- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

September 19, 2024 at 11:03 am #11849September 19, 2024 at 10:54 am #11848

A look at the day ahead in U.S. and global markets from Mike Dolan

After a typical skittish first-day reaction, world markets are on Thursday embracing the new Federal Reserve stance as insurance on the holy grail of a soft economic landing.

Fed boss Jerome Powell described Wednesday’s outsize half-point interest rate cut as a ‘recalibration’ rather than some panicky emergency, and investors are taking the move as a sign the Fed will seek that new ‘neutral’ quickly without necessarily being forced into it by a weakening economy.

Morning Bid: Stocks lap up Fed’s fast ‘recalibration’, BoE up next

September 19, 2024 at 10:40 am #1184750pt cut joke

–From his piece: “The decision lowers the federal funds rate to a range between 4.75%-5%. While the rate sets short-term borrowing costs for banks, it spills over into multiple consumer products such as mortgages, auto loans and credit cards.”

Kids … let me remind you that the previous federal funds rate was 5.25 – 5.50

Jeff kindly reminds us that the federal funds rate is now 4-75 – 5% —– borrowing costs for banks. ROFL.

In real life banks take the higher end of federal funds rate into their accounting. Effectively, the banks are looking at at best a 25pt reduction on the spreadsheet.

This is a ridiculous calculus and basically means nothing in the real world.Jeff is an enthusiastic peddler if one reads his headline : aggressive start to its campaign. Jerome, if you paid attention to his presser said no such thing. In fact jerome tried to reiterate that “we’re going to be making decisions meeting by meeting based on the incoming data …. that the actual things that we do will depend on the way the economy evolves we can go quicker if that’s appropriate we can go slower if that’s appropriate we can pause if that’s appropriate but that’s that’s what we are contemplating (powell around the 945 timeline)

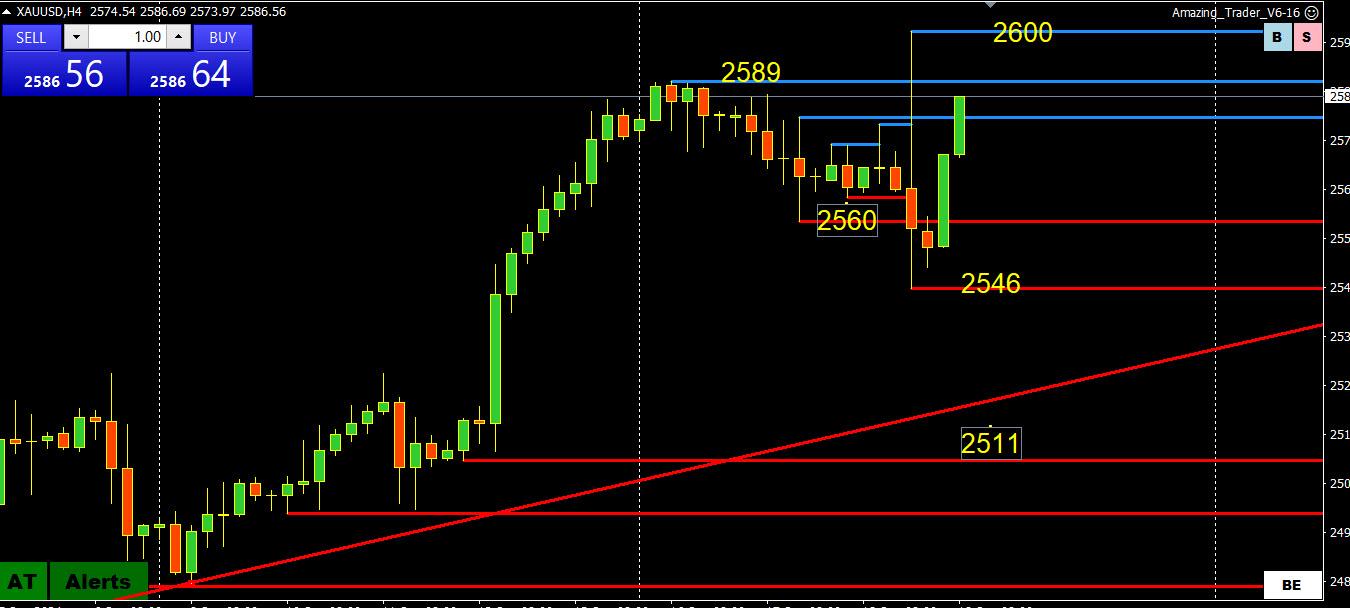

September 19, 2024 at 10:27 am #11845September 19, 2024 at 10:12 am #11843September 19, 2024 at 9:54 am #11842September 19, 2024 at 9:49 am #11841September 19, 2024 at 9:15 am #11840September 19, 2024 at 9:02 am #11839XAUUSD 4 HOUR CHART –

Looking at this chart, clear out the broken lines and it is 2500-2600 (record high), upside exposed as long as it stays above 2550.

To repeat what I posted yesterday:

XAUUSD extended its record high BUT THEN HIT A WALL AT 2600.

