- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

November 7, 2024 at 1:59 pm #14125

Abbey Cohen, Columbia University Business School. The school with the riot supporters and anarchists.

She is on Bloomberg telling everyone Trump is going to de-fund science programs. Columbia is a complete liberal staffed which claimed Trump is Hitler and the economy is red hot. Elon Musk of Space X is on Trumps staff. The economy is far from red hot.

The insanity continues.

Meanwhile it appears stocks and the Dollar are settling into what they more often what they do, which is move opposite to each other. Yesterday was just a 100% display of risk on enthusiasm across the board.

Things may slowly return to normal looking forward.

November 7, 2024 at 1:28 pm #14122USD is trading lower

Logic says and easy to say with hindsight

Trading on what Trump might do (e.g. tariffs) when he doesn’t take office for another 2 months and has yet to choose a cabinet is a bit of a stretch so a retracement should not be a surprise.

Scroll below for updates with some FIBO levels in EURUSD and USDJPY.

November 7, 2024 at 12:01 pm #14121November 7, 2024 at 11:54 am #14120NEWSQUAWK US OPEN

Bunds under pressure following German coalition collapse; FOMC & BoE due

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are modestly firmer across the board, with US futures also slightly higher, but ultimately taking a breather following the significant strength in the prior session.

Dollar is giving back recent gains, Antipodeans outperform attempting to claw back post-election losses amid resilience in China.

USