- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

October 4, 2024 at 2:44 pm #12473October 4, 2024 at 2:41 pm #12472October 4, 2024 at 2:36 pm #12471

To keep it simple

EURUSD upside is limited a long as it trade below 1.10

USDJPY downside is limited if it can stay above 148 but scaled down interest as long a it is above 147.20

Geopolitical risks ahead of the weekend.

Monday Oct 7 is the one year anniversary of the Hamas attack on Israel, so another reason to be cautious into the weekend.

October 4, 2024 at 2:18 pm #12470GVI – 2:13 …….. I was just about to post something to that effect. The activity in UsdJpy is reflecting that with a return so far to what amounts to sideways activity in both spot and in futures and in options and forwards and other metrics. Someone would have a difficult time convincing me we are headed into a rose garden this Friday. Not to sound pessimistic.

October 4, 2024 at 2:13 pm #12469October 4, 2024 at 1:55 pm #12468October 4, 2024 at 1:40 pm #12467October 4, 2024 at 1:36 pm #12465October 4, 2024 at 1:18 pm #12463Word to the wise: Any time there is economic data, the financial “experts” you listen to predominantly explain what the impact is and why based on their political leaning. Today’s data was decent. And so some are giddy as if inflation was never present after 2020 and was the devil prior to 2020.

Others are more sane.

October 4, 2024 at 12:51 pm #12456October 4, 2024 at 12:48 pm #12455October 4, 2024 at 12:36 pm #12454October 4, 2024 at 12:32 pm #12453October 4, 2024 at 12:25 pm #12452October 4, 2024 at 10:50 am #12451A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street has weathered an edgy start to the final quarter reasonably well this week, with the September employment report now an obvious final hurdle on Friday and firmer oil prices an irritant even as a three-day U.S. ports strike ends.

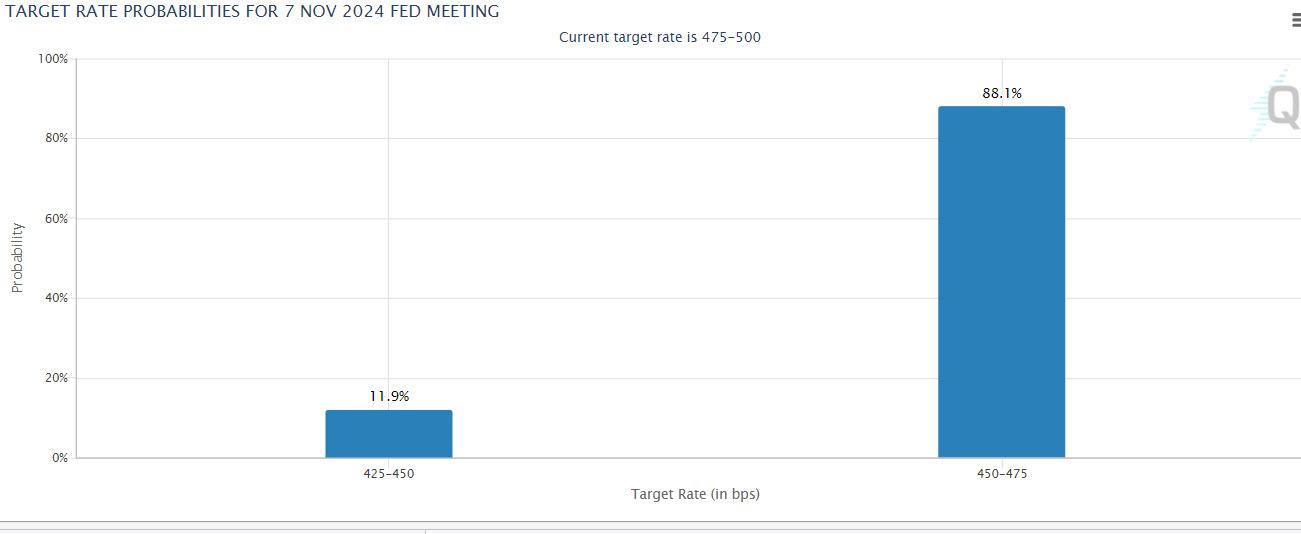

As has been the case for weeks, markets are trying to find the balance between signs of persistent growth but at a pace soft enough to sustain disinflation and Federal Reserve interest rate cut hopes.

October 4, 2024 at 10:15 am #12450Join the Global-View Trading Club and claim your 50% member benefit discount for The Amazing Trader

October 4, 2024 at 10:14 am #12449As noted in our Weekly FX Chart Outlook, how markets end the week will be more important than how it starts out.

The same goes for today once the dust settles on the US jobs report reaction, the question is how aggressive do traders want to position into the weekend given the risk of an Israeli reprisal vs. Iran.

As for NFP, as I noted, even a small deviation from the 149K consensus (e,g, 120K or 160K) can have an outsized knee jerk reaction.

October 4, 2024 at 9:52 am #12448GBPUSD 4 HOUR CHART – BOUNCE OFF THE LOW

If you are looking for the flow behind the GBPUSD bounce, look at EURGBP (lower).

Given the sharp move down yesterday, see below for retracement levels using our Fibonacci Calculator as potential resistance levels. In any case, 1.32 is pivotal (5-% at 1.3198) on the upside. Otherwise, roll the dice, NFP is up next..

October 4, 2024 at 9:37 am #12447

October 4, 2024 at 9:37 am #12447USDJPY DAILY CHART – Waiting for NFP

Bounce from 141.64 performing technically, testing the next key level at 147,20 (yesterday’s high 146.25).

On the downside, the former high around 146.50 now becomes pivotal post-NFP although only back below 145 would shift the focus back on the downside.

Re NFP, in this environment, even a small deciation from the consensus can have an oiutsized eddect.

Note, when trading USDJOY, allow for small moves through key levels, such as the one described. Same occurred on the break of 141.79.

October 4, 2024 at 12:53 am #12446It is normal to assess why markets were the way they were after the close of any given day. Today in the US session things began with a nervous tone due to the elements noted below by other GVI members.

In relation to the US Dollar one might consider that prior sessions were significantly one dimensional and singularly directional. That is often followed by markets going sideways or somewhat sideways in the sessions that follow and that was the case with UsdJpy. Sterling was a little different, which makes sense considering the one dimensional selling of late.

There is significant data tomorrow in the US session.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View