- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

March 20, 2025 at 5:44 pm #21206March 20, 2025 at 5:23 pm #21205March 20, 2025 at 5:05 pm #21198March 20, 2025 at 4:57 pm #21197

Ethereum Price Analysis: Is ETH Ready for a Decisive Break Above $2K?

Ethereum has been going through a terrible period of depreciation, as the price has been consistently making lower highs and lows. Yet, things might just be about to change.On the daily chart, ETH has been in a strong downtrend, breaking below the critical 200-day moving average and losing multiple key support zones. Prices have recently bounced from the $1,900 demand zone but face resistance near the $2,100 level.

The 200 DMA, currently above $2,800, adds additional overhead pressure, making recovery attempts challenging. Meanwhile, the RSI is climbing from oversold territory, indicating potential short-term relief. However, unless ETH regains the $2,400 area and the 200-day moving average, the broader trend remains bearish.

March 20, 2025 at 4:42 pm #21196

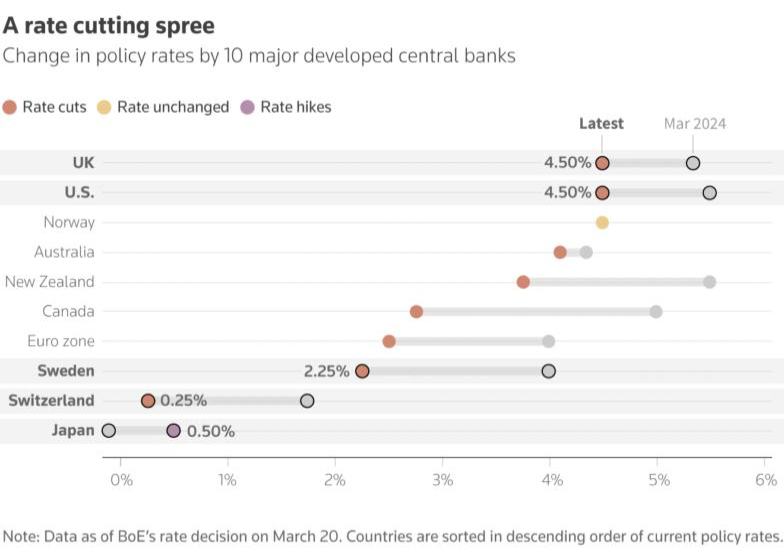

March 20, 2025 at 4:42 pm #21196BOE Leaves Rates on Hold, Points to Gradual Cuts Ahead

The Bank of England left the bank rate at 4.50% on Thursday and warned of risks to inflation, partly resulting from external factors such as U.S. trade tariffs. It flagged likely gradual cuts to interest rates over the coming months as the U.K.’s economy remains weak. The next reduction could come as earlier as May, analysts say. The following is a selection of analyst comments.Declining U.K. Pay Growth Should Support a BOE Rate Cut in May

U.K. pay growth is likely to fall considerably, raising the likelihood of an interest-rate cut in May, Morgan Stanley analysts say in a note. Markets currently price in a 47% chance of a May rate cut after the BOE left interest rates on hold in a decision Thursday, LSEG data show. Most members of the BOE’s monetary policy committee probably consider that interest rates are restrictive given that the meeting minutes “noted weakness in rate-sensitive sectors of the economy,” Morgan Stanley says. “We assume that barring major upside surprises in the pay and inflation data, rates will be cut in May again.

More Than Two More U.K. Rate Cuts This Year Could Hit Sterling

March 20, 2025 at 4:37 pm #21195

March 20, 2025 at 4:37 pm #21195Wall St rises in choppy trading, Fed comments provide tailwind

Weekly jobless claims at 223,000

Accenture falls after flagging federal contract cancellations

Darden Restaurants narrows annual profit forecast

Indexes up: Dow 0.42%, S&P 500 0.34%, Nasdaq 0.50%

U.S. stock indexes recouped some of the early losses on Thursday, as investors digested the Federal Reserve’s outlook on interest rates amid persistent tariff worries.

Traders looked to build on the previous session’s gains after a massive sell-off in recent weeks due to the uncertainty tied to President Donald Trump’s trade policies.

The Fed maintained current interest rates on Wednesday as expected and reaffirmed its forecast for two 25 basis point reductions by the end of year.

The central bank also projected slightly reduced growth and increased inflation for the year, alongside a modest uptick in the unemployment rate by 2025.

All the three major stock indexes closed higher by more than 1% each in the previous session. The CBOE volatility index VIX, also known as Wall Street’s fear gauge, fell 0.3 points and was last at 19.6 – at a nearly one-month low.

March 20, 2025 at 2:49 pm #21194March 20, 2025 at 2:40 pm #21193GER30 4 HOUR – What is The Amazing Trader (AT) showing

2 blue AT lines (bearish directional indicator) requires a firm break below 22925 to build momentum to the 22400 area.

Otherwise, it is just consolidation.

March 20, 2025 at 2:29 pm #21192March 20, 2025 at 2:13 pm #21189March 20, 2025 at 2:09 pm #21188March 20, 2025 at 2:00 pm #21187Higher Tariffs Would Raise Inflation, Slow Growth, ECB’s Lagarde Says

A rise in U.S. tariffs on imports from the European Union that was met with retaliation would weaken economic growth in the eurozone and push inflation higher, European Central Bank President Christine Lagarde said Thursday.

Should the European Union retaliate by raising tariffs on imports from the U.S., growth would be reduced by half a percentage point, while the eurozone’s inflation rate would be raised by the same proportion.

In its most recent forecasts, the ECB saw the eurozone economy growing by 0.9% this year and 1.2% in 2026, while it expected inflation to average 2.3% this year and 1.9% the next.

Lagarde said the inflationary impact would fade over time however, an indication that the central bank likely wouldn’t respond by raising its key interest rate.

The ECB’s analysis of the impact of higher tariffs is similar to that offered by the Federal Reserve, which Wednesday left its key rate unchanged but lowered its growth outlook and raised its inflation projections.

March 20, 2025 at 1:32 pm #21186March 20, 2025 at 1:26 pm #21184March 20, 2025 at 1:16 pm #21182Dollar higher as Fed signals no rush to cut rates, BoE holds rates steady

· Dollar up as Fed says in no rush to cut

· Sterling slips after hitting four-month high, BoE on hold

· SNB cuts, Riksbank on hold

· Aussie down after soft labour data, kiwi down 0.5%

· The dollar rose on Thursday after the Federal Reserve indicated it was in no rush to cut rates further this year due to uncertainties around U.S. tariffs, while the pound remained lower after the Bank of England kept rates steady.

· The Swiss franc weakened slightly after the Swiss National Bank lowered its policy rate to 0.25%, while the Swedish crown was soft after its central bank maintained its interest rate.

· U.S. policymakers projected two quarter-point interest rate cuts were likely later this year, the same median forecast as three months ago, even as they expect slower economic growth and higher inflation. On Wednesday, the Fed held its benchmark overnight rate steady in the 4.25%-4.50% range.

· “There is probably not enough in the Fed communication to build fresh USD shorts,” said ING FX strategist Francesco Pesole.

· Traders are pricing in 63 basis points of Fed easing this year, about two rate reductions of 25 bps each and around a 50% chance of a third. Markets are fully pricing in the next cut in July, LSEG data showed.

March 20, 2025 at 12:51 pm #21175March 20, 2025 at 12:40 pm #21174March 20, 2025 at 12:12 pm #21173March 20, 2025 at 12:03 pm #21171March 20, 2025 at 11:57 am #21170

March 20, 2025 at 12:51 pm #21175March 20, 2025 at 12:40 pm #21174March 20, 2025 at 12:12 pm #21173March 20, 2025 at 12:03 pm #21171March 20, 2025 at 11:57 am #21170

US OPEN

European risk sentiment slips, USD firmer and Bonds bid post-FOMC

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European risk tone deteriorates with US futures also slumping into the red, potentially driven by EU fiscal focus, post-FOMC pullback and attention returning to tariffs/trade.

USD up vs. peers, Antipodeans lags, EUR slides and GBP eyes BoE.

Bonds are bid post FOMC & as the tone deteriorates, Gilts lead on data & reports around the Spring Statement.

Crude succumbs to the risk-off sentiment, with base metals also heading lower.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View