- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 18, 2024 at 11:16 am #13085

A look at the day ahead in U.S. and global markets by Harry Robertson

From U.S. small-cap stocks to bitcoin to the dollar, some investors are seeking out assets that can prosper under a second Donald Trump presidency.

The former president has taken the lead over Vice President Kamala Harris in betting markets, although Harris held a marginal lead in a Reuters/Ipsos poll this week.

So-called Trump trades focus on those parts of the global economy likely to feel the force of tariff hikes, deregulation, and bigger deficits.

October 18, 2024 at 10:59 am #13084Newsquawk US Open

Chinese sentiment lifted overnight whilst European markets are tentative and choppy thus far

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mixed/firmer given China tailwinds; NQ +0.5%, driven by NFLX +5%

USD is broadly softer vs peers, GBP outperforms after Retail data, Antipodeans benefit from China data & PBoC musings

Fixed benchmarks relatively contained, Gilts initially hit on data while EGBs & USTs attempt to move higher

Choppy trade for Crude into a weekend of potential geopolitical risk. Metals glean support from China

Chinese sentiment was eventually lifted after comments from PBoC Governor Pan who reiterated that they could cut RRR further this year and noted expectations for a 20bps-25bps reduction in the Loan Prime Rates on Monday.

October 18, 2024 at 10:32 am #13083October 18, 2024 at 9:35 am #13082Some ECB governors at this week’s meeting wanted to drop the [;edge to keep policy tight, according to Reuters sources (Newsquawk.com)

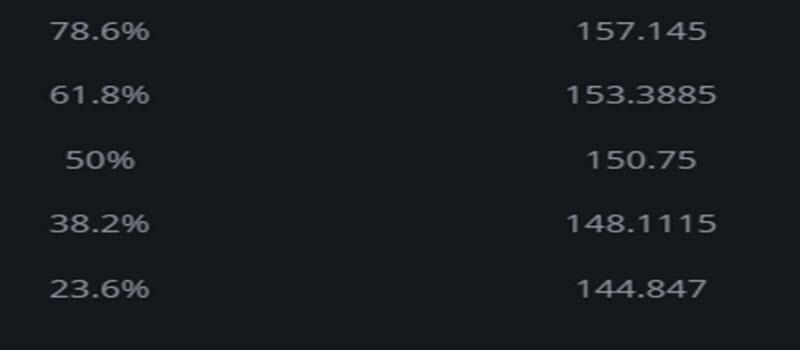

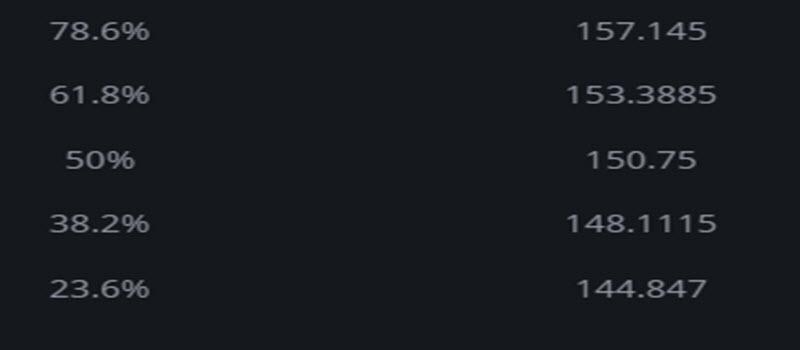

October 18, 2024 at 9:29 am #13081USDJPY 1 HOUR – WHAT’S HOT AND WHAT’S NOT

What’s hot: When it trades above 150

What’s not so hot: When it trades below 150

Note 50% FIBO at 150.75 vs. high at 150.32. Maybe the MoF watched our forum as there was some vague verbal intervention that seemed to cool the upside.

To s

uggest the high is in 149.39 would need to be broken.

October 18, 2024 at 9:22 am #13080

October 18, 2024 at 9:22 am #13080EURGBP DAILY CHART – WHAT’S HOT AND WHAT’S NOT

What’s not: Not EURGBP which extended its low (by 5 pips) to .8295 before a quick bounce back.

On the upside, intra-day resistance start at .8325, upside limited while below it.

