- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

October 29, 2024 at 11:26 am #13594October 29, 2024 at 11:15 am #13593October 29, 2024 at 10:57 am #13592October 29, 2024 at 10:52 am #13591

A look at the day ahead in U.S. and global markets from Mike Dolan

Even as public borrowing estimates were shaved on Monday, U.S. Treasury yields continue to probe three-month highs as markets lean toward a win for Donald Trump in next week’s election and a possible clean sweep in Congress for his Republican party.

In an event-packed fortnight that sees the first of this week’s five U.S. megacap earnings later on Tuesday alongside critical job openings data, Wall Street stock indexes remain buoyant near record highs.

Morning Bid: Election-Agitated Treasuries Meet Megacap Earnings

October 29, 2024 at 10:41 am #13590Eye on Yellen

–

Hey peasants, listen here !

..you ”are better off than they were when President Joe Biden took office.”But … “more work was needed to bring down the cost of living but said that wages have risen faster than prices.

“Which means that the typical American can afford more goods and services than before the pandemic. And Americans are starting new businesses at a record rate, reflecting optimism about the economy,”A week before US vote, Yellen revives arguments on strong economy – RTRS

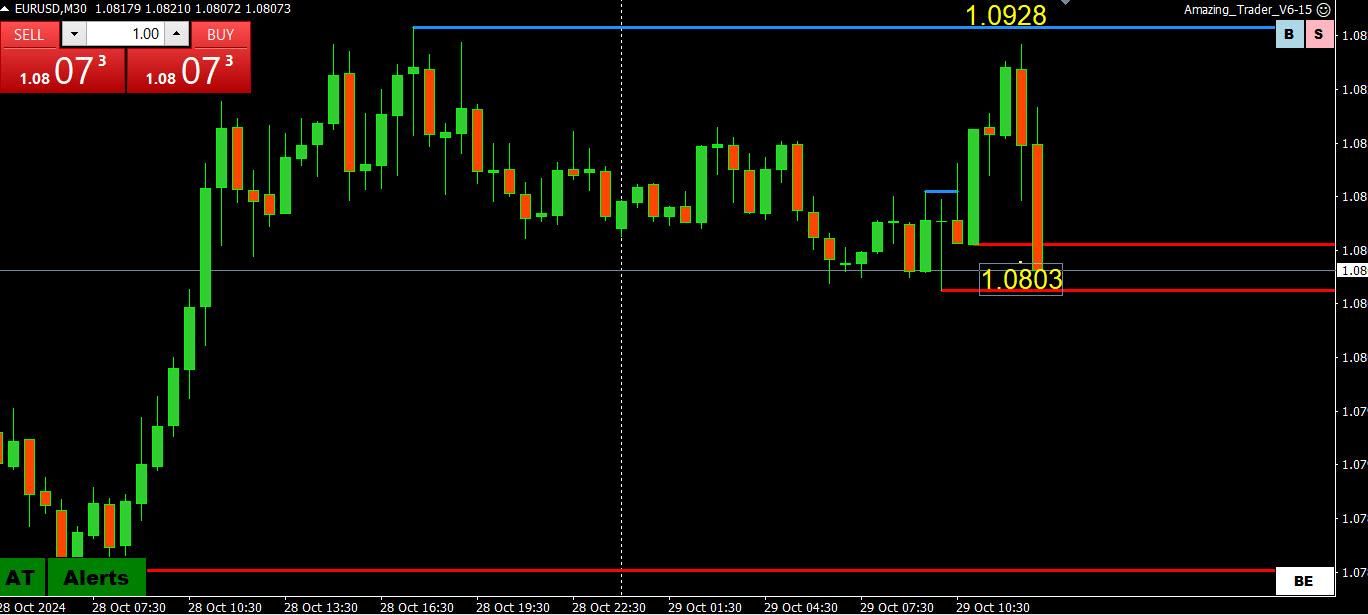

October 29, 2024 at 10:30 am #13589EURUSD 30 MINUTE CHART – Will 1.08 trade again?

