- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

November 4, 2024 at 7:47 pm #13935November 4, 2024 at 7:03 pm #13934November 4, 2024 at 6:44 pm #13921

BTCUSD DAILY CHART – BRACING FOR THE US ELECTION

BTCUSD may be setup to have the most volatility given Trump’s support of cryptos while Harris has not made it an issue.

So, let’s pick a range and ask whether 60K or 75K (7500 pips from the current price) are safe in any knee jerk reaction to the election result.

Going strictly by the charts, key resistance is the record 73840 high and support 65233 and 58893.

November 4, 2024 at 6:24 pm #13917USDMXN WEEKLY CHART – Holding its Breath

The Mexican Peso is seen as one of the currencies that could see a sharp reaction either way following the US election. The other, to a lesser extent is the CAD.

Why?

If trump gets elected with a Republican sweep, he could look alter USMCA, the United States-Mexico-Canada (free trade) Agreement that started in July 2020 in order to place tariffs on goods from both partner countries. Harris is seen as maintaining the status quo. Note USMCA replaced the North American Free Trade Agreement (NAFTA) gthat exited from 1994-2020.

So you can see why technicals matter little until the dust settles on the US election result, especially the MXN. We will also see the extent to which a rik of a Trump presidency has been factored into weakness in each of these currencies.

November 4, 2024 at 5:07 pm #13916November 4, 2024 at 5:03 pm #13915November 4, 2024 at 4:54 pm #13914November 4, 2024 at 4:37 pm #13912November 4, 2024 at 4:32 pm #13911November 4, 2024 at 4:08 pm #13910I post in flurries because I am all over the place in analysis.

I am largely dialed in on crosses today due to the schizophrenia present in the majors due to the looming election. AudCad looks good from 9150 or so for the buy side. If it trades below 9140 and you get closes under there, the dynamic will have almost surely changed to a dominant sell side. This pair can be slow as molasses but the risk impact is reduced, which may be fitting in current conditions.

November 4, 2024 at 3:48 pm #13909November 4, 2024 at 3:39 pm #13908November 4, 2024 at 3:34 pm #13907I mentioned Friday I like Franc and Loonie to hold and so far so good but expecting a little pull back any time now. With the looming insane levels of volatility to come tomorrow you either had to catch the lows Thursday/Friday and sit or just play in and out because you don’t want to chase it heading into tomorrow night.

November 4, 2024 at 3:29 pm #13906November 4, 2024 at 3:29 pm #13905XTIUSD (WTI CFD) 1 HOUR CHART – ANOTHER MIND THE GAP

There are so many gaps today that I feel like going into a Gap store and buying some clothes.

Opening week gap to 69.71

Back below 70. 65 would put the gap in play, caps the downside while above it

Resistance at the 72.11 high, key levels at 72.50-85 lie above it.

Crude reacting to OPEC+ but pre-election poition adjustments likely a factor as well. .

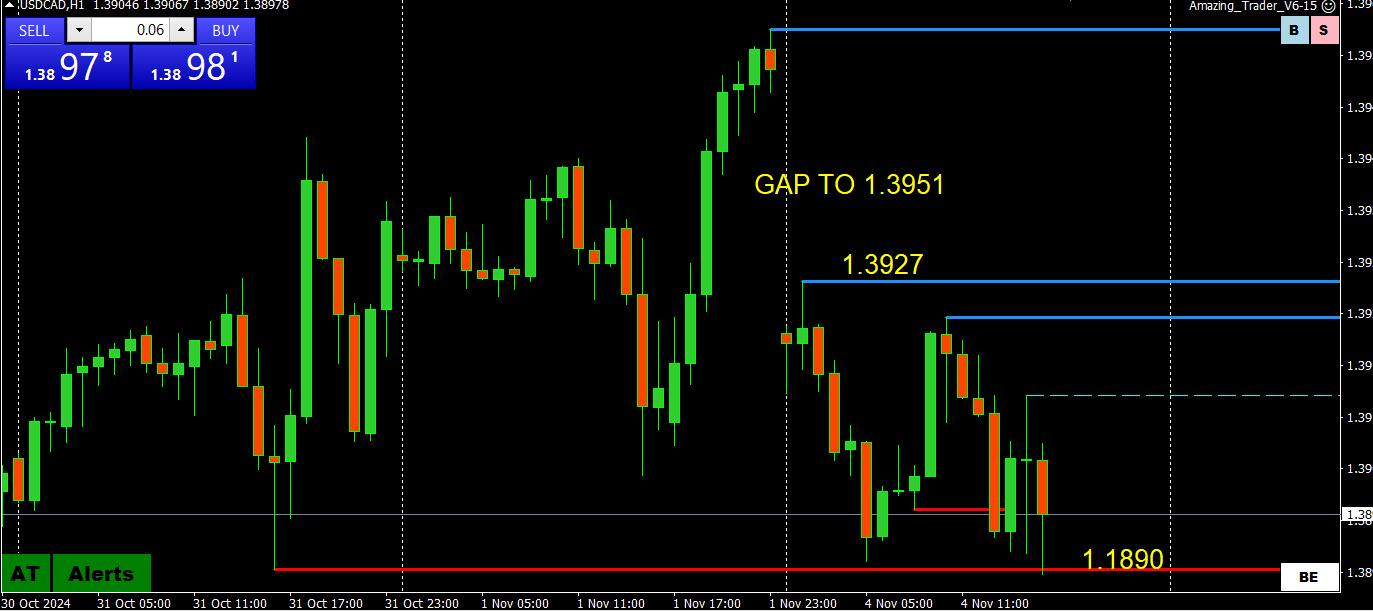

November 4, 2024 at 2:39 pm #13903USDCAD 1 HOUR – ONE MORE UNFILLED GAP

Opening week gap to 1.3951

Back above 1.3927 would put the gap in play, caps the upside while below it

Support at 1.3890 tested, below it is 1.3875 and then a void.

Price action more likely the result of pre-US election position adjustments as it is hard to see big bets given the uncertain outcome.

November 4, 2024 at 1:59 pm #13902How Traders Should Prepare for the U.S. Election

Anyone trading knows how hyper sensitive global markets are to news, whether it be economic, monetary policy related or geopolitical.

Being in sync with what markets are expecting and on alert for a surprise prepares a trader to assess a news reaction. This, in turn, allows a trader to be setup beforehand so he/she can take advantage of a news reaction rather than vice versa.

The question is then How Traders Should Prepare for the U.S. Election?

November 4, 2024 at 1:53 pm #13901i remember the 2016 election where I believe the betting odds were 85/15 on Clinton beating Trump.

As polls came later election night it became clear that Trump was going to win.

This was not clear in 2016 due to mail in ballots and a race decided by a handful of vote in a few key states.

Now in 2024, watch the early results from Georgia (polls close at 7 PM and North Carolina at 7:30) but barring a surprise, the outcome will not be called on election night. I believe both Wisconsin and Pennsylvania don’t start counting mail in votes until the polls close so the earliest may be sometime on Wednesday.

‘

Whatever the outcome, markets will be extremely skittish and jumping around on any hint of a trend in the voting.November 4, 2024 at 1:41 pm #13900November 4, 2024 at 1:21 pm #13895 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View