As I have been noting, this cross can be used as a EUR strength/weakness indicator with an influence on both EURUSD and GBPUSD.

October 18, 2024 at 9:12 am #13079EURUSD 4 HOUR – WHAT’S HOT AND WHAT’S NOT

What’s not: Not the EURUSD but the pause above 1.08 yesterday (1.0811 low) suggests a possible defense of an option level.

In any case, EURUSD is taking a breather as the USD backs off a touch elsewhere but would need to renew 1.0850+ (the bias setter, upside limited while below it) and then break 1.0873 to suggest anything other than ajust a minor retracement.

With that said, no key stops are left on the downside until the low is taken out.

October 18, 2024 at 9:02 am #13078XAUUSD 4 HOUR – WHAT’S HOT AND WHAT’S NOT

What’s hot: XAUUSD as it set another record high (2714)

As I have noted, when in record unchartered territory use the most recent high (low) as the only resistance (support).

As also noted yesterday, expect support as long as it trades above 2680-85, and add in 2700 for it to have a mega bid.

October 18, 2024 at 8:08 am #13076Small-cap stocks, bitcoin climb; Mexican peso, Treasuries slip

Trump Media & Technology Group shares up 140% since Sept. 23

Investors debate if market moves are due to Trump or economic optimism

NEW YORK, Oct 18 (Reuters) – Corners of financial markets that could feel the impact of a Donald Trump victory are stirring again, as the U.S. presidential race tightens with less than three weeks until Election Day.

From bitcoin to Mexican peso, ‘Trump trades’ are appearing again

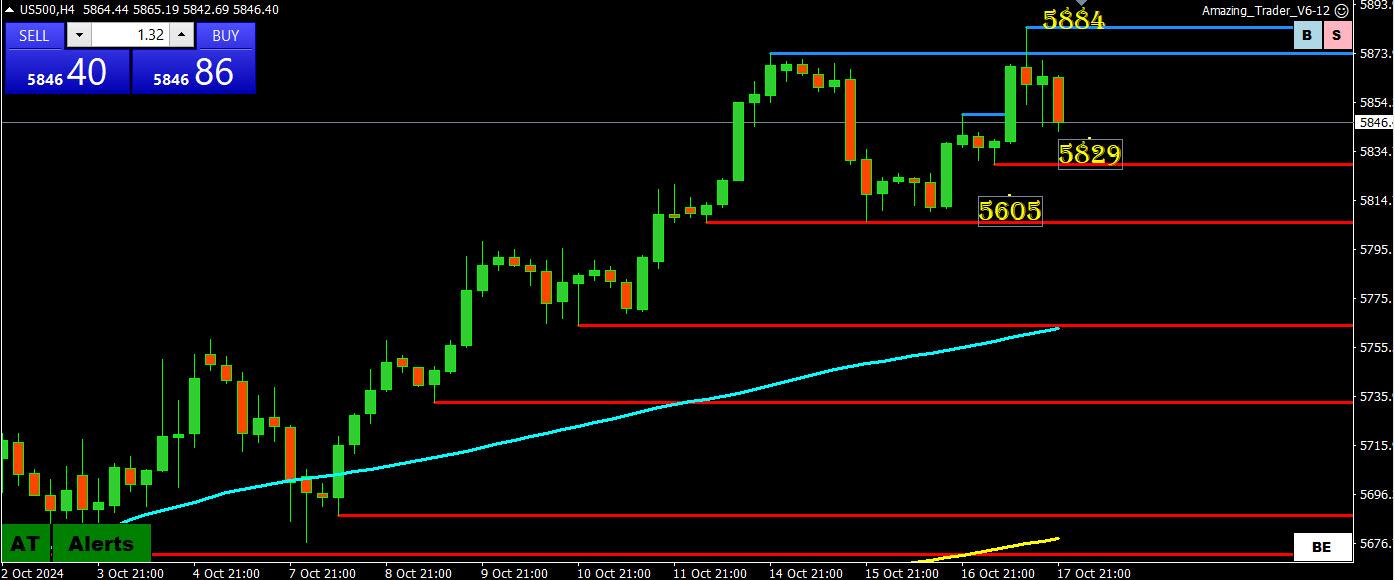

October 17, 2024 at 9:27 pm #13074October 17, 2024 at 8:40 pm #13073October 17, 2024 at 8:27 pm #13072October 17, 2024 at 6:51 pm #13067October 17, 2024 at 6:40 pm #13066October 17, 2024 at 6:07 pm #13065NAS100 4 HOUR CHART – Record high still looms

Still waiting for NAS100 to make a new high (record high 20766) but so far only coming close.

