- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 19, 2025 at 5:38 pm #21137March 19, 2025 at 4:54 pm #21136March 19, 2025 at 4:16 pm #21135

Just posted in our blog

Good reading during the wait for the FOMC

What is President Trump’s Tariff Game Plan?

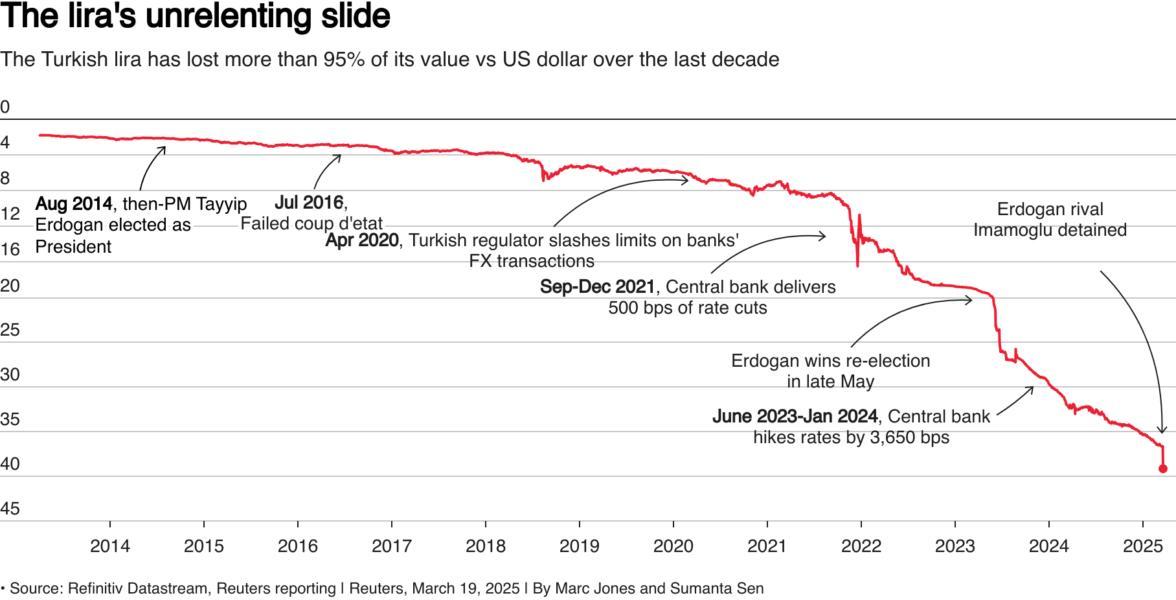

March 19, 2025 at 4:06 pm #21134Watch the Dot Plots

FOMC dot plot projections are updated at today’s meeting. Given the economic uncertainties resulting from tariffs, Fed members will have a hard time making interest rate projections.

What is the dot plot?

The FOMC dot plot is a chart published by the Federal Open Market Committee (FOMC) of the Federal Reserve that shows the interest rate projections of its members. It is released four times a year as part of the Summary of Economic Projections (from the internet).

