- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 22, 2024 at 11:58 am #13195October 22, 2024 at 10:41 am #13194

Newsquawk US Open

Oil surges on recent geopolitical updates; speakers & earnings ahead

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses are entirely in negative

territory, with initial outperformance in the DAX 40 (due to strong SAP results) now entirely erased; US futures are also lower.Dollar is flat, Antipodeans outperform attempting to recoup some of its recent losses.

Bonds remain on the backfoot in a continuation of the pressure seen in the prior session

Crude was initially subdued, giving back some of the prior day’s gains; however, following two key geopolitical updates, the complex soared to session highs.

1) Israeli PM Netanyahu will hold consultations tonight with various cabinet ministers,

2) Iranian embassy officials were reportedly involved in the drone attempt on NetanyahuNot signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

October 22, 2024 at 10:33 am #13193October 22, 2024 at 10:13 am #13192October 22, 2024 at 9:54 am #13191Assuming EURUSD 1.08 is being defended as an options strike, the way it generally works is the seller (writer) of the option buys EURUSD ahead of 1.08 to defend the level.

If EURUSD bounces without 1.08 being traded, it sells out its EURUSD (with a profit) so it can reload if EURUSD comes down again. The options seller repeats the process until the option expires, the defense covers or limits the cost of the option or the strike trades and option is triggered.

Note, it is much harder to defend a level that goes against a prevailing trend.

Also, I just making an assumption that 1.08 has been defended based on the price action.

October 22, 2024 at 9:51 am #13190October 22, 2024 at 9:32 am #13189October 22, 2024 at 8:47 am #13188XAUUSD 4 HOUR CHART – RECORD HIGH LOOMS ABOVE

Retracement from another record high did not last long but only a break of 2740 would take it again into unchartered territory where 2750 and 2800 would be potential pause levels.

Support starts at 2714 but this only becomes the key level if 2740 high is broken. Otherwise, key support remains at 2701.

October 22, 2024 at 8:40 am #13187EURUSD 4 HOUR CHART – IS 1.08 BEING DEFENDED?

As noted, 1.08 is one of those key options level that had potential to be defended.

So far, the bounce from 1.0811 suggests this may be the case but only back above 1.0850 would slow the risk, back above the 200 day mva (1.0872) would be needed to neutralize it.

Whatever the case, 1.08 is the line in the sand blocking the next target at 1,0777.

October 22, 2024 at 8:32 am #13186USDJPYDAILY CHART – TESTING MOVING AVERAGE BAND

With next key resistance not until 155.20, key moving averages become the focus.

150.78 = 100 day mva (blue)

151.35 = 200 day mva (yellow)

What caught my eye is the overnight low at 150.50, a Power of 50 level… expect support as long as it holds.

Below 150.50 would put 150 in play again.

October 22, 2024 at 8:26 am #13185October 22, 2024 at 8:14 am #13184October 22, 2024 at 8:04 am #13182Japan’s general election outcome could muddle BOJ plans

Summary

Recent poll shows risk of ruling coalition losing majority

New coalition could include party favouring easy policy

Messy election outcome could hurt Ishiba’s hawkish streak

Political disorder risks causing delay in BOJ rate hikes

TOKYO, Oct 22 (Reuters) – The risk of Japan ending up with a minority coalition government after the upcoming general election is raising concerns that the central bank could face complications in its quest to gradually wean the nation off decades of monetary stimulus.October 22, 2024 at 8:04 am #13183Japan’s general election outcome could muddle BOJ plans