What I like to do is scan the time frames and see if there is a level or indicator that jumps out. In this regard, look at the 100 period 4 hour moving average (blue line) and how to checked the downside.

Otherwise, 20K on this CFD chart is the ultimate bias setter and whether this run about will finally set aa new record.

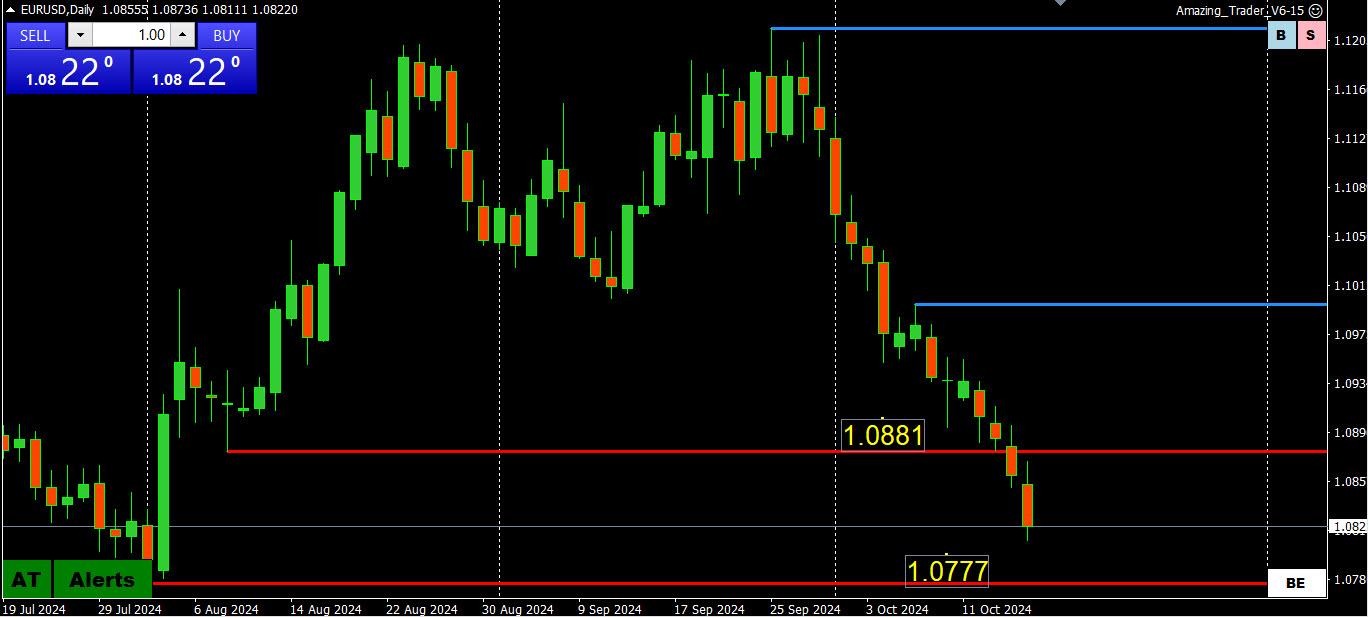

October 17, 2024 at 5:41 pm #13062EURUSD DAILY CHART – 1.0777

For those long time Global-View members, you will remember Zeus pointing out levels like 1.0777

Well, if you look at this Amazing Trader chart the target is clear.

However, much depends on how hard 1.08 will be defended as an options barrier level.

On the upside, only back above 1.0840-50 would postpone the risk.

October 17, 2024 at 4:58 pm #13061October 17, 2024 at 4:26 pm #13060October 17, 2024 at 4:10 pm #13059October 17, 2024 at 3:35 pm #13057 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View