Look for support as long it trades above 2500-11 but unlike recent days, there are no stops to go for on the upside unless 2600 is taken out.

If it trades between 2500-2600, then 2550 will set its intra-day bias.

September 19, 2024 at 8:47 am #11838September 19, 2024 at 12:57 am #11837September 19, 2024 at 12:26 am #11836September 19, 2024 at 12:09 am #11835It may be different this time, of course, but the average one-year stock market return after the first Fed rate cut is almost 5% even when a recession occurs. And it’s more than 16% when the cuts come without a recession materialising at all – the most likely scenario now facing investors.(From Reutets article linked to earlier)

September 18, 2024 at 9:05 pm #11834September 18, 2024 at 8:55 pm #11833September 18, 2024 at 8:42 pm #11832September 18, 2024 at 8:41 pm #11831XAUUSD 4 HOUR CHART- Post FOMC Whipsaw

XAUUSD extended its record high BUT THEN HIT A WALL AT 2600.

Look for support as long it trades above 2500-11 but unlike recent days, there are no stops to go for on the upside unless 2600 is taken out.

If it trades between 2500-2600, then 2550 will set its intra-day bias.

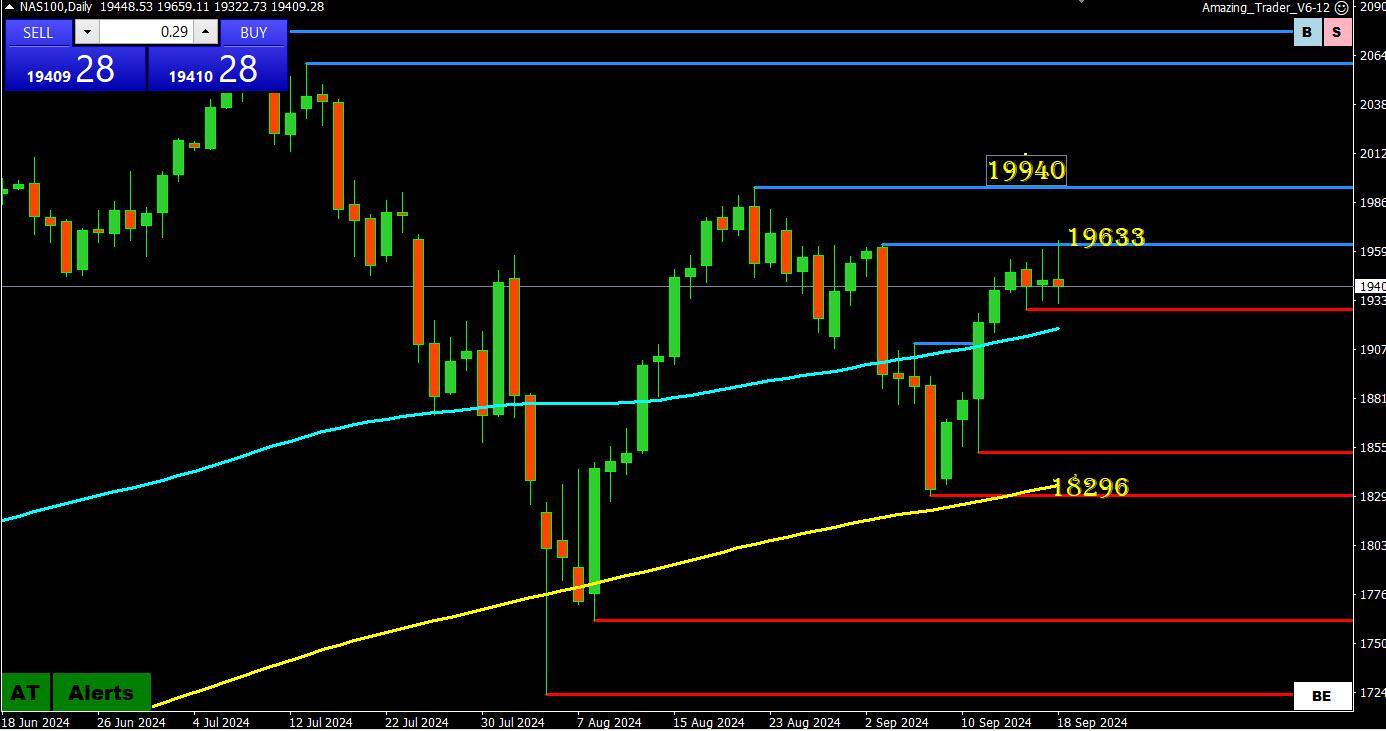

September 18, 2024 at 8:35 pm #11830NAS100 DAILY CHART – 20k OR BUST?

NAS100 finding support by holding above its 200 day mva (yellow) and moving back above its 100 day mva (blue).

On the upside, key resistance is close enough to 20,000 to use this as the level that would need to be taken out to suggest the record high is in play again.

September 18, 2024 at 8:30 pm #11829September 18, 2024 at 8:00 pm #11828 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View