- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

October 1, 2024 at 1:00 pm #12324

US stocks have been unenthusiastic about going on a run overnight and yesterday. Upcoming US data has to be not soggy for any upside to develop of note. Global conditions are not particularly celebratory with the cumulative effect of economic weaknesses and global tension.

I hope you are not one of the gullible one’s buying the US administration snake oil about inflation being under control. My Jello pudding now costs 600% above what it did 3 years ago.

October 1, 2024 at 12:48 pm #12323October 1, 2024 at 12:42 pm #12322Us Dollar is up and I don’t think that changes unless/until 101.025 is convincingly breached. UsdJpy has been sideways since 2am PST. If AudJpy can stay above 99.40 convincingly the buy side is likely favored but if not it would amount to the market not seeing value above it yet. 10yr yield opened decidedly down, that does not mean is prohibited from pulling up.

I am just doing what the market is doing and not attempting to form an opinion.

October 1, 2024 at 12:23 pm #12321October 1, 2024 at 11:59 am #12320A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street’s S&P500 (.SPX), opens new tab kicks off the final quarter of a stellar 2024 from yet another record close notched on Monday – with odd quarter-end effects competing with measured Federal Reserve guidance as labor market updates hit the radar.

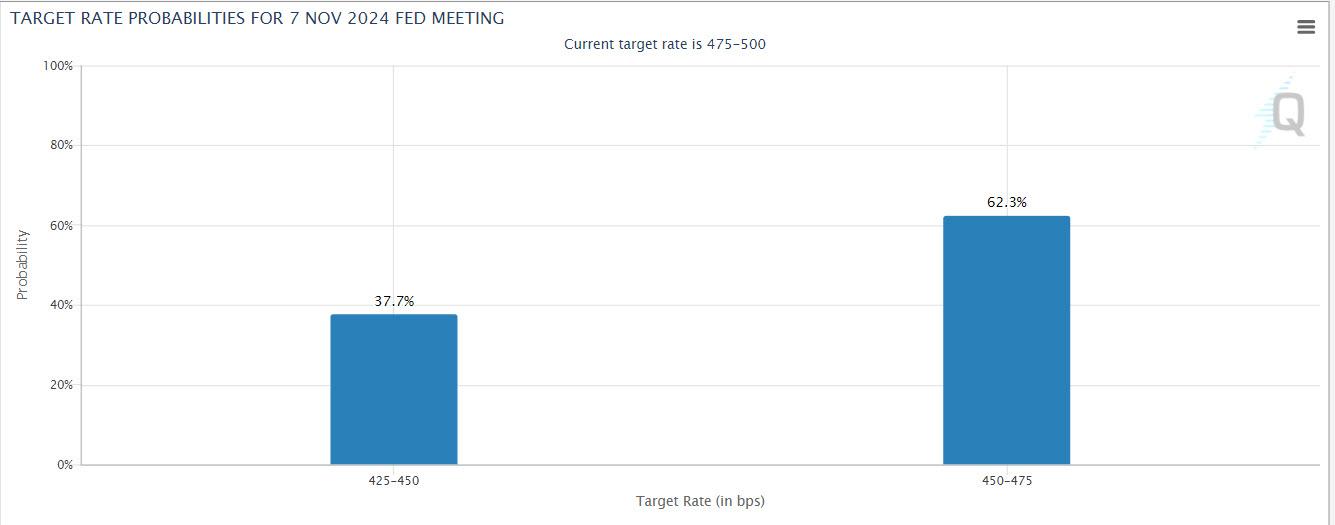

Fed chair Jerome Powell cooled speculation of a second 50 basis point cut at the central bank’s next meeting, indicating the central bank was in no rush and suggesting that two more quarter-point rate cuts by year’s end was a base case.

Morning Bid: Stocks kick off Q4 at record, euro inflation undershoots

October 1, 2024 at 11:29 am #12318GBPUSD Daily

Supports : 1.32700 , 1.32450 & 1.31850

Resistances : 1.33450 , 1.33600 & 1.33850

Bullish angle has been lost, and only question is if this is going to be a correctional phase or full blown downtrend.

Monthly and weekly charts are more in favour of a correction and continuation of the Uptrend later on.

October 1, 2024 at 11:21 am #12317October 1, 2024 at 10:54 am #12315

October 1, 2024 at 11:21 am #12317October 1, 2024 at 10:54 am #12315GBPUSD 4 HOUR CHART – Tests key support

EURUSD leading, GBPUSD following with a lag (note EURGBP)

1.3310 tested and remains key support.

Back above 1.3350-69 would be needed to deflect the risk.

As noted in our Weekly FX Chart Outlook</a>

On the downside, 1.3310 is the make or break level, keeping the risk on the high while above it.

Logic says for GBPUSD to make a serious break to a new high, EURUSD would need to establish above 1.12 and/or EURGBP would need to make another leg down.

