- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 21, 2024 at 9:24 am #13133October 21, 2024 at 9:19 am #13132

EURUSD 4 HOUR CHART -Day without news

RANGE SO FAR 1.0846 -1.08715

As posted in our Weekly FX Chart Outlook

Trend down

While 1.0850 sets the intra-day tone, any move to the upside that fails to break 1.09 should be treated as a retracement.

On the other side, as we noted, 1.08 is one of those options strike levels that would likely be defended (low was 1.0811)

Levels to watch: 1.0873 (yellow line – 200 day mva) and 1.0881 breakdown level..

October 21, 2024 at 12:10 am #13130War affects currency flows.

As reported in Reuters today, 2 classified US intelligence reports were leaked detailing Israel’s plans with Iran. The day after Biden said he knew of Israel’s plans and saw room for ceasefire.

A little bird had me feeling there would be a leak last night through the New York Times, the democrat party’s propaganda source. Which is exactly what happened.

The goal of the Biden administration and democrats is to foul up Israel’s plans and maybe get lucky right before the US presidential election by being able to claim they stopped Israel.

From protecting itself.

Dear Jewish people. There is not one democrat who is your friend.

This is going to put heavy weight on into any gallant thoughts over a risk on environment next week. Therefore it will really take something to convince me and a lot of others that DX gets heavy buy flows that would sustain yet.

The US is not supporting a key, long time ally, over hopes of political gain while being an embarrassment.

October 20, 2024 at 11:58 pm #13129The upcoming week has a light economic calendar, especially from the US in a forex market that seems to need news to create volatility. Arguing for consolidation, at least to start the week, is a light economic calendar and that there are no key USD buy stops unless last week’s highs are taken out.

Let’s look at daily charts to see the broader picture.

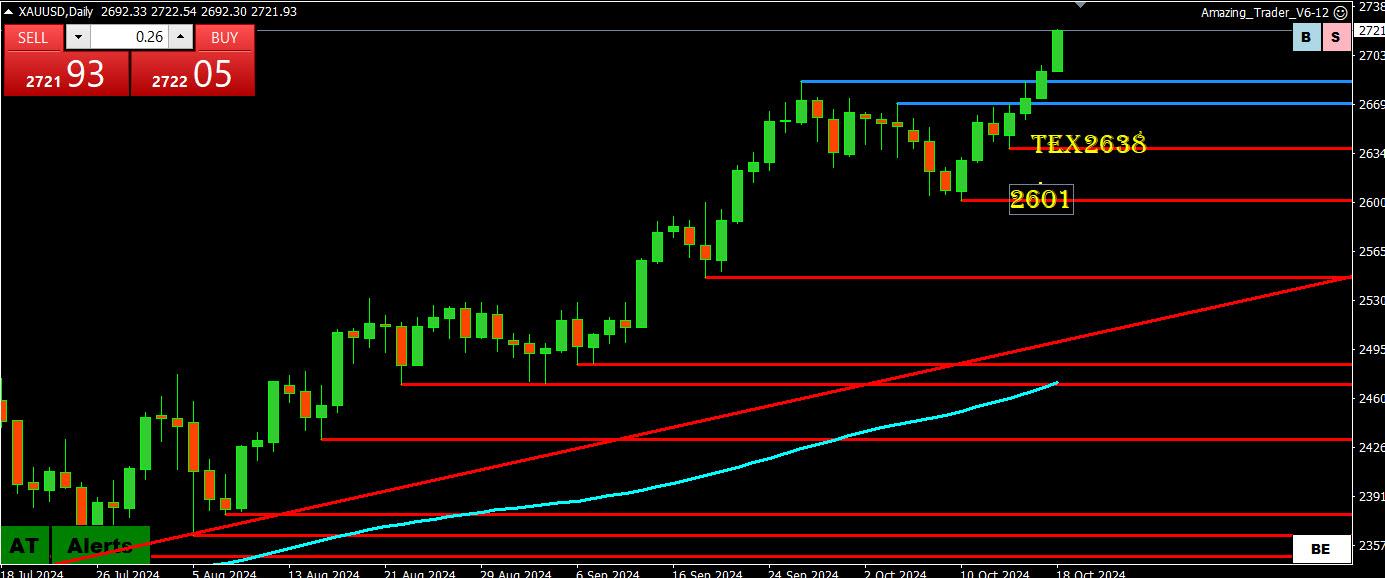

Weekly FX Chart Outlook – October 21-25 (plus XAUUSD)

