- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

September 25, 2024 at 11:30 am #12044September 25, 2024 at 11:09 am #12043September 25, 2024 at 11:02 am #12042

A look at the day ahead in U.S. and global markets from Mike Dolan

The unexpected downturn in U.S. household confidence this month and growing anxiety about jobs has spurred aggressive interest rate cut bets anew – dragging Treasury yields, the dollar and stock futures lower into Wednesday’s open.

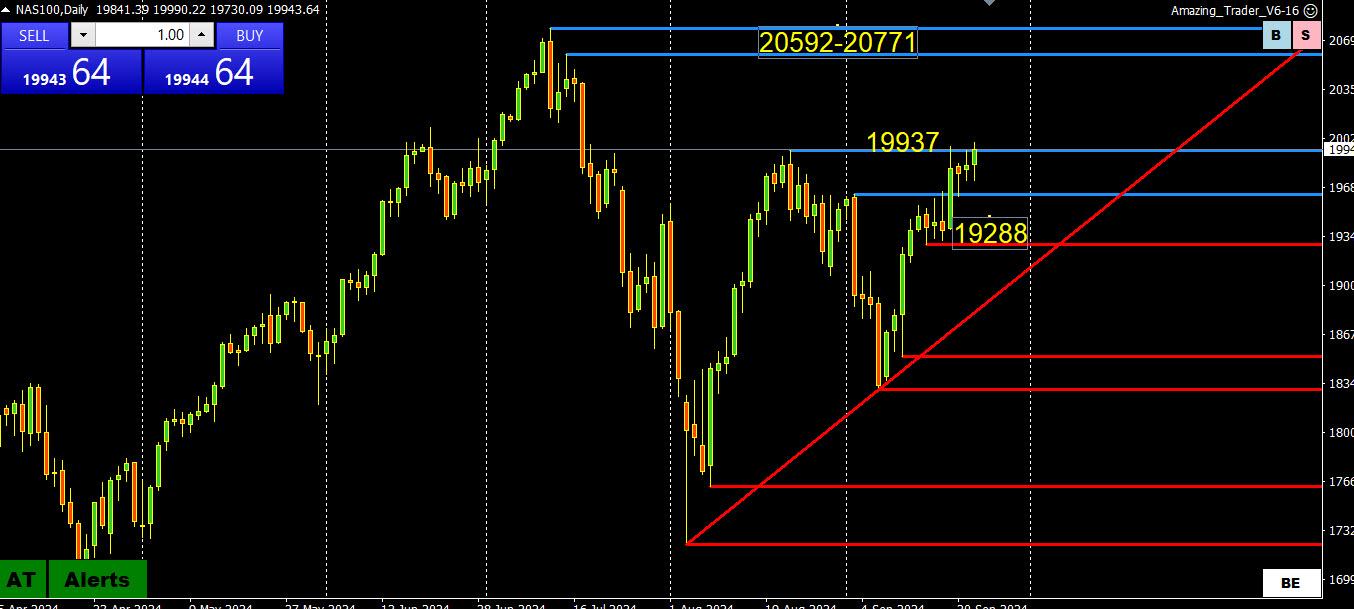

Morning Bid: US confidence wobble weighs, China buoyedSeptember 25, 2024 at 10:21 am #12041USDJPY WEEKLY CHART

Let’s take a look at what technical traders are looking at.

Last week was an outside week and close to an outside week key reversal although I was told many years ago that it doesn’t work well with currencies.

I just took a look at a broker’s sentiment and it shows 50% of trader positions are short USDJPY.

So, looking at the COT report as well, short USDJPY positions no longer look extended so it might take a move outside of 140-145 to expose key levels.

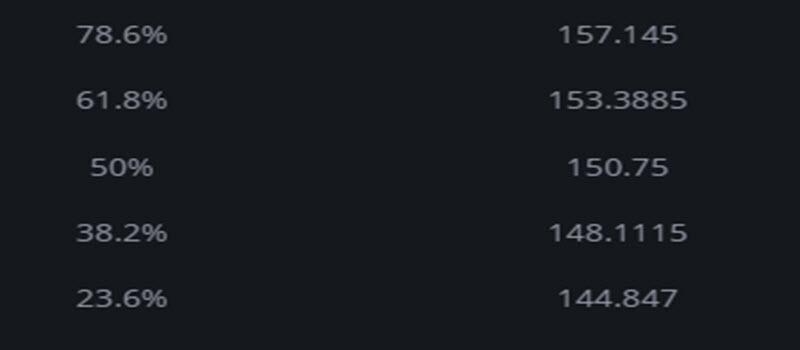

In any case, this can still be considered a retracement phase with FIBOS for 161.93-139.58 shown below

September 25, 2024 at 9:47 am #12039

September 25, 2024 at 9:47 am #12039EURGBP 4 HOUR CHART – BOUNCE FROM MULTI-YEAR LOW

If trading EURUSD and GBPUSD, it pays to keep an eye on EURGBP, which is firmer today… weighing on GBPUSD while EURUSD follows with a lag

This follows a bounce from ,8317, lowest level since early 2022.