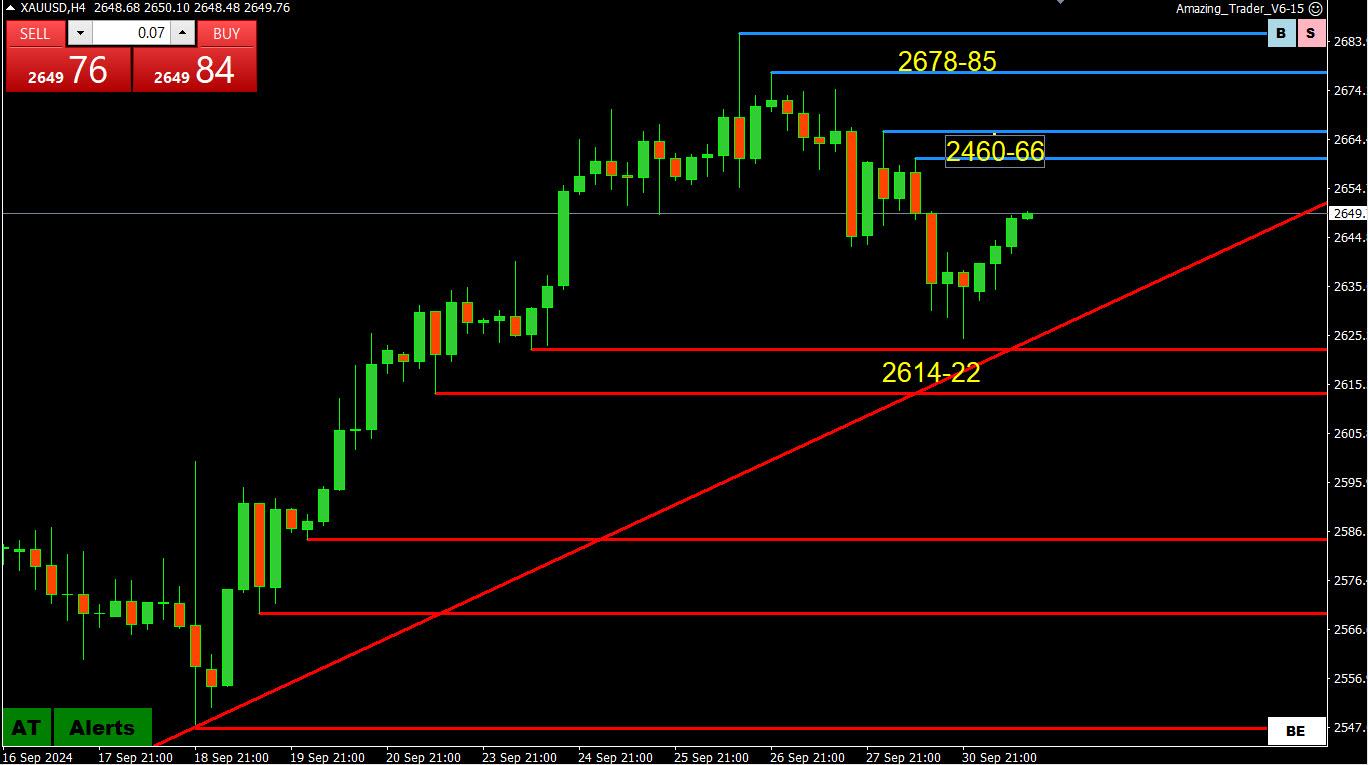

October 1, 2024 at 10:15 am #12308XAUUSD 4 HOUR CHART

Having paused above the top of 2614-22 support the focus shifts back to 2650 as a bias setter.

To suggest another run at the record high, 2660-66 would need to be overcome.

Otherwise, rising Middle East tensions suggest some safe haven demand but unless the high is taken out, it may just be a period of consolidation within 2600-2700.