https://global-test.financialmarkets.media/weekly-fx-chart-outlook-october-21-25/October 20, 2024 at 10:10 pm #13118

https://global-test.financialmarkets.media/weekly-fx-chart-outlook-october-21-25/October 20, 2024 at 10:10 pm #13118THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Starting off Monday is Germany’s producer price index which is estimated to fall 0.25 percent month over month, after rising 0.2 percent in August.

Wednesday will have Canada’s monetary policy report and US existing home sales data release.

Bank of Canada is expected to cut its policy interest rate by 50 basis points to 3.75 percent. This follows a 25-basis point cut to 4.25 percent last month. US existing home sales are expected to rise at a 3.9 million annual rate in October after falling 2.5 percent to 3.860 million units in September. Also in US reports Wednesday, the release of the Beige Book covering the period between late August and mid-October will show the impacts from Hurricanes Helene and Milton, reports out of Atlanta, Richmond, and St. Louis. This could well pull the overall tone of the report down, and coming on the heels of a lackluster assessment of conditions in the prior Beige Book, it could cause some handwringing about the US economy.

In Thursday’s reports, South Korean GDP is expected to rise 2.1 percent year over year, and the PMI composite flash for the UK is expected to expand in both composite, manufacturing, and services in its flash release.

Econoday

October 20, 2024 at 9:48 pm #13115October 20, 2024 at 12:27 am #13112Just WHERE is yellen ?

worried about Howard Lutnick and trumps potential tariffs

–

BRICS to discuss new global financial system – Reuters

At next week’s BRICS summit Moscow plans to unveil new payments platform for international trade without need for dollar.Putin says BRICS, not the West, will drive global economic …

(Reuters) The BRICS group will generate most of the global economic growth in the coming years thanks to its size and relatively fast growth compared …At BRICS summit, Russia to push to end dollar dominance

(Reuters) Russia is seeking to convince BRICS countries to build an alternative platform for international payments that would be immune to Western …Russia calls on BRICS partners to create alternative to IMF

(Reuters) Oct 10, 2024 — Russia, which chairs the BRICS group this year, has called on its partners to create an alternative to the International Monetary Fund (IMF)October 19, 2024 at 4:39 pm #13111October 19, 2024 at 4:03 pm #13110October 19, 2024 at 12:15 am #13101October 19, 2024 at 12:11 am #13100October 18, 2024 at 7:22 pm #13097It is worth revisiting this article

If I told you that there was a large order in the market to buy EUR and sell GBP would you be looking to sell EURUSD and buy GBPUSD, do the opposite or step aside as the order gets executed?

October 18, 2024 at 5:28 pm #13095October 18, 2024 at 3:54 pm #13094October 18, 2024 at 3:07 pm #13093October 18, 2024 at 2:33 pm #13091October 18, 2024 at 2:28 pm #13090October 18, 2024 at 1:34 pm #13089So let’s summarize the price action… I know this is just one flow but has impacted both spot pairs

EURGBP extended its bounce from .8295 to .8323

EURUSD firmed and GBPUSD followed with a lag

EURGBP stalled below .8325 (thanks to The Amazing Trader for that level) and then slipped back

GBPUSD firmed as the cross slipped

EURUSD barely moved

EURGBP did not go far on the downside, GBPUSD lost its cross bid, EURUSD slipped back with a lag

Sounds like a puzzle… this is using crosses to trade Spot101

Contact me jay@localhost if you want a further explanation

October 18, 2024 at 1:23 pm #13088October 18, 2024 at 11:28 am #13086This is a popular article that is worth revisiting

I first heard the term “feels bid in an offered market” on the Global-View.com Forex Forum many years ago. It was posted by one of our professional trader members, LA Mel, who used the term mainly for the EURUSD. However, it soon became apparent that it could be applied to all currencies and on both sides of the market (e.g. feels offered in a bid market and vice versa). I soon added to my trader toolbox and still use it today

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View