- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

October 8, 2024 at 4:10 pm #12595

Let me start out by saying where you place a stop is more important than where you enter a trade. Understand this concept and you are on your way to changing the way you look at trading

Let’s see if this turns around the way you look at trading

October 8, 2024 at 4:02 pm #12594US500 4 HOUR CHART

When you compress this chart you can see US500 has been in a range and consolidating for more than a week.

It feels like markets in general are waiting for Israel’s reprisal to get the focus away from geopolitical risks.

Stocks, meanwhile , are waiting for earnings to see if current lofty valuations can be justified.

In any case, risk of a recession has faded and question is whether the uS economy is headed for a soft landing or no landing (i.e. continued growth).

October 8, 2024 at 3:50 pm #12593October 8, 2024 at 3:18 pm #12592Forward are selling on the outside contracts and buying on the nearby contracts for both UsdJpy and EurUsd. Dow Puts are being dominated by calls. Reflective of a slight risk on condition. Bear in mind there are often delayed reactions with relation to those elements and since the end result is mixed then if there is an unforeseen purst it is likely to be on the sell side in Euro if/when participating algorithms and fund managers etc begin to decide they should hedge risk.

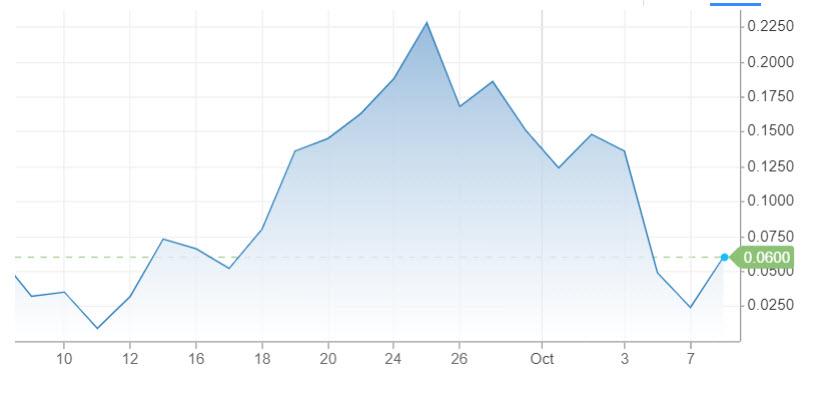

October 8, 2024 at 3:02 pm #125912-10 yield curve widens by 4bps to 0.06

Source: CNBC

A positive yield curve indicates that long-term debt interest rates are higher than short-term debt rates.

A positive yield curve can mean that the economy is expected to grow in the future. This is because a rational market will generally want more compensation for greater risk, and long-term securities are exposed to greater risk.(AI Overview)

October 8, 2024 at 2:56 pm #12590GVI at 2:42 pm — It depends on the source for the worth. Human nature for sardines to want to know where the other sardines are in the water so maybe you have a chance of survival.

If it is a retail broker it has no worth to me. If it is institutional that says something. But institutional brokerages would lose their clients fast if they did that absent of a market-wide data output without someone being fired. Been there to see it.

October 8, 2024 at 2:42 pm #12589October 8, 2024 at 2:41 pm #12588October 8, 2024 at 1:55 pm #12584There are times when 1 + 1 = 3

This feels like one of them in the absence of fresh economic news

Middle East tensions simmer with Israel reprisal vs Iran looming at any time

US bond yields up, stocks up – no ign of risk off

Commodity currencies still struggling – sign of risk off

‘

GOLD unable to catch a safe haven bidAs for FX, use the anti-dollar EURUSD 1.10 as a USD strength/weakness indicator…. last at 1.0975

October 8, 2024 at 12:15 pm #12580EURGBP 4 HOUR CHART – REVERSAL OIF FORTUNE

Retreat from .8404 helping to give GBPUSD a bid while EURUSD lags after a tepid attempt at 1.10, on a reversal of the price action seen yesterday.

With key support at .8349, .8350-00 seems more like a no man’s land so watch this cross as it is influencing EURUSD and GBPUSD.

October 8, 2024 at 12:06 pm #12579Reuters Pollsays 68 out of 75 economists see the ECB cutting the deposit rate by 25bps in October and December. Median show ECB to cut deposit rate to 2.0% by end 2025 (prev 2.50% in Sept poll)… Newsquawk.com.

October 8, 2024 at 11:29 am #12578EURUSD 4h

Waiting from yesterday to see 1.10 and reaction to it – lame…

Supports : 1.09750 , 1.09500 & 1.08850

Resistances : 1.10000 , 1.10350 & 1.10500

Close of this Bar above 1.09850 would be Bullish short term – another leg Up

Close below 1.09800 would indicate possible continuation of the Downtrend

October 8, 2024 at 10:41 am #12577

October 8, 2024 at 10:41 am #12577A look at the day ahead in U.S. and global markets from Mike Dolan

World markets painted a messy picture on Tuesday, with recently pumped-up crude oil prices retreating sharply and disappointment surrounding China’s economic stimulus already setting in – knocking Hong Kong shares (.HSI), opens new tab back almost 10%.

