- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

September 16, 2024 at 9:10 am #11689September 16, 2024 at 9:08 am #11688

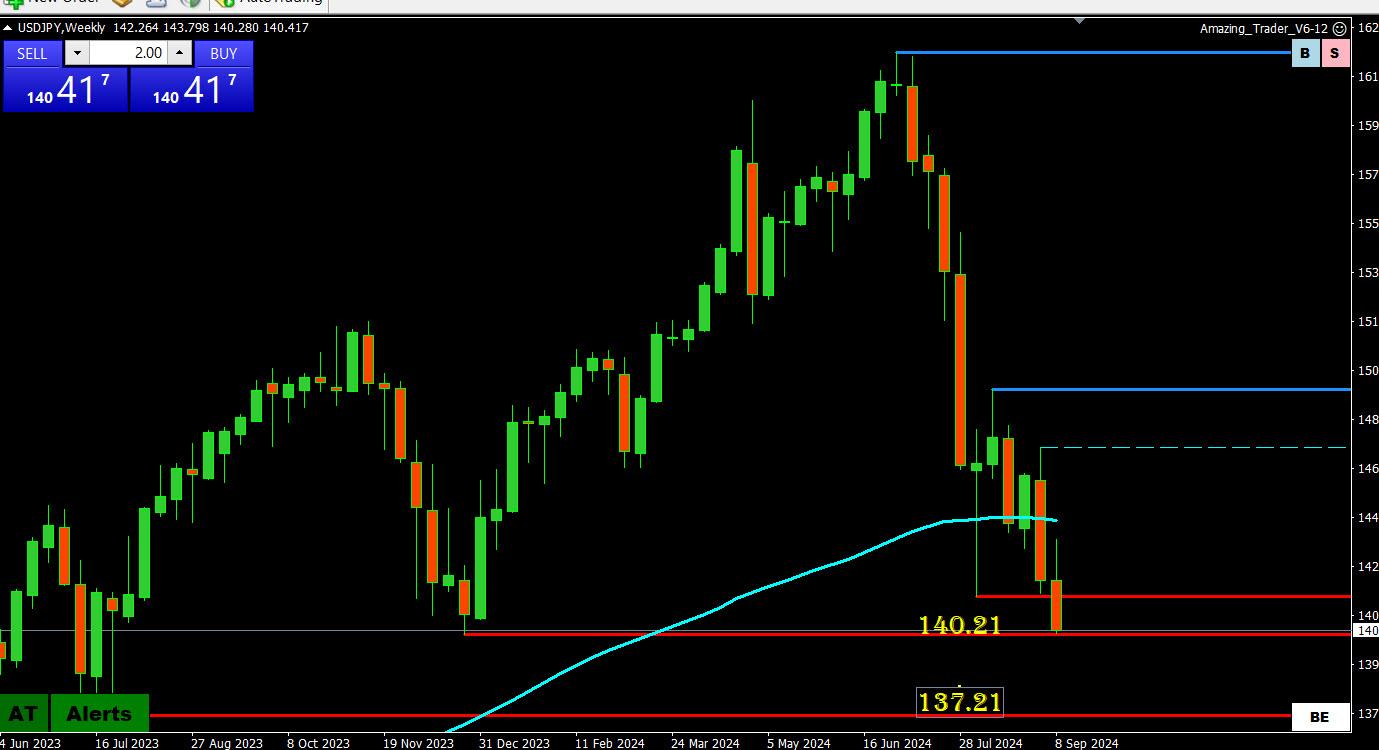

USDJPY MONTHLY CHART – Up like an escalator and down like an elevator

It took nearly a year for USDJPY to climb to nearly 162 following the initial move above 140 and 3 months to fall back below it.

This chart shows the risks if the 140 break holds in a market that, at least to start the week, is hoping the Fed cuts by 50bps.

Logic says this suggests the current FX moves are fragile given the size of the anticipated rate cuts is seen as a toss up.

September 16, 2024 at 8:58 am #11687yes and yes and YES

Stock futures are little changed as investors await major Fed decision: Live updates

… “central bankers are expected to cut rates for the first time since 2020” – yes

just as

“The S&P 500 is less than 1% away from its July record and could notch a new all-time high this week” – – yes

and

“as many investors hope the decision could lower borrowing costs for companies and improve overall earnings growth — boosting economic growth“ — YES!

10-yr Yield | 4:52 AM EDT 3.644%

September 16, 2024 at 4:31 am #11684AND A … JOKE

Harris or Trump? Once Again, Election Results Could Take Awhile.