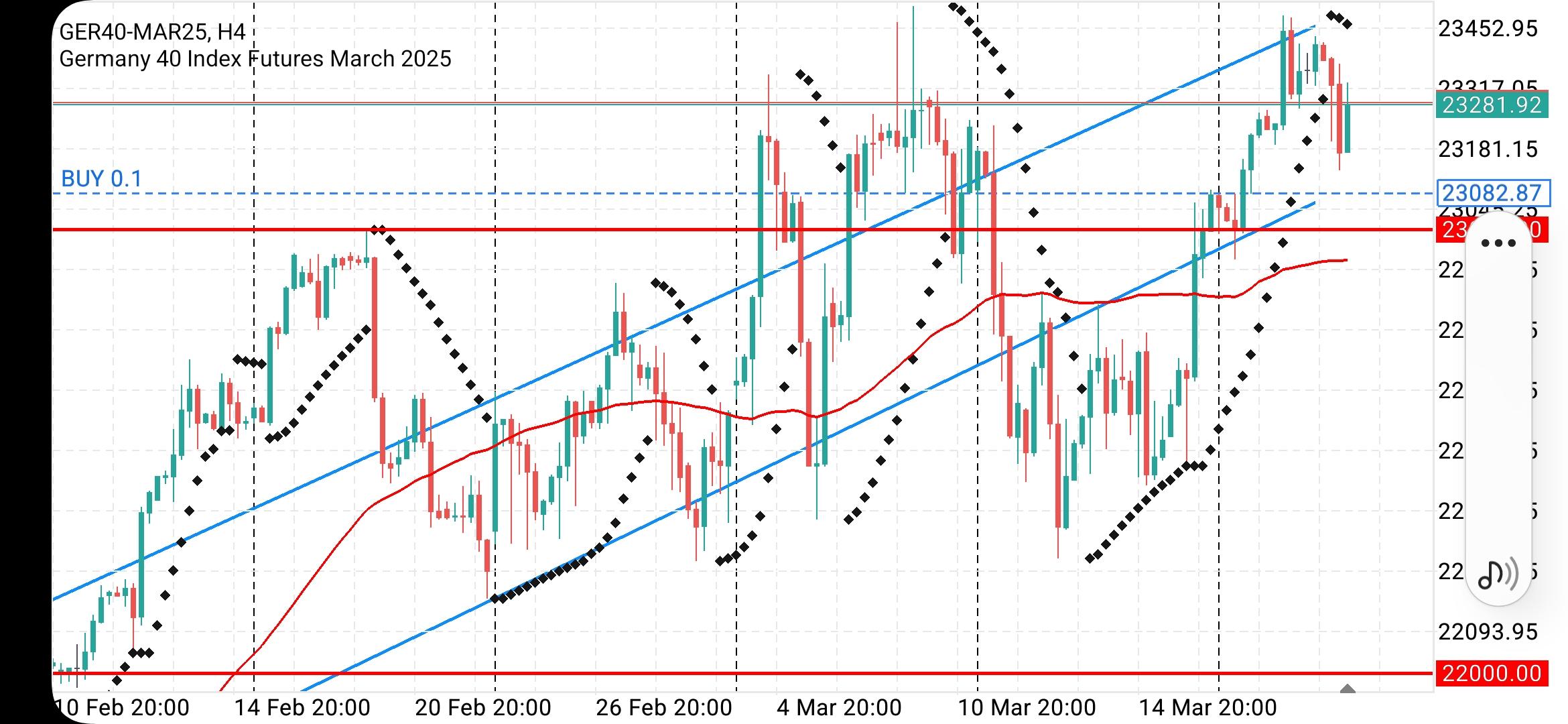

March 19, 2025 at 3:58 pm #21133March 19, 2025 at 3:40 pm #21132European rally faces tariff reckoning

Is it a time for some clear thinking ?

· STOXX 600 up 0.1%

· IT firm Softcat pops on results

· Fed rate decision awaited

· Turkish assets tumble

· Wall St futures inch up

· Fast money investors have been a key force behind this year’s strong rally in Europe, and now that real money flows are starting to pour in, tariff risks are back to the fore.

· This could keep volatility high and curb gains near term, say Barclays, pointing to the April 2 deadline by which reciprocal tariff rates in the U.S. are intended to take effect.

· “A ‘worst case’ 25% blanket tariff, should it materialise, would indeed take away most of the growth expected this year in Europe,” says strategist Emmanuel Cau at the UK bank.

· “However, US goods exports are only c.12% of revenues for (the STOXX 600)… And, with tariff losers underperforming notably ytd, some of the risks are arguably priced in.”

· Despite the short-term risks, Cau is upbeat about the long-term as a landmark fiscal reform in Germany will likely boost the broader European growth for 2026 and beyond.

· This could drive “more inflows/rotation”, Cau notes.

· As a result, Barclays has doubled its 2026 EPS growth forecast for the STOXX SXXP to 8%, lifting the year-end target to 580 from 545 – a 4.7% upside to Tuesday’s close.

March 19, 2025 at 3:38 pm #21131EURO 1.0887

–

PUPPY CAME TO REST ATM IN THE HIGHER 1.088″s after majestically failing to pierce N of 1.0950on the larger time frames puppy still in uP trend and still I d be looking to B-o-minorDips

for this puppy to turn in its trand would probably take over 100 – 125 pips dump and stay there.

which raises the Q of what thinng would make the dollar rally thusly

March 19, 2025 at 3:29 pm #21130March 19, 2025 at 3:27 pm #21129–

14:00 FOMC decision on policy around “money”

— players and pundits are expecting no change (to 4.5%)

— markets is pricing total of 50bps easing for all of 2025 max.

—- half hour later jerome will try to explain his and gang’s thinking about inlation that is NOT working its way towards his 2% target and that in the by tariff muddied and fogged environment. Jerpme may try to bambooxle players using his staff’s dot-plot and thus try to wash his hands off any allusions to future directional prognostication.At this junction for the dollar to rally players would somehow have to draw a perception that the FED is in a hawk mood (if only to try to piss off donald)

March 19, 2025 at 3:19 pm #21128March 19, 2025 at 2:56 pm #21120March 19, 2025 at 2:44 pm #21119March 19, 2025 at 2:30 pm #21118March 19, 2025 at 2:19 pm #21117March 19, 2025 at 1:57 pm #21116March 19, 2025 at 1:39 pm #21115March 19, 2025 at 1:10 pm #21110March 19, 2025 at 1:04 pm #21109European stocks steady while U.S. futures tick up, Turkish assets tumble

· European stocks little changed, U.S. futures up· Investors focused on tariff and growth concerns

· Turkish assets drop after arrest of Erdogan rival

European shares struggled for direction on Wednesday while U.S. futures ticked up after a selloff on Wall Street, as investors waited for the Federal Reserve rates decision later in the day.

