- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 23, 2024 at 2:58 pm #13291October 23, 2024 at 2:56 pm #13290

I have very close relationships with influential people from Mexico. The good one’s not the bad one’s.

The USMCA trade agreement between the US and Mexico was fostered and completed under the Trump administration. This created, as of 2023 the US accounting for 60% of Mexico’s trade income, which is an historic high.

Funny enough, the Mexican trade minister, who is a socialist, is all over the place promoting that Harris should be elected to sustain that level. The politics of lies never stops with these people (socialists).

October 23, 2024 at 2:42 pm #13289October 23, 2024 at 2:35 pm #13288October 23, 2024 at 2:07 pm #13287October 23, 2024 at 1:48 pm #13282October 23, 2024 at 1:44 pm #13281October 23, 2024 at 1:36 pm #13280October 23, 2024 at 1:26 pm #13279October 23, 2024 at 1:00 pm #13278October 23, 2024 at 12:23 pm #13276October 23, 2024 at 11:08 am #13275A look at the day ahead in U.S. and global markets from Mike Dolan

The dollar continues to ride higher on the back of an anxious pre-election climb in U.S. Treasury yields, notching its best levels in almost three months against the euro and yen on starkly contrasting economic and interest rate pictures.

With the International Monetary Fund’s annual meeting underway and G7 finance chiefs and central bankers gathering, the exceptional performance of the U.S. economy was underlined in updated IMF global forecasts on Tuesday.

October 23, 2024 at 11:05 am #13274Newsquawk US Open

European bourses trading negative, US futures follow suit with earnings ahead

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are generally trading in negative territory; US futures follow suit, ahead of a busy earnings slate.

DXY continues to march higher, USD/JPY climbs back above 152 to a current 152.74 peak.

USTs are modestly lower ahead of 20yr supply; Bunds were unreactive to a well-received 10yr auction.

Crude is subdued and continues to await geopolitical updates; XAU is slightly higher whilst base metals are mostly in the red.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

October 23, 2024 at 10:55 am #13273October 23, 2024 at 10:04 am #13272USDCAD DAILY CHART – 25 or 50BPS?

Reaction to the BoC decision will dictate whether a 50bps rate cut is discounted or the trigger for a run at the major 1,3946 level…1.3850 would need to become support to put 1.3946 at risk

On the downside, back below 1.38 would be needed to cool the threat

Re the BoC, surprise would be a 25bps rate cut although I saw a Canadian bank calling for 25bps.

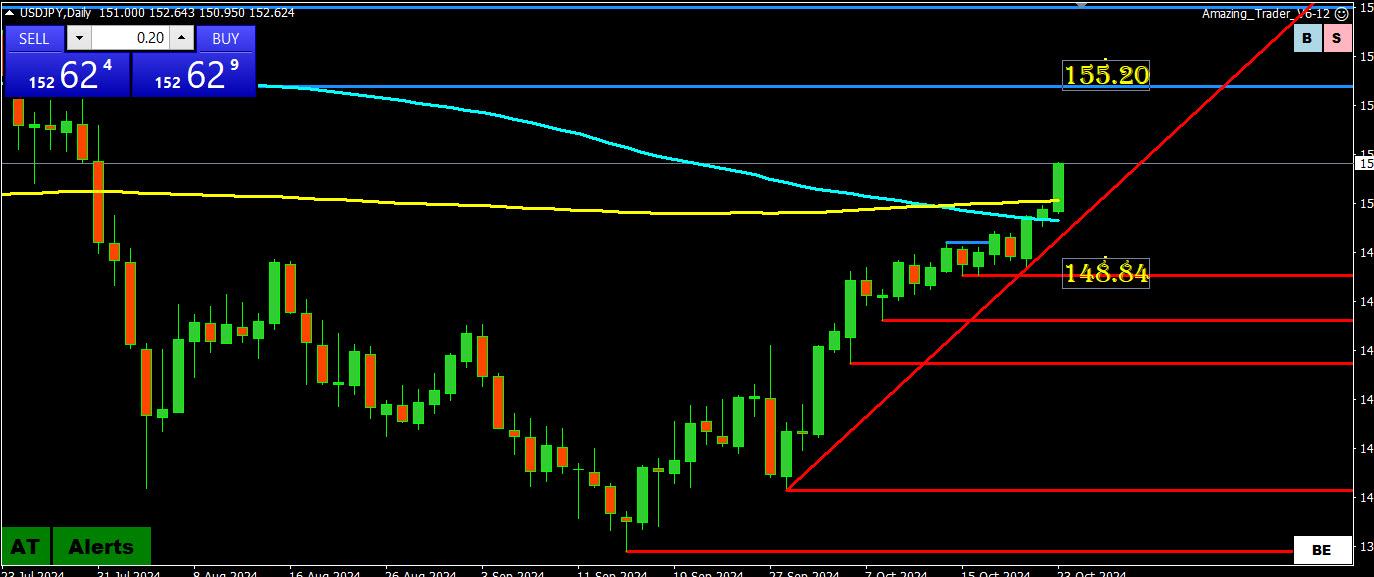

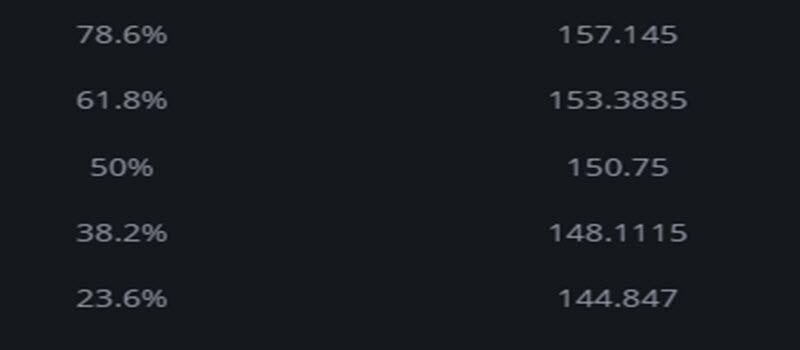

October 23, 2024 at 9:56 am #13269October 23, 2024 at 9:50 am #13263October 23, 2024 at 9:38 am #13255 USDJPY DAILY CHART – 200 DAY MVA

USDJPY DAILY CHART – 200 DAY MVAAs I have been noting, there was a void of key level until 155.20 other than the 200 day mva (151.37), break of which propelled USDJPY higher, and a 61.8% FIBO.

Now 152 becomes pivotal as the level that needs to hold keep a strong bid and put 155.20 on the radar.

Note, the correlation between the JPY and firmer US yields.

Risk of verbal intervention rises given pace of JPY slide.

FIBOS: 153.39 = 61.8% of 161.93-139.58

October 23, 2024 at 9:34 am #13253

October 23, 2024 at 9:34 am #13253eye on yellen

–

Yellen Says US to Contribute $20 Billion for Ukraine Loan

G-7 set to finalize $50 billion loan for Kyiv on Friday

Loans backed by profits from frozen Russia central bank assetshaving listend to her voice talking about f-kking w / russian money

yellen – maybe , maybe not – feels safe in numbers of the G-7October 23, 2024 at 9:04 am #13239 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View