Curtesy New York Times

September 16, 2024 at 4:28 am #11683September 15, 2024 at 11:02 pm #11681September 15, 2024 at 9:47 pm #11679THIS WEEK’S MARKET-MOVING EVENTS

The week begins early, on Saturday Chinese time with the country’s release of monthly industrial production and retail sales data, both of which are expected to slow appreciably. The Federal Reserve, despite indications of continued economic strength, is expected to cut rates by 25 basis points on Wednesday. The Bank of England is expected to hold policy steady on Thursday as are the People’s Bank of China and the Bank of Japan, both on Friday.

Canadian consumer prices on Tuesday are expected to break lower to a near target 2.1 percent. UK consumer prices on Wednesday, which will help inform Thursday’s BoE meeting, are expected to hold steady at 2.2 percent.

US retail sales on Tuesday are expected to show underlying strength in contrast to US industrial production which, also posted on Tuesday, is expected to remain flat. The first estimate of New Zealand GDP on Thursday is expected to contract a quarterly 0.4 percent followed by Australia’s August labour force survey, which also on Thursday, is expected to show continued strength.

Econoday

September 15, 2024 at 8:06 pm #11678fwiw… UBS has forecasted 275bps.

I some what disagree… FED will either hold or raise them by 25bp now because a rate cut now means they cannot raise them later down the line in stormy weather. and that means the true one who is to meant to become the next US president won’t become president. In any case, Japanese can be helpful in buying short term treasuries since they lend at almost negligible interest rates.

They can think of cutting rates after a few more quarters…

The US needs to become a Saviour Economy as it once was. I would balance geo-economical tensions and keep geo-political dominance by ha-flyin-gas-bags in check… holding rates until inflation lingers/stays below the target level during many quarters would cause “inflation and it’s inflationary effects” to fizzle out.

low rates means people would then keep on borrowing, so that kind of servant mentality of theirs has to go, so they have to save their money (at high rates) so they do not need to take loans… or at least I want it to be that way.

think about it if Americans get outta debt the first thing they do is start helping people.

Americans also do tend to do better business by sourcing high quality goods at very reasonable rates from European and UK companies when they are not under economic uncertainty. They can always take loans from japanese funds to pay for european imports into the mainland, since there is negligible interest rate it would be very easy to pay off provide the tariff levels for european imports and egyptian cotton remains low…

eg. asian tiger economies which are still struggling to carry out a covid reset… The world will not recover from covid for many more decades because it will again become a resurgence in a few years of time.

many of the various economic classes in the asian economies lost their sole breadwinners and future sole breadwinners to covid, additionally some children lost their parents to covid and need to grow up to be sober and sensible young business people, and not turn to crime/join gangs etc. So those supporting them tend to look for stability in savings accounts to finance them through their growing years.

September 15, 2024 at 12:52 pm #11677TARGET RATE PROBABILITIES FOR 18 SEPTEMBER 2024 FED MEETING CME FED WATCH TOOL

hahaha 50% odds

markets is a masochist

onto itselfSeptember 15, 2024 at 12:34 pm #11674everyone LOVES a rollercoaster n’est pas ?

World Braces for Fed Easing Amid 36-Hour Rate Rollercoaster

——-

——

—–

—-

—

—

–September 14, 2024 at 9:30 pm #11662A Full News Events Calendar in the Week Ahead

September 14, 2024 at 1:46 pm #11658September 14, 2024 at 11:58 am #11654The Fed has the proof it wants that inflation is slowing, but the next move is still up in the air

A week’s worth of inflation data showed that price pressures have eased substantially.– jeff cox

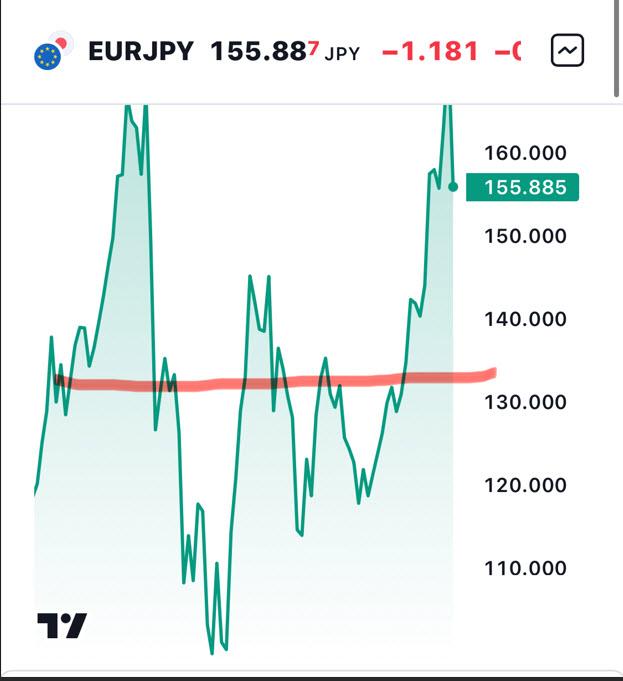

September 14, 2024 at 11:54 am #11653September 13, 2024 at 11:56 pm #11652EURUSD AND USDJPY – Combine the two majors and one gets: EURJPY

And once again a long-term view can produce a shorter timeframe trade

September 13, 2024 at 4:33 pm #11643Re: XAUUSD “to the moon.”

