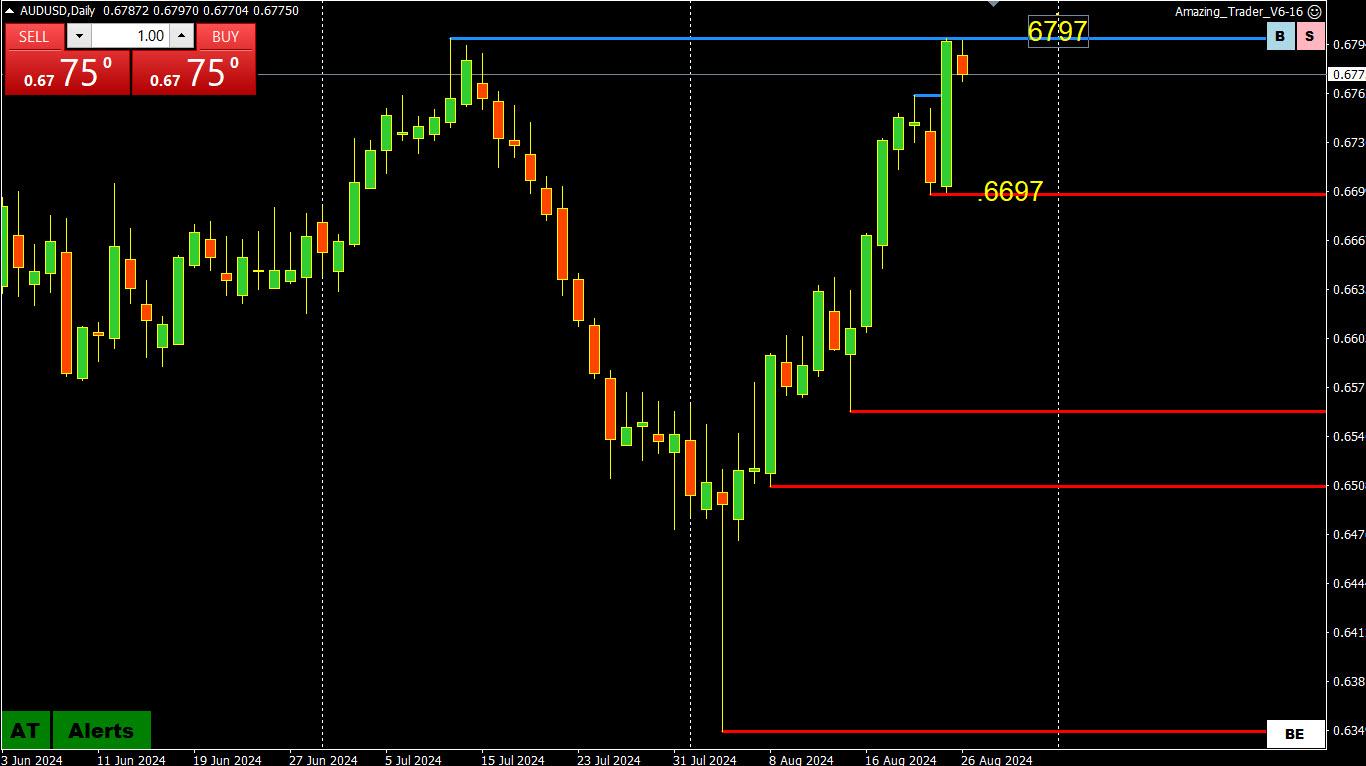

August 26, 2024 at 10:06 am #10939August 26, 2024 at 9:27 am #10938AUDUSD DAILY CHART – TESTS 2024 HIGH

What caught my eye is the AUDUSD, which tested .6797 (high .6798) and then backed off.

As posted in our Weekly FX Outlook

Key target tested at the 2024 high at 6797.

Suggest .6800 is equally important as there is a void above it to .6799

Strong bid while above .6760.

August 26, 2024 at 9:07 am #10936August 26, 2024 at 8:57 am #10935I don’t remember a time when all the key currencies were focused on pivotal levels, which will dictate respective tones going forward.

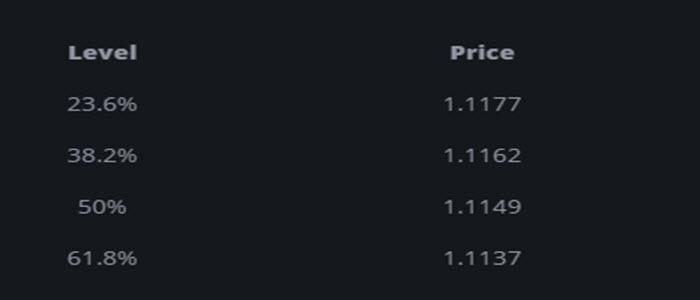

(EURUSD 1.12, USDJPY 145, GBPUSD 1.32, USDCAD 1.35, AUDUSD .68)

See our

August 25, 2024 at 11:20 pm #10933August 25, 2024 at 11:20 pm #10934August 25, 2024 at 10:41 pm #10930THIS WEEK’S MARKET-MOVING EVENTS (all days local)

German CPI flashes on Thursday aren’t expected to show much improvement unlike Eurozone flashes on Friday where forecasters see the headline slowing to 2.3 from 2.6 percent with the HICP reading, however, only seen slowing to 2.8 from 2.9percent. Australian monthly CPI on Wednesday is expected to cool to 3.4 from 3.8 percent in a report that will help set expectations for the Reserve Bank of Australia’s next move.

US durable goods orders on Monday are expected to recover only a portion of June’s sharp decline on aircraft cancellations. US consumer confidence on Tuesday is expected to remain depressed while PCE price indexes on Friday, part of the personal income and outlays report, are expected to show modest pressure on the month (up 0.2 percent) and no more than moderate pressure on the year (up 2.6 percent).

GDPs from India and Canada are both on Friday, with the former expected to slow to 6.9 from 7.8 percent year-over-year growth and the latter expected to slow to monthly growth of 0.1 from 0.2 percent.

Econoday

August 25, 2024 at 10:31 pm #10927August 25, 2024 at 10:21 pm #10926I found the comments from Michael interesting due to, in part, that I am and remain a verifiable Quant. Not Youtube Quant but real Quant. A Quant who has actually run an investment firm and had coffee over a chair in multiple cities by invite, all paid for. It is how this CTA approaches markets. That said, After careful analysis I believe that person is almost absolute in analysis.

Very simply, if you take a breath and look at the math “vibration” there is a median in markets which will be met 100% of the time. What matters as an active trader is your timing within the timing. That is difficult.

For example, anyone can say that Euro will hit Ysquared in time. That would be theoretically correct regardless of indicator. The variables is what causes discount in equations, factors that cannot replace real time motion.

And so, you must factor such variations. Which is why such things as standard deviations of 3.0% and 3.5% matter more than the usual 2/0% deviations that you hear about on any given form of media, including the more popular formats.

After back testing and real time performance, the back testing is garbage in real world scenarios when you are on the phone with a major broker. They can tell if you are a skilled linguist or for real.

I concur with the mention of vibration in markets. I have a deep past with calculations that lives depend on, and so there is no room for variance.

I felt it important to acknowledge that prior to making a call for the end of week price level in various currencies. My hit rate is 98.6%.

How you approach it is what matters based on how you attack markets and your existing tolerance levels.

August 25, 2024 at 9:35 pm #10925August 25, 2024 at 9:34 pm #10924 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View