Summary

Recent poll shows risk of ruling coalition losing majority

New coalition could include party favouring easy policy

Messy election outcome could hurt Ishiba’s hawkish streak

Political disorder risks causing delay in BOJ rate hikes

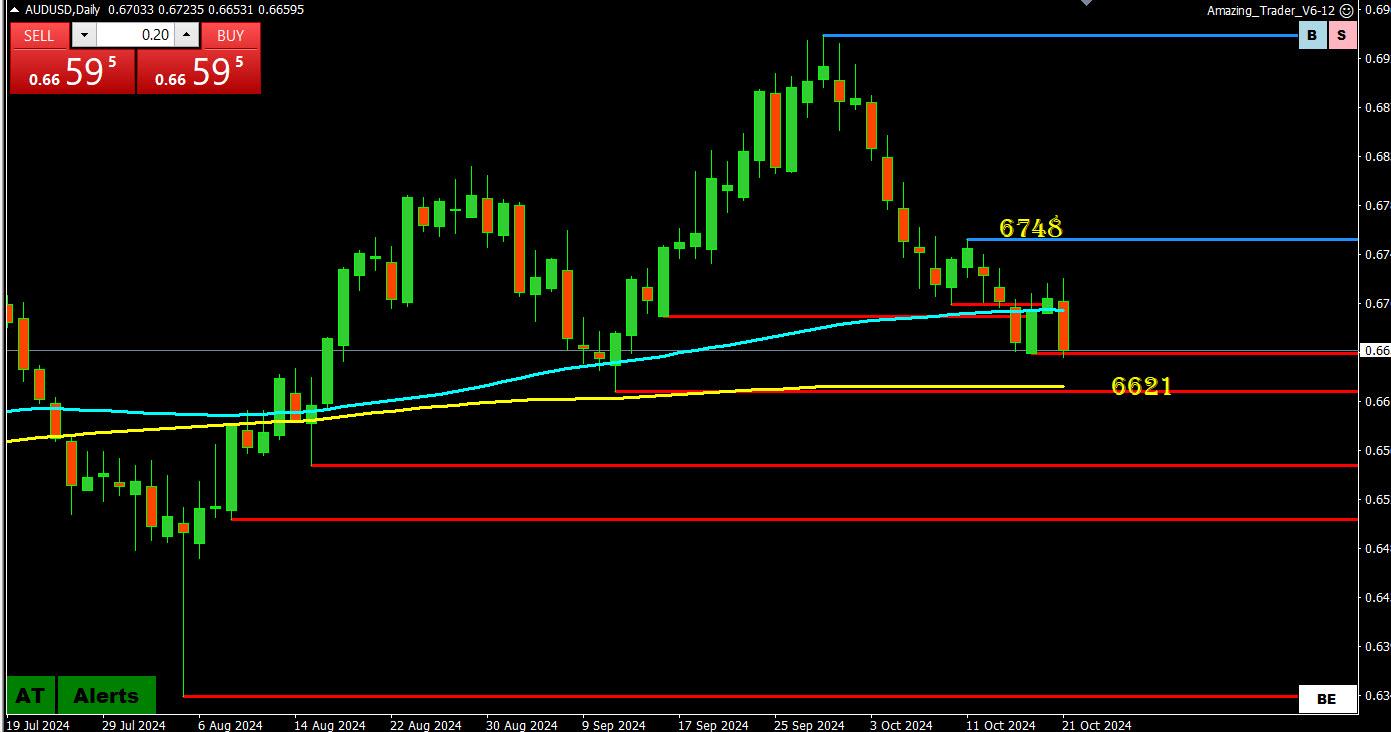

TOKYO, Oct 22 (Reuters) – The risk of Japan ending up with a minority coalition government after the upcoming general election is raising concerns that the central bank could face complications in its quest to gradually wean the nation off decades of monetary stimulus.October 22, 2024 at 7:54 am #13181October 21, 2024 at 11:57 pm #13180October 21, 2024 at 9:50 pm #13179October 21, 2024 at 8:22 pm #13178October 21, 2024 at 8:14 pm #13177AUDUSD DAILY CHART – KEY LEBEL LOOMS BELOW

As noted in our Weekly FX Chart Outlook

Trend down but above key level

Key level is clear at .6621, which is also around the 200 day mva. As long as AUFUSD stays above it, the downside risk is limited.

On the upside, a move above 6758 would be needed to suggest a reversal of fortune.

October 21, 2024 at 8:07 pm #13176 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View