The return of mainland Chinese markets after a week’s holiday there did see the CSI300 (.CSI300), opens new tab index play catch-up with another jump of about 6%. But the Hang Seng, which had remained open for much of the week and rallied significantly during that time, turned tail.

October 8, 2024 at 10:24 am #12576October 8, 2024 at 9:51 am #12575XAUUSD DAILY CHART

Since setting a record high 9 days ago, XAUUSD has traded either side of 2650 in the following 8 days.

This is clearly the pivotal level, especially if you view the current range at 2600-2700.

‘

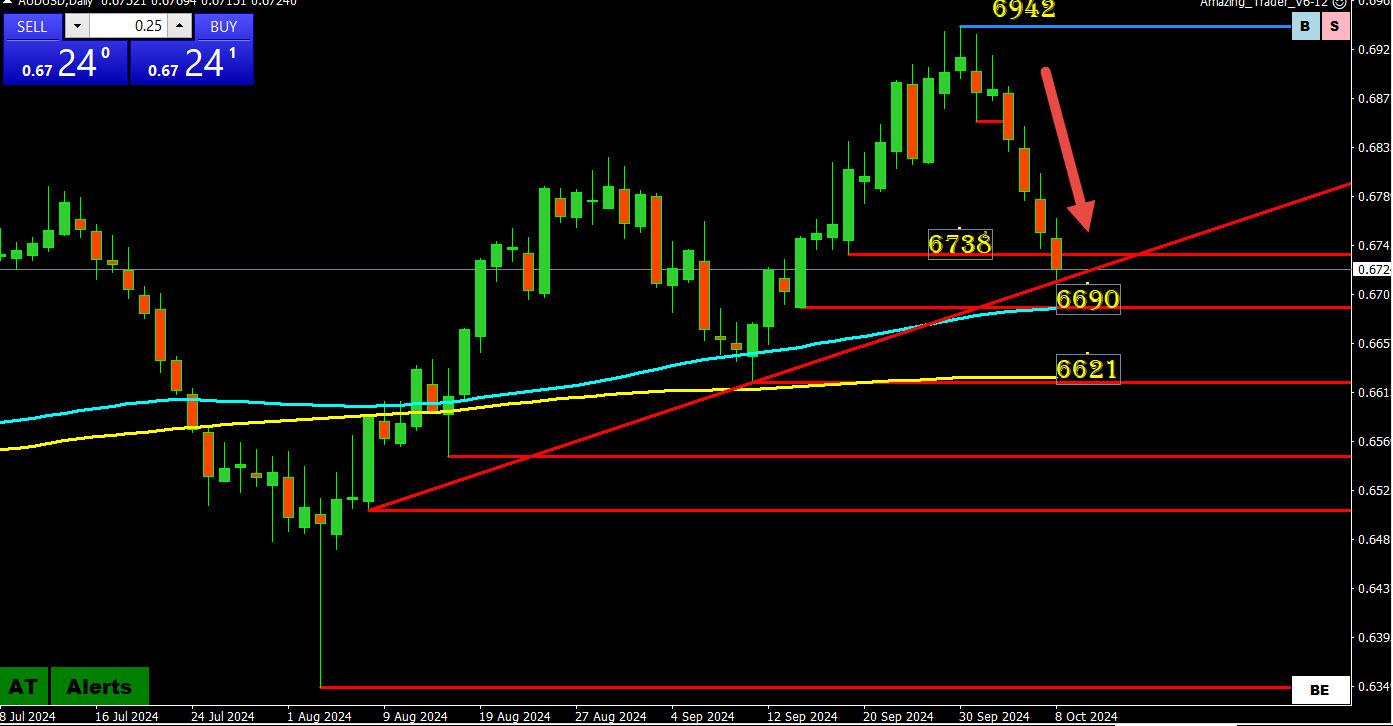

GOLD has been aa disappointment in that it is not benefiting from safe haven flows but it remains to be seen if it is just biding its time, In any case, 2650 will eventually dictate whether the current move is just a pause or the start of a retracement,October 8, 2024 at 9:39 am #12574AUDUSD DAILY CHART – Commodity currencies extend slide

AUDUSD continues its retreat from .69+ but faces potential tough areas of support.

Trendline: Around 6713

Key supports:

6690 (also around the 100 day mva – blue)

6621 (also around the 200 day mva – yellow)

On the upside, back above .6738-50 would be needed to slow the risk

October 8, 2024 at 9:31 am #12573USDCAD DAILY CHART – Tests key resistance

Commodity currencies continue to trade weaker

5 green daily candles in a row

Tests the 1.3647 level cited here as the next target, so far holding. A firm break exposes almost another 100 pips on the upside.

Look for support as long as it stays above 1.3600-10

October 8, 2024 at 9:26 am #12572October 8, 2024 at 8:47 am #12570October 8, 2024 at 8:47 am #12571 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View