It must be Friday the 13th.

Thursday, it was noted by a particular firm out there that it was the 176th trading day of the year. The firm noted that – “As of this afternoon, the S&P 500 was up 17.6% year-to-date, while last year on the 176th trading day of the year, the index was up 17.7% year-to-date,”

This is where you start looking for black cats in Forex.

September 13, 2024 at 4:24 pm #11642September 13, 2024 at 4:20 pm #11641NAS100 DAILY CHART – 5 DAYS UP HERE TOO?

5 up days here, too, (assuming there is a higher close today) but you can see the key levels on this chart that would need to be taken out to make this more than just an impressive rebound.

Attention will be on whether the 5 day up pattern can be extended when the new week starts.

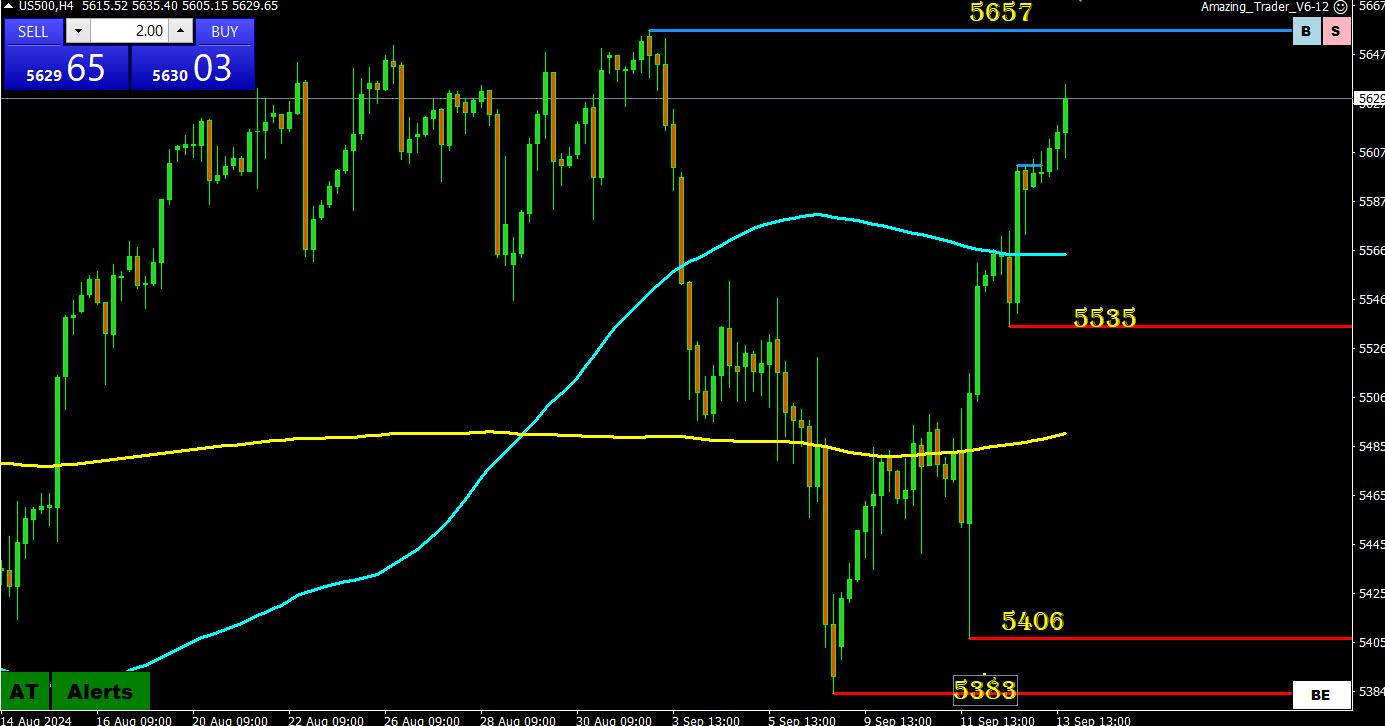

‘September 13, 2024 at 4:14 pm #11640September 13, 2024 at 4:13 pm #11639US500 4 HOUR CHART- 5 DAYS IN A ROW

It has been pretty much a straight line up since the higher 5406 low but to make this more than just a rebound, it would need to take out the record 5672 high.

Standing in its way is 5657.

ATTENTION WILL BE ON THE 5 DAY UP PATTERN WHEN THE NEW WEEK STARTS ASSUMING THERE I A HIGHER CLOSE TODAY..

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View