- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 28, 2024 at 11:30 am #13521October 28, 2024 at 10:57 am #13520

Newsquawk US OPEN

Equities lifted and oil sinks as traders digest Israel’s limited strike on Iran

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are on a firmer footing, traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; US futures also benefit.

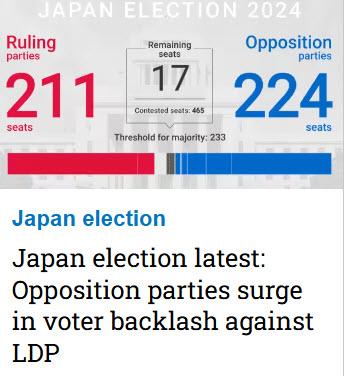

USD is mixed, losing vs EUR & GBP but significantly stronger vs JPY after the Japanese general election which has seen the ruling coalition lose its parliamentary majority.

Bonds are pressured by the removal of geopolitical risk premia, but have lifted off lows in recent trade given the continued pressure in oil prices.

Crude gapped lower overnight and has continued to slip since the European cash open; Brent Jan’25 currently at lows of USD 71/bbl. XAU/base metals are also pressured.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

October 28, 2024 at 10:34 am #13519October 28, 2024 at 10:11 am #13513October 28, 2024 at 10:04 am #13508October 28, 2024 at 9:39 am #13507October 28, 2024 at 9:31 am #13506EURUSD 4 HOUR CHART – 1.08 PATTERN

EURUSD extending its trading pattern around 1.,08 to 4 days in a row a it consolidates above last week’s 1.0761 high.

To further highlight the 1.08 pattern, the current range is 39 pips either side of it (1.0761-1.0839)\

To suggest momentum for a run at 1.0761, 1.0782 swould need to be broken.

October 28, 2024 at 9:23 am #13505October 28, 2024 at 9:07 am #13504EURJPY 4 HOUR CHART – MIND THE GAP

Opening week gap here as well to Friday’s 154.40iush close

Support starts at last week’s 155.02 high through 154,70 (today’s low).

Chart hows a big void above 155,02 so us today;s high as initial reistance.

Less chance to see BoJ intervening in EURJPY and buying of this cross may be one flow supporting the EURUSD>

October 28, 2024 at 8:56 am #13503USDJPY 1 HOUR CHART – ELECTION FALLIUT

Opening week gap to Friday’s 152.35ish close not filled.

As noted, BoJ was likely lurking on top after the election results fallout with charts showing little until 155.20

Initial support is 153.17 (last week’s high) through 152.67 but always a risk the gap would get filled.

October 27, 2024 at 11:34 pm #13502Oct 28 (Reuters) – A look at the day ahead in Asian markets.

A hugely pivotal week for world markets begins with investors in Asia already bracing for volatile trading in Japanese assets on Monday after Prime Minister Shigeru Ishiba lost his parliamentary majority in the country’s general election.

Ishiba’s Liberal Democratic Party has ruled Japan for almost all of its post-war history, so the initial market reaction to a political earthquake of this magnitude could trigger a selloff in the yen and Japanese stocks, and higher Japanese Government Bond prices.

Morning Bid: Japan election shockwaves kick off critical week

October 27, 2024 at 10:20 pm #13501THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Next week Monday, the Regional Federal Reserve bank manufacturing indicators are expected to contract In the US Dallas Fed manufacturing Survey for October. Forecasters expect another minus 9 index in October, unchanged from minus 9 in September.

On Tuesday, The US international trade goods (advanced) report is expected to show the goods deficit widened to $95.8 billion in September from $94.1 billion in August while the US consumer confidence index is estimated to drop to 98.7 in September from 105.6 in August. Forecasters look for a recovery to 99.1 in October, but sentiment is expected to remain depressed from summer levels.

Wednesday, French GDP for the third quarter is expected to rise 0.4 percent. Germany’s GDP is expected to contract 0.1 percent and Italy’s is expected to rise 0.3 percent in Q3. US GDP is expected to rise 3.0 over the quarter. US pending home sales are estimated to rise 1.0 percent this month for September.

Friday closes the last full week of data before the US Presidential election on Tuesday, November 5, with the one data release that could rise above all the clamor – the US employment report for October. The consensus forecast calls for a rise of 125,000 in payrolls for October. There are two special factors that might lead to a surprise.

The first is Hurricane Helene’s impact on large parts of the Southeast. Widespread devastation can make it difficult for the statistical agency to collect the normal data. Establishments may be hard to contact and unusual circumstances make it difficult to answer the standard questions. The same can be true of the household survey side. The BLS has experience dealing with this sort of challenge, but it may have an impact nonetheless. It may also result in more revisions than usual when the November data is released on December 6 at 8:30 ET.

The second is strike activity. There are two new strikes in aerospace that affect 38,000 workers. These workers will be deducted from October manufacturing payroll counts. Additionally, there is a new strike of 3,400 hotel workers which will be deducted from leisure and hospitality payrolls. These are one-time impacts. They will be added back in once each strike is settled, whenever that is. However, the strikes at Boeing and Textron may result in some layoffs and/or delays in hiring at businesses that are part of the chain of goods and services for aircraft manufacture. Businesses are reluctant to lose workers now who may be harder and/or most costly to replace later. But if the strike drags on, there could be effects in the coming weeks or months.

Econoday

October 27, 2024 at 9:33 pm #13500October 27, 2024 at 8:54 pm #13499October 27, 2024 at 7:52 pm #13498October 27, 2024 at 6:47 pm #13497There were 11 false breaks on an intra-day session to session basis in Yen futures from the start of the Asian session Thursday night through the close of the US session. Due to the election in Japan one might consider not being overly aggressive in the coming Asian session unless it is a clear directional condition.

October 27, 2024 at 6:24 pm #13496October 27, 2024 at 11:48 am #13492From Nikkei Asia

8:11 p.m. 50 seats have been confirmed as going to the ruling bloc, with 27 for the opposition. 233 are need for a majority.

8 p.m. Voting closes. The ruling bloc is at risk of losing their lower house majority, Nikkei projected immediately after polls closed based on exit surveys of voters and other factors.

The main opposition Constitutional Democratic Party (CDP) is expected to gain seats in the chamber, as is the Democratic Party for the People, amid public anger at the LDP over a political funds scandal involving dozens of its lawmakers.

October 27, 2024 at 10:48 am #13490October 27, 2024 at 12:12 am #13489Newsquawk Week Ahead Highlight Oct 28-Nov 1

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View