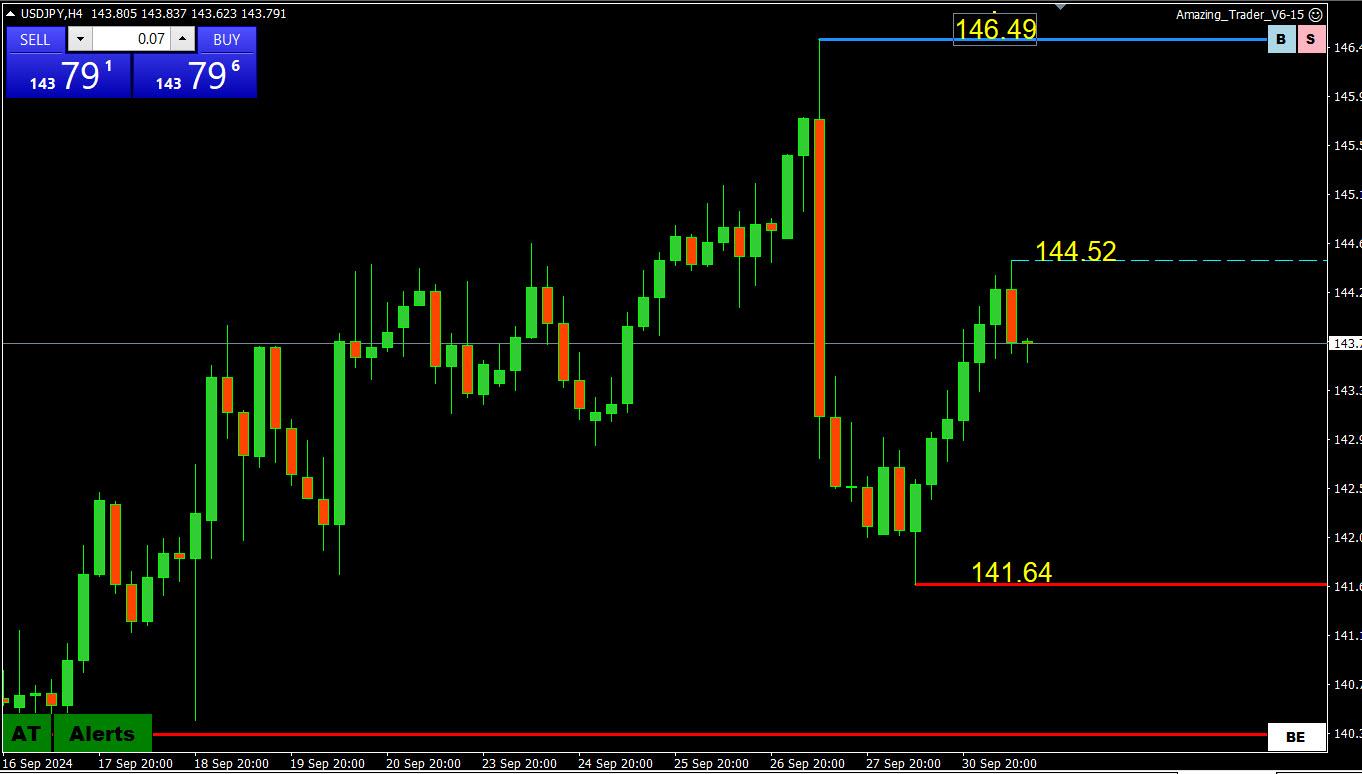

October 1, 2024 at 9:23 am #12307USDJPY 4 HOUR CHART – Retracement?

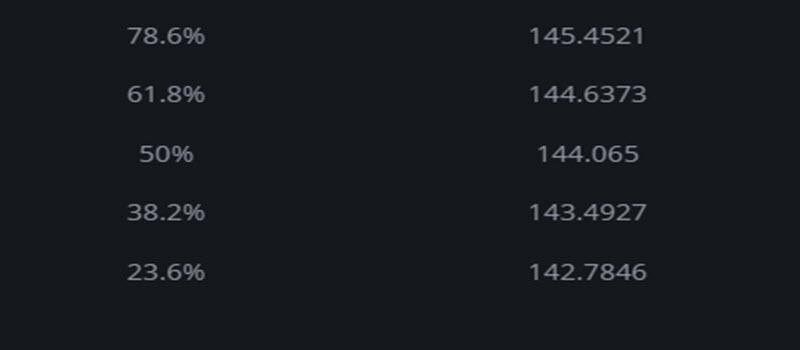

As noted yesterday, the sharp Friday-early Monday drop from 146.49-141.64 left little in the way of obvious resistance levels. above the market. This left retracement levels as potential resistance.

In this regard, the move up has so far paused below the 61.8% FIBO,(see below) which if broken would shift the risk back to 145 and Friday’s high.

Otherwise, it looks like 142-145.

USING OUR FIBONACCI CALCULATOR

October 1, 2024 at 9:10 am #12306

October 1, 2024 at 9:10 am #12306EURUSD 4 HOUR CHART – Back on the defensive

Having failed above 1.12, EURUSD has tested the neutral midpoint of 1.10-1.12.

If 1.1100-03 is firmly broken, then 1.1083 and 1.1068 come on the radar with a black hole below it

If 1.1100 holds, then 1.1120-25 would need to hold on top or risk shifts back to 1.1150.

Focus now shifts to US data with JOLTS and ISM PMI next on the docket.

October 1, 2024 at 8:01 am #12303October 1, 2024 at 12:30 am #12302September 30, 2024 at 10:28 pm #12299One thing that has not changed over the years is that the forex market continues to be driven by news. I remember when I first started out, the key report was the monthly trade report. We used to quote spreads of 200 pips wide after the report and other bank would trade on it….

Forex Trading: You Can Teach an Old Dog New Tricks

See this article in our blogSeptember 30, 2024 at 10:24 pm #12298

See this article in our blogSeptember 30, 2024 at 10:24 pm #12298New quarter, data focused market… see what is in store for Tuesday

September 30, 2024 at 8:52 pm #12296September 30, 2024 at 8:49 pm #12295September 30, 2024 at 8:40 pm #12294XAUUSD 4 HOUR CHART – Top is in for now?

Lower blue AT lines indicate risk shifting to the downside and a retracement

To suggest a retracement, needs to stay below 2643-50 to maintain that risk.

Supports at 2614-22 need to hold as well as the trendline to contain the downside but 2600 may be most important in keeping the bid.

September 30, 2024 at 8:29 pm #12293September 30, 2024 at 8:29 pm #12291 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View