- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

September 26, 2024 at 12:11 pm #12097

Last week US jobless claims showed a surprise drop… consensus is for a modest rebound… markets are highly sensitive to US jobs related data…see our Economic Calendar

September 26, 2024 at 11:09 am #12096Headline overload

* Federal Reserve Board Governor Michelle Bowman and Lisa Cook both speak, New York Fed President John Williams, Boston Fed chief Susan Collins, Minneapolis Fed chief Neel Kashkari and Fed Vice Chair for Supervision Michael Barr all speak; European Central Bank President Christine Lagarde and ECB board members Luis de Guindos and Isabel Schnabel all speak

September 26, 2024 at 11:09 am #12095September 26, 2024 at 11:05 am #12094A look at the day ahead in U.S. and global markets from Mike Dolan

With quarter-end fast approaching, tech excitement returned to Wall Street overnight with another AI-driven earnings beat from Micron Technology (MU.O), opens new tab, while China’s stocks (.CSI300), opens new tab surged anew after this week’s monetary easing blitz.

The artificial intelligence theme had gone a bit flat in recent weeks as attention switched to aggressive Federal Reserve interest rate cuts – but Micron added fresh fizz overnight

Morning Bid: Micron adds fresh tech fizz, China surges anewSeptember 26, 2024 at 10:50 am #12093September 26, 2024 at 10:44 am #12090AUDUSD 4 HOUR CHART – BOUNCE FROM ABOVE SUPPORT

I cited ,6814 yesterday as the key level on the downside and note the pause and bounce from just above it.

There was a rationale why this was more than just a support. It is all part of The Amazing Trader logic, which not only identified the key level but also why this was the key level.

In any case, AUDUSD is in limbo while within .68-.69 with a bid if it can stay above ,6850

Fundamentally AUDUSD stands to benefit from China stimulus given its close ties to the Chinese economy

September 26, 2024 at 9:59 am #12089XAUUSD 4 HOUR CHART

Consolidating between 2650-2570 (record high) for 2 days… given the strength of this move, there are not likely to see a lot of stops above the high bid… keeps a bid as long a 2650 trade.

Risk on/risk off does not seem to influence gold so watch to see if can extend its record high… if not then it would need to break below 2650 to suggest anything more than a pause.

September 26, 2024 at 9:40 am #12088GBPUSD 4 HOUR CHART – Bounced but…

Bounce from 1.3310 helped by firmer crosses (e.g. vs EUR)

One change from yesterday is that deck is cleared of buy sop until the 1,3420 high.’

On the downside, key level is the 4 hour trendline (see chart)

This leaves GBP in sort of limbo if it stays between 1,33-1,34

Key focus in Fed speakers, Weekly jobless claims, US PCE tomorrow (typically would suggest a limited USD upside ahead of it).

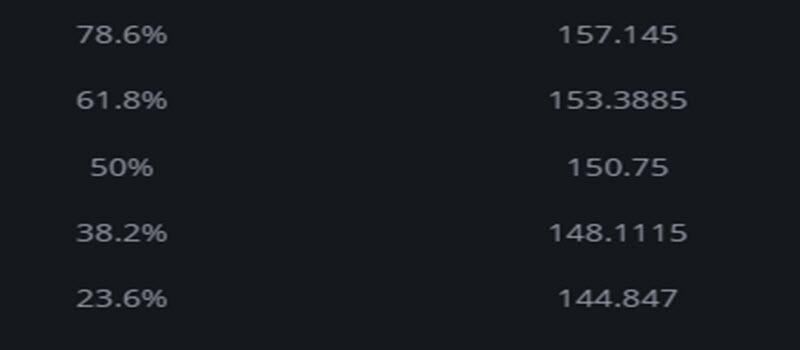

September 26, 2024 at 9:12 am #12087September 26, 2024 at 8:48 am #12086USDJPY 4 HOUR CHART – 145+ tested

Following the theory that the forex market lives to run stops, a test of 145 seemed inevitable.

Now that 145 has been tested (high 145.20), it becomes the clear bias setting level.’

USDJPY 144.50 is a pivotal level as well as it needs to become support to keep the focus on 145.

Supports are at 144.44/50, 143.85 and the trendline. Intra day resistance 145.20, key is at 147.19

FIBO levels (161.93-139.58) posted below.

