- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

October 11, 2024 at 3:05 pm #12817October 11, 2024 at 2:58 pm #12815October 11, 2024 at 2:56 pm #12814October 11, 2024 at 2:00 pm #12810

Of the forward rates I observe, UsdJpy has the strongest conviction, which is toward the sell side. The others are mainly stronger in the further out contracts and weaker in the nearby’s indicating a bit of a mix early in the session. Bear in mind it quite often takes some time for this element to work its way through markets, but that is the condition and it changes daily.

October 11, 2024 at 1:41 pm #12809Noting a disconnect between S&P and Dow internals at the open with S/P sell side activity present and not as much in Dow. Euro correlates more strongly with Dow than S&P. I had an arrogant genius try to convince me years ago that only S&P was the only thing that mattered other than bonds. Arrogance and ignorance are not a good mix.

October 11, 2024 at 1:23 pm #12808Aud is on the back foot a bit pre-US open as are a few others in terms of flows but not necessarily strength of conviction, but that is the condition for the moment in my view. Am interested to see what the report from Canada is at the start of the next hour with relation to business outlook survey. Canada has been doing a fairly good job if I am not missing something.

October 11, 2024 at 12:23 pm #12807October 11, 2024 at 12:16 pm #12806October 11, 2024 at 11:27 am #12805From the Reuter Morning Bid report

But the picture encouraged doubts about whether the Fed will cut again in November, with some Fed officials clearly wavering.

The relatively hawkish Atlanta Fed boss Raphael Bostic told the Wall Street Journal he was considering a pause until the data fog lifted a bit. “Maybe we should take a pause in November. I’m definitely open to that.”

While other Fed officials indicated further easing was still in store, futures remain only just over 80% priced for another quarter point rate cut on November 7.

October 11, 2024 at 11:25 am #12804October 11, 2024 at 10:30 am #12803A look at the day ahead in U.S. and global markets from Mike Dolan

Even though futures pricing had already turned queasy before the sticky September inflation report on Thursday, the prospect of the Federal Reserve skipping another interest rate cut next month has now become part of the mix.

An aggravating miss on U.S. consumer price readings for last month, which saw the annual core inflation rate unexpectedly tick higher to 3.3%, was partly offset by a jump in weekly jobless claims amid distortions from recent strikes and storms.

October 11, 2024 at 10:14 am #12801October 11, 2024 at 10:14 am #12802October 11, 2024 at 9:43 am #12800EURUSD 1 HOUR CHART: 1.09-1.10

The bounce from 1.0900 suggests the wide range is 1.09-1.10 with the risk down unless the top end is taken out, stronger if 1.0950 becomes resistance.

For intra-day, 1.0950 remains the pivotal level with 1.0955 (yesterday’s post data high) key day resistance

Otherwise, it is hard to see big bets ahead of the weekend

October 11, 2024 at 9:24 am #12799October 11, 2024 at 9:24 am #12798October 11, 2024 at 7:29 am #12788A look at the day ahead in European and global markets from Tom Westbrook

Friday’s session brought a cautious mood to the markets, ahead of a smattering of data and an uncomfortable weekend.

China’s finance minister has called a fiscal policy briefing for Saturday against a backdrop of high expectations and jittery trade. Investors and, as of Thursday, Swedish furniture shop IKEA want fiscal stimulus to reinvigorate the economy.

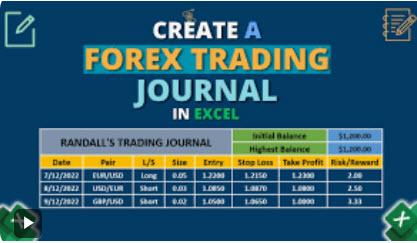

October 10, 2024 at 11:33 pm #12779Those who have followed me know how I feel about treating trading as a business and not a casino. If you treat it like a casino you will wind up like most of those who visit Las Vegas. If you treat it like a business then you have a chance to be successful.

Trading Tip: Treat Your Trading as a Business: Keep a Ledger.

October 10, 2024 at 11:29 pm #12778At first glance forex broker client sentiment reports showing net client positions seem like a useful tool.

However, when you dig deeper it raises the question whether the data should be taken at face value.

October 10, 2024 at 8:57 pm #12777 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View