- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

November 1, 2024 at 1:30 pm #13802November 1, 2024 at 1:19 pm #13801November 1, 2024 at 1:15 pm #13800November 1, 2024 at 12:41 pm #13796November 1, 2024 at 12:03 pm #13795November 1, 2024 at 11:15 am #13794

NFP on deck today

—————–

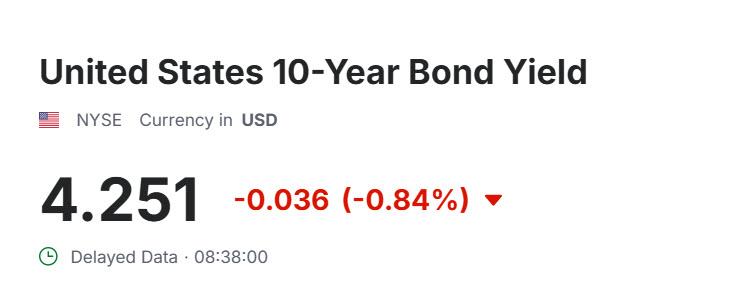

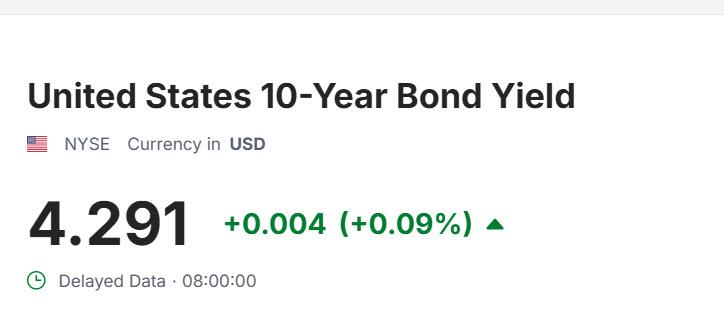

U.S. 10 Year Treasury

4.291%

https://www.cnbc.com/quotes/US10Yall I need …

November 1, 2024 at 11:14 am #13793NEWSQUAWK US OPEN

‘

Equities firmer following strong AMZN/INTC results & DXY gains ahead of US NFPGood morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

Click below to read the full report and listen to the guys doing the podcast.

4 Things You Need to Know

European bourses are entirely in the green alongside modest strength in US futures following post-earning strength in Amazon/Intel & ultimately outmuscling losses in Apple.

Dollar is firmer, CHF sinks after the region’s inflation data and JPY pares recent strength.

Gilts continue to underperform with benchmarks generally softer pre-Payrolls.

Crude is lower as risk-premium returns into the weekend though participants have NFP to navigate first.

November 1, 2024 at 10:48 am #13792November 1, 2024 at 10:47 am #13791A look at the day ahead in U.S. and global markets from Mike Dolan

With next week’s U.S. election now dominating thinking, the last two megacap earnings reports of the week appear to have calmed the stock market somewhat and a potentially noisy October payrolls report is up next.

Amazon and Apple got different market receptions to their updates overnight – the remaining two of five “Magnificent Seven” firms reporting this week.

November 1, 2024 at 10:36 am #13790November 1, 2024 at 9:54 am #13789November 1, 2024 at 9:07 am #13788EURUSD 1 HOUR CHART – WAITING FOR NFP

Market is biding its time waiting for the US jobs report,

A sharp price in EURGBP yesterday helped give EURUSD a bid and it has backed off today as the cross eased back.

1.09 should be tough on top, back below 10840-50 would be needed to shift the focus back to 1.08,

Oct NFP:

A weak jobs # is expected following a sharp rise in Sept BUT NFP will likely be distorted by the hurricanes and strikes,

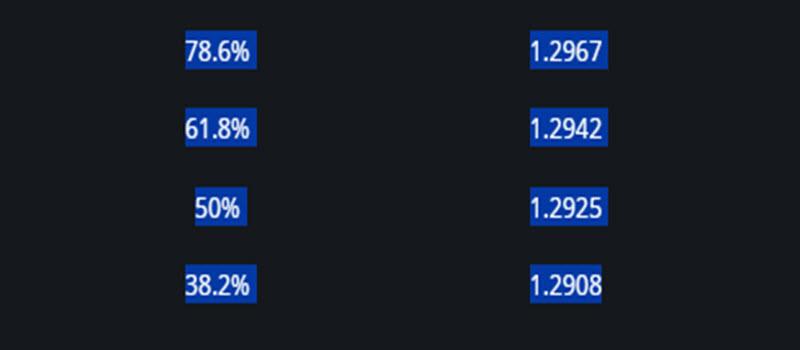

November 1, 2024 at 8:56 am #13787GBPUSD 1 MONTH – NEW MONTH, NEW BALL GAME?

GBP sold off yesterday on a plunge in the bond market (higher yields) and today it seems to be benefiting from the higher yields. So price action suggests month end flows may have been a factor in the ell off.

Whatever the case, it was a straight line move from 1.2999 to 1.2851.

For today 1.2880-85 needs to hold to keep the bid.

On the upside, no resistance other than the day high so treating the move up as a retracement, use FIBOS as possible levels

From our Fibonacci Calculator

November 1, 2024 at 5:54 am #13786November 1, 2024 at 5:45 am #13785October 31, 2024 at 10:21 pm #13784

November 1, 2024 at 5:54 am #13786November 1, 2024 at 5:45 am #13785October 31, 2024 at 10:21 pm #13784Yikes.

• Family Dollar has announced 677 store closings this year.

• Walgreens is closing 1,200 stores.

• Big Lots is closing 360.

• LL Flooring is shutting down entirely.

• Major retailers have announced 6,189 store closures so far this year, already outpacing last year’s total of 5,553, according to Coresight Research. Chains are on track to close the highest number of stores in 2024 than any year since 2020, when the Covid-19 pandemic decimated the industry.

October 31, 2024 at 9:58 pm #13783October 31, 2024 at 9:54 pm #13782October 31, 2024 at 8:15 pm #13781October 31, 2024 at 8:12 pm #13780Amazon – AMZN

Amazon.com beats estimates for quarterly revenue

Amazon.com AMZN beat market estimates for quarterly revenue on Thursday, boosted by strong growth in its cloud services unit thanks to growing enterprise spend on AI.Shares of the company were up 6% in extended trading.

Amazon Web Services, the company’s cloud business, reported a 19% increase in sales to $27.5 billion, in line with estimates, according to LSEG data.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View