- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 17, 2025 at 4:41 pm #21026March 17, 2025 at 4:37 pm #21025

JP// Thanks I needed that… I was thinking this last week and then this week an article comes out on the same thing… but corrections are not signs of a healthy trend… they make a profit yes, but do not generate wealth… on profit’s one has to pay tax then that money has to be reinvested, and remember you pay to buy and sell and then again have to pay to buy and sell… but then when a trend goes back to where it started then where is the profit in that…? Corrections are a sign of people’s money getting stuck AND for a healthy growing economy you need “high velocity movement of large sums of money”… B2G and B2B and B2C. The way it is now is G2P or government paying Soc Sec over to the population.

March 17, 2025 at 4:25 pm #21024Rafe … more for your analytical mind:

Treasury Secretary Bessent says White House is heading off a ‘guaranteed’ financial crisis

https://www.cnbc.com/2025/03/16/treasury-secretary-bessent-says-white-house-is-heading-off-financial-crisis.htmlMarch 17, 2025 at 4:19 pm #21023So when they find drugs floating in the sea and so forth, they can put it on a C-130 and air drop the packages from high onto the streets… it’s the least they can do… out of kindness… it would reach a point of equilibrium and no drugs… They can even air drop the drugs back into those countries using “ha flyin chinese gas biags”.

March 17, 2025 at 4:10 pm #21022—And since USA has problems with terrorism they can re-route those shipments for sale back into the country of origin not necessarily the country of production but country from which it is landed, so if they flood the USA with drugs then USA will help terrorists to flood those countries of origin with 3 times more both in terms of street value and quantity, for every 1 user in the USA the countries of origin need to have 3 users.

Some countries try intentionally to destabilize the USA so the USA can return the favor thrice more… To keep the streets clean… Reciprocality would serve it’s purpose very well here…

March 17, 2025 at 4:08 pm #21021March 17, 2025 at 4:02 pm #21020hassett said wha? that things would clear up when tariff’s wha?

What cheap products does the USA produce to offset cheaper priced imports other than placing tariffs on other countries while those same countries may first levy export duties which will be tariff-ed by mass importer USA?

Is USA planning to export ganja to other countries?

March 17, 2025 at 3:29 pm #21012March 17, 2025 at 3:29 pm #21011March 17, 2025 at 3:09 pm #21010more uncertainty over tariff candy

Trump economic advisor Kevin Hassett warns of more uncertainty over tariffs

* National Economic Council director Kevin Hassett warned of “some uncertainty” in the coming weeks related to President Donald Trump’s tariff policies.

* But Hassett predicted that things will clear up when the Trump administration implements its plan to impose “reciprocal tariffs” next month.

* Trump and Treasury Secretary Scott Bessent have declined to rule out the possibility that the U.S. could enter a recession.

March 17, 2025 at 3:03 pm #21009DLRx 103.20 = key Support here

–

every political chicken is screaming “tariff = uncertainty”China is an economic basket case screaming that IT needs 100% tariff of its cars OFF (in europ, US, canada)

why ? it needs work for its peasants … all the while interest on its deficits and debt are running astronimically exponential . Europe is being “thankful” to donald for forcing it into “investing” billions into military spending, calling it an economic boost.In the meantime on deck this week:

Fed, BoE, BoJ, BCCh — players are expecting all to stay pat

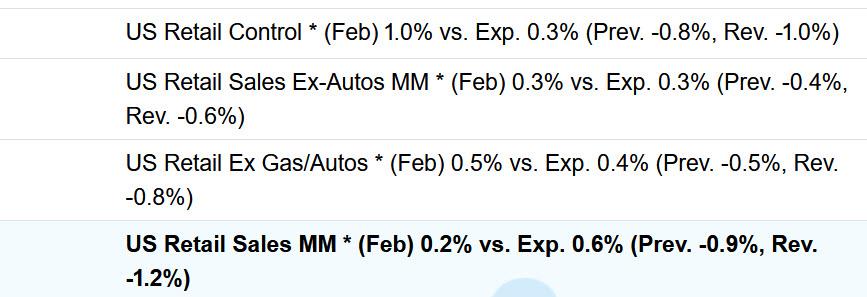

players appear to give some odds SNB will cut 25March 17, 2025 at 2:45 pm #21008March 17, 2025 at 2:24 pm #21006March 17, 2025 at 1:55 pm #21002March 17, 2025 at 1:38 pm #21001March 17, 2025 at 1:02 pm #21000March 17, 2025 at 12:42 pm #20999Mixed retail salaes… headline miss vs rest of the report…big miss in Empire manuf ignored … stocks, bond yields, dollar all tick up

March 17, 2025 at 12:12 pm #20998

March 17, 2025 at 12:12 pm #20998US retail sales up next … See our Economic Data Calendar

March 17, 2025 at 11:21 am #20995March 17, 2025 at 11:19 am #20994

US OPEN

US equity futures are softer & Crude bid after Trump orders strikes in Yemen; US Retail Sales due

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

• US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th.

• European bourses modestly firmer whilst US futures are in negative territory.

• USD is a touch softer ahead of a risk-packed week; Antipodeans benefit from Chinese data and as China unveiled a plan to boost weak consumption.

• EGBs bid with OATs leading after Fitch while Bunds await fiscal updates.

• Gas deflates after US President Trump said he will speak with Russia’s President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday. -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View