- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

August 30, 2024 at 3:37 pm #11148August 30, 2024 at 3:23 pm #11147August 30, 2024 at 3:20 pm #11146August 30, 2024 at 3:18 pm #11145August 30, 2024 at 3:04 pm #11144August 30, 2024 at 2:29 pm #11142

DLRx 101.44

Showing little leg, but mixed vs bag of ccies.Re jobs: I am guessing market is noticing workers are somewhat prudent if not outright anxious about jobs especially on the lower end of the pay scale.

With all calendar data now out of the way for today players are likely to focus on closing shop without much radical price volatility ahead of the weekend. Be enough opp to yingyang pricing next week starting Wednesday and the Friday.

DLR may close a little bit on the friski but it does not look ambitious – bit of a t/p into the close would not be a surprise – at least not to me.

Res 101.50 (eh Jay what have you to say ?)

Sup 100.70August 30, 2024 at 2:21 pm #11140The life of a trader…you were up at 2:30am chasing trades and your wife is shaking her/its head, only to wake up hours later looking at the fight that took place in your account. Yay I got it rifght. And what do you do? Go on an 8 mile power walk/sprint, protect some kid you’ve never seen before with your Shaolin skills, get back to safety, and take a nap and get back in the ring.

And you say … man that ___ can fight lol.

Still standing. Market call pending in a few lol

August 30, 2024 at 1:56 pm #11139August 30, 2024 at 1:17 pm #11138August 30, 2024 at 1:08 pm #11137August 30, 2024 at 1:02 pm #11136August 30, 2024 at 12:44 pm #11135August 30, 2024 at 12:37 pm #11134August 30, 2024 at 12:25 pm #11129August 30, 2024 at 12:16 pm #11126August 30, 2024 at 12:12 pm #11125A look at the day ahead in U.S. and global markets from Mike Dolan

Record stock market highs have lit up across the world once again – though not yet for the usual suspects in the S&P500 (.SPX), opens new tab and Nasdaq (.IXIC), opens new tab.

Despite a rare stumble for the artificial intelligence theme after Nvidia’s results underwhelmed this week, the rest of the stock market complex shrugged it off and has instead lapped up a tasty diet of brisk economic growth along with falling inflation and interest rates.

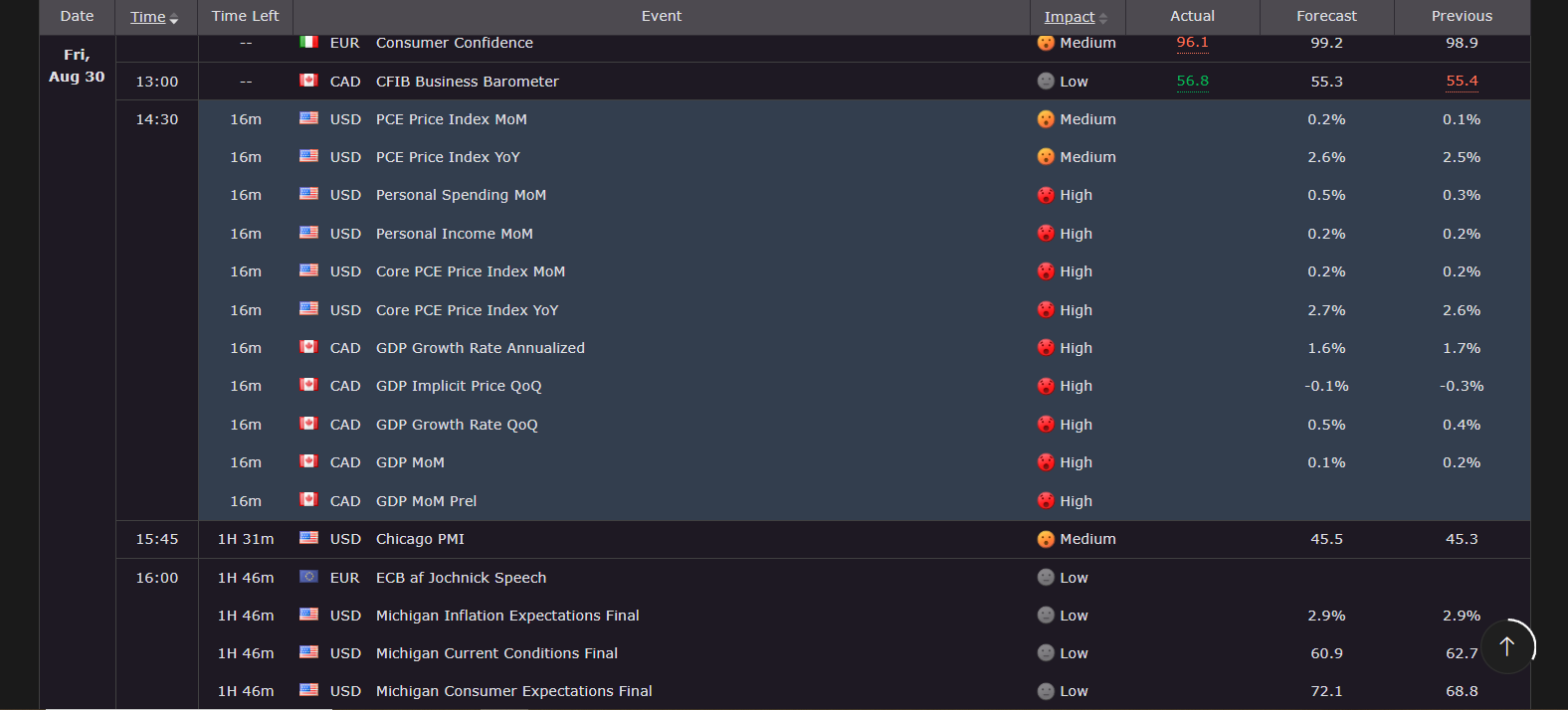

August 30, 2024 at 11:17 am #11124August 30, 2024 at 11:04 am #11123Key times today

12:30 GMT US PCE (Fed’s favored inflation indicator)

15:00 GMT London 4 PM (month end) fixing

In between is the Chicago PMI and U of M final consumer sentiment

Note US jobless data seems to be the greater focus over inflation now that the Fed ha signaled a shift to rate cuts.

See our Economic CalendarNpte also, US market will be thin and likely thin further ahead of the long Labor Day weekend.

August 30, 2024 at 8:05 am #11121What ate FX rebalancing flies?

FX rebalancing flows are large-scale institutional transactions that involve buying and selling assets in a portfolio to maintain a desired asset allocation. These flows are often seen at the end of the month, and their impact is usually most felt near the 4 PM London fix on the last trading day.

AI Overview

August 29, 2024 at 10:17 pm #11114To detail the trade I was long from 144.28 and was confident 145.25 would be seen with t a ceiling of EITHER 145.50 or 145.60 on over-reach. Failed to take the money around 145.40 to be safe, endured the pullback, loaded up elsewhere in conjunction with the AudUsd positioning I mentioned coming into the NY session so was just fine but that is quite a trim on gains by being impatient and not reacting aggressively enough in the same opera.

If you are not swimming in money precision is important. I hope this helps novices or anyone else for me to share my perspective as a former CEO of an investment firm. None of us are perfect and all of us face the same market.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View