Supports: .8339, .8317

Resistance: .8389 (this week’s high)

September 25, 2024 at 9:37 am #12038September 25, 2024 at 9:14 am #12037September 25, 2024 at 8:48 am #12036I have been scanning the news looking for reasons for the bounce in USDJPY back to 144

I have so far come up empty but this caught my eye

The COT (futures) report showed a huge drop in long positions, which explains some of the recent USDJPY support

Open interest fell -47%, fastest weekly pace on record

177k contracts closed

Open interest at 376.5k contracts in the prior week was its second highest level on record

The Commitment of Traders (COT) report is a weekly market report that summarizes the holdings of participants in the US futures market. The Commodity Futures Trading Commission (CFTC) publishes the report every Friday at 3:30 PM Eastern Time, and it covers the previous Tuesday’s trading day.

(AI Overview)

September 25, 2024 at 8:48 am #12035I have been scanning the news looking for reasons for the bounce in USDJPY back to 144

I have so far come up empty but this caught my eye

The COT (futures) report showed a huge drop in long positions, which explains some of USSDJPY support

Open interest fell -47%, fastest weekly pace on record

The -177k contracts closed

Open interest at 376.5k contracts in the prior week prior was its second highest level on record

September 24, 2024 at 11:47 pm #12034The forex market is largely controlled by interest rates. In fact, the interest rate is generally the single most important factor when it comes to determining the value of that specific currency. Investors will constantly look at how the interest rate on one currency compares to another, and they will use this information to take action in the markets.

September 24, 2024 at 9:13 pm #12033September 24, 2024 at 8:11 pm #12032September 24, 2024 at 7:17 pm #12031September 24, 2024 at 7:04 pm #12030When I mention price/value magnets these are either reoccurring values or range related values of importance to large firms. You won’t find that with an Macd it comes from experience in banking (Jay of GVI) or as a CTA. With Yen much of that is import/export related entities, especially in the Asian session. UsdJpy 143.20 and 142.90 are medium term cycle magnets. If the latter is definitively compromised then look out below. If it holds we see likely see 146 in time.

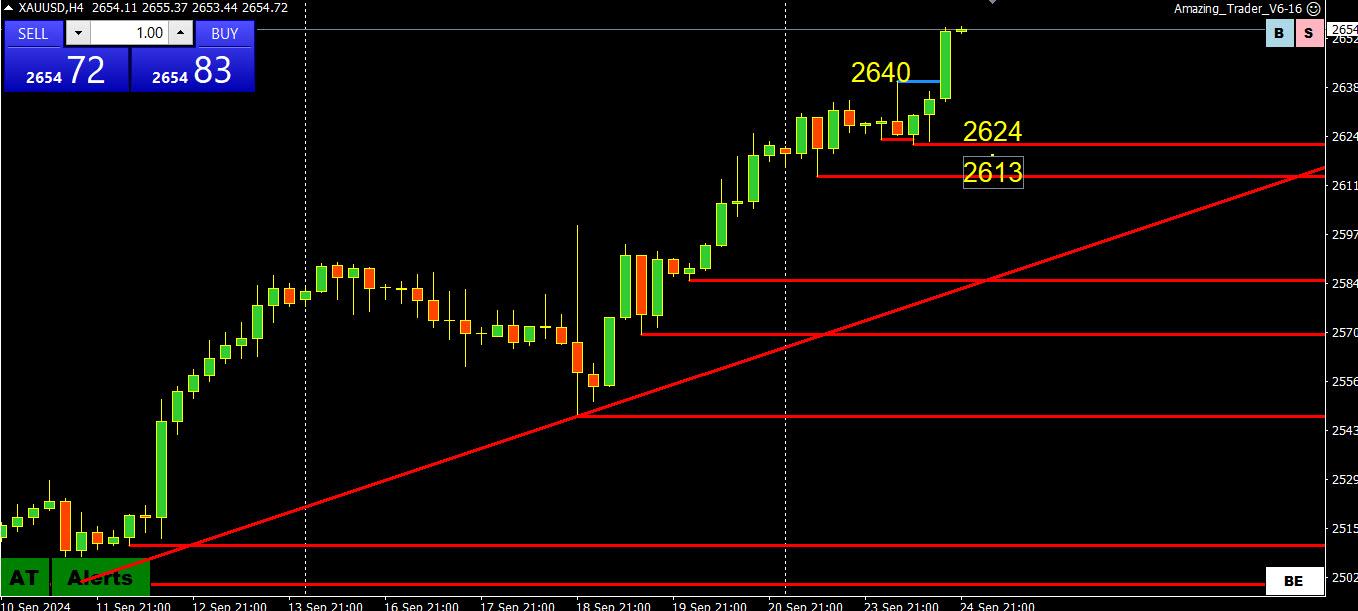

September 24, 2024 at 6:53 pm #12029September 24, 2024 at 6:26 pm #12028September 24, 2024 at 6:20 pm #12027XAUUSD 4 HOUR CHART – Another day, another record high

With another record high day, there is no change to:

When in unchartered record territory, resistance is only a guess so use the latest high as the only level that matters,

Otherwise, look for a strong bid if it stays above 2640, scaled down buy interest as long as it trades above 2600.

To suggest a pause, it would need a day without a new high.

September 24, 2024 at 6:15 pm #12026US500 4 HOUR CHART – RESISTANCE?

Note that CFD price feeds can differ between broker, even those using the same symbol. Ss, look at the chart pattern if the levels below do not line up with the prices on your chart.

US500 ran into resistance at yesterday’s record high (5735 on this chart).

As I have said, there is no reason to guess at a top when in record high territory but it pays to keep an eye on the high to see if it holds.

Supports 5697, 5671

Resistance, 5735, ?

September 24, 2024 at 5:04 pm #12025September 24, 2024 at 4:59 pm #12024 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View