September 26, 2024 at 8:40 am #12085

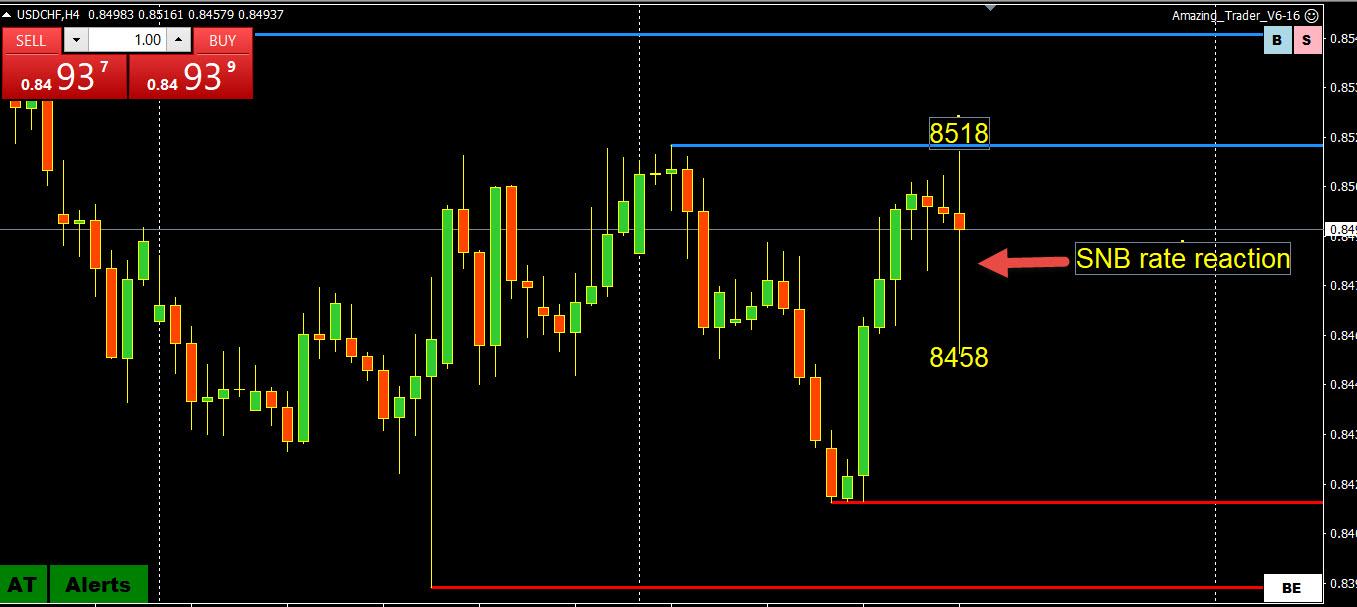

September 26, 2024 at 8:40 am #12085USDCHF 4 HOUR CHART – See the reaction to the SNB rate decision (High for the week .8518)

SNB cuts policy rate by 25bps as expected to 1.00%; prepared to intervene in FX market as necessary. Further cuts in the SNB policy rate may become necessary in the current quarters to ensure price stability over the medium term (Source: Newsquawk.com)

September 26, 2024 at 7:56 am #12084September 25, 2024 at 10:29 pm #12083When I was a bank trader, I became friendly with a trader who managed a forex dealing room. He related his philosophy, which I call a professional trader’s game plan that can be used by retail traders today.

A Professional Trader’s Strategy for the Retail Forex Trader

September 25, 2024 at 9:32 pm #12082September 25, 2024 at 9:03 pm #12081BTCUSD Monthly

Just my 10 cents worth… To understand BTC , one should go with the biggest time frame , and then use that picture to position him/herself on smaller intraday time frames. We have very interesting situation here – 5 days till months end and possible perfect pattern for a break UP . 63.480.00 is a pivotal – if closes above , most probably will break 70K and continue to new high around 80K Only below 63K we can talk about down.

September 25, 2024 at 8:13 pm #12080

September 25, 2024 at 8:13 pm #12080US500 4 HOUR CHART

This is a hard one with the upside showing some signs of consolidating and at least on this chart needing to clear 5750 to put 5800 on the radar.

On the downside, support is at 5670-00.

Note that CFD price feeds can differ between broker, even those using the same symbol. Ss, look at the chart pattern if the levels below do not line up with the prices on your chart.

September 25, 2024 at 6:42 pm #12079September 25, 2024 at 6:03 pm #12078BTC 4 HOUR CHART – Stuck in a rut

BTC remains stuck in 60-65K as it continues to trade sideways in a range. Given its history, the range is too tight to last for long but while within it expect more chop.

Looking at this chart, you have seen me mention my Amazing Trader charting algo, which even with a volatile crypto, forms patterns and levels (see the bounce off resistance) that can be used to trade.

September 25, 2024 at 5:59 pm #12077September 25, 2024 at 5:54 pm #12076 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View