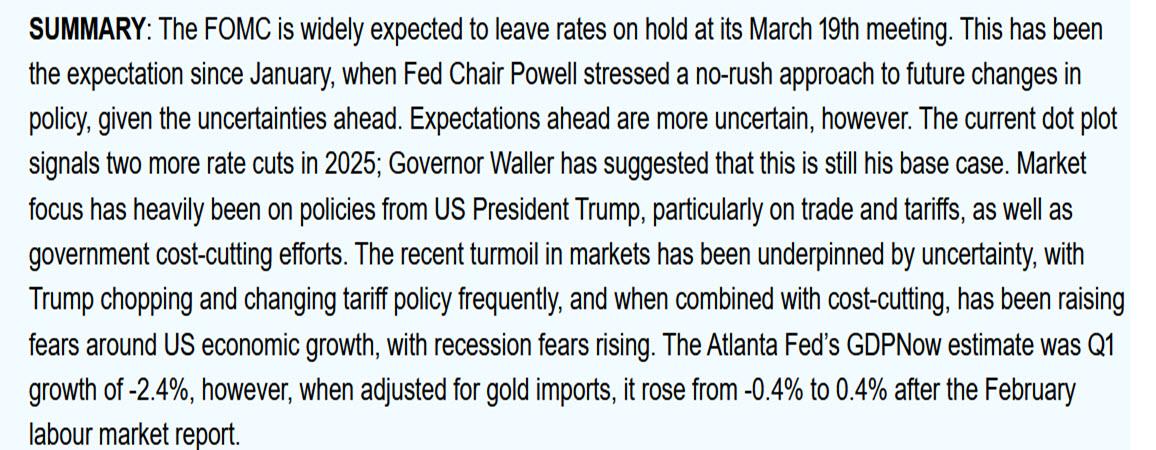

Meanwhile, Turkish stocks, bonds and the lira all slid, helping boost the safe-haven U.S. dollar, after authorities detained President Tayyip Erdogan’s main political rival on Wednesday.

TURKISH SELL-OFF

The Turkish lira slid in its biggest daily fall since the peak of the country’s most recent currency crisis in June 2023 and last traded at around 38 per dollar, down around 4% USDTRY.

Investors ditched Turkish assets after authorities detained Ekrem Imamoglu, the Istanbul mayor, on Wednesday on charges including corruption and aiding a terrorist group. The main opposition party called the arrest “a coup against our next president”.

March 19, 2025 at 1:00 pm #21108

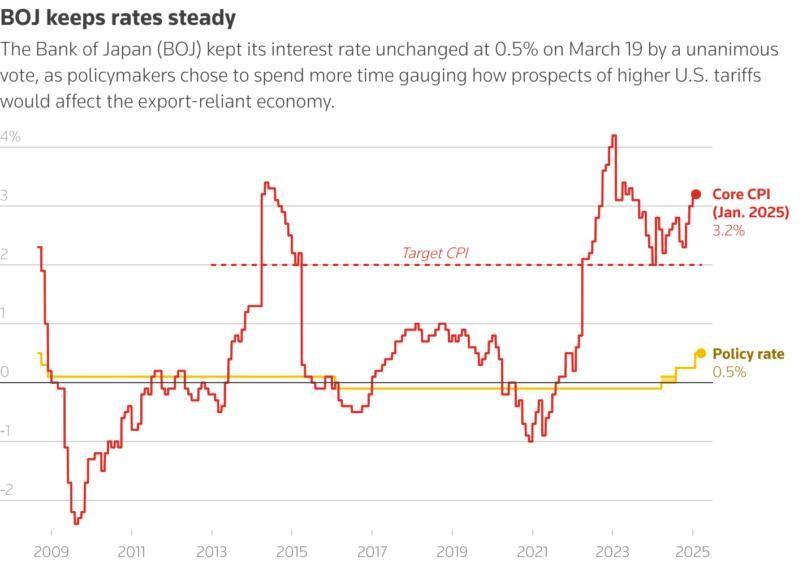

March 19, 2025 at 1:00 pm #21108USDJPY

The yen weakened against the dollar, which rose 0.3% to 149.805 in volatile trade as investors mulled the BOJ decision to hold rates steady and comments from Governor Kazuo Ueda

he widely expected BOJ decision underscored policymakers’ preference to spend more time gauging how mounting global economic risks from higher U.S. tariffs could affect Japan’s fragile recovery.

“The decision to leave monetary policy unchanged itself is not a surprise, so its impact on exchange rates is limited. However, the earlier-than-usual timing of the announcement seems to have led financial markets to initially interpret that the BOJ (did not consider) bringing forward a rate hike,” said Hirofumi Suzuki, chief FX strategist at SMBC.

March 19, 2025 at 12:57 pm #21107

March 19, 2025 at 12:57 pm #21107Dollar rises ahead of Fed; Turkish lira drop reins in G10 currencies

Key points:

· Dollar up, Fed decision key for markets on Wednesday

· Safe haven currencies rise after Turkey lira plunges

· Yen up after BOJ stands pat on rates

· Euro stays near five-month peak on German fiscal reform

The dollar rallied on Wednesday ahead of the Federal Reserve’s decision on interest rates, but retreated from the day’s highs after markets stabilised from an early shock caused by the detention of Turkish President Tayyip Erdogan’s main rival.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View