As noted in the eek ahead and again yesterday, my view is to treat moves to the upside as retracements unless 1.0839 is firmly taken out.

See this chart and how the Amazing Trader resistance line held.

Now we see if 1.08 can exert a magnetic pull as it enters a 1.0800-10 support zone.

Note how EUR crosses have undercut the earlier EURUSD bid (e.g. EURJPY held resistance, EURGBP dips).

October 29, 2024 at 10:18 am #13588October 29, 2024 at 10:13 am #13587There us soime US data that could spark soime movements’

US Trade balance (largely ignored)

JOLTS (job openings)

CB Consumer Confidence

See our Economic Data Calendar

October 29, 2024 at 10:11 am #13586profits of the other kind

–wsj

Pentagon Runs Low on Air-Defense Missiles – BOOOO! – as Demand Surges – YEeeeey !

The U.S. is running low on some types of air defense missiles, forcing the Pentagon to make difficult decisions about how it defends against attacks by Iran and its allied militias in the region.You ll have to do your own homework who and which company is facing the Air Defense Missiles surging demand

October 29, 2024 at 9:27 am #13585EURJPY 4 HOUR CHART – Retests the high

JPY weakness following Japanese elections is providing offset support to currencies such as the EUR and GBP while upporting USDJPY.. Curious that AUD has not benefited.

As for EURJPY, yesterday’s 166.08 high has been re-tested and its significance is there is little on the upside for another 9-10 big figures. This makes 166,08 a key level.

Note this follows yesterday’s bounce from just above the bottom of the ipoening week gap.

October 29, 2024 at 9:15 am #13584USDJpY DAILY CHART – Fun and Games

Fun and game yesterday after USDJ{Y retreat from a 153.85 post-election high found support in its opening week gap (above 152.35-40) and popped back above 153. Scroll back to yesterday’s posts to see a good real-time illustration of trading opening week gaps.

Here is a way to keep it simple

If current range is 152-155, then the 153.50 midpoint will dictate which side is ultimately at risk

If the range i a tighter 152-154, then 153 sets the tone.\

Correction: USDJPY high should read 143.88

Otherwise, uptrend is intact unless 151.44 is taken out but consolidating while below 153.85.

October 29, 2024 at 8:42 am #13583October 29, 2024 at 8:33 am #13582AUDUSD DAILY CHART – WILL SUPPORT HOLD?

A noted in our Weekly FX Chart Outlook

AUDUSD: Trend: Down

Closing the week below .6621 and the 200 day mva (.6629 confirms a shift in risk that has potential for..6505-55. You can see by this chart why this area i important.Back above .6610-30 would be needed to slow the risk.

Range this week .6610 => .6658 (today’s low)… so nice textbook move, support target so far holding

October 29, 2024 at 8:25 am #13581BTCUSD WEEKLY CHART – RECORD HIGH ON THE RADAR?

While currencies consolidate, BTCUSD is trying to make a run at its record 73840 high following the long awaited move back above 70K.

To make a run at the high, 72K would need to be firmly broken.

Back beoow 70L would cool the risk, strong bid while above it.

October 29, 2024 at 8:19 am #13580XAUUSD 4 HIUR CHART – AIMING FOR ANOTHER RECORD HIGH?

Keep this one simple

Uptrend consolidating

Watch 2750… if it becomes support, a run at the record high would seem inevitable

Should 2758 be broken, it would then need to become support for 2780-00 to come on the radar.

Back below 2739-50 would cool the risk.

October 29, 2024 at 8:12 am #13579EURUSD 4 HOUR CHART – FOCUS ON 1.08

Current consolidation range is 1.0761-1.0839, a symmetric 39 pip range either side of 1.08.

1.08 has printed 4 days in a row coming into today… see if this pattern can be extended or broken.. a break of this type of pattern often sends a directional signal.

So, 1.08 is clearly pivotal and will dictate the tone going forward.

October 28, 2024 at 10:07 pm #13577October 28, 2024 at 9:08 pm #13570October 28, 2024 at 8:24 pm #13566October 28, 2024 at 6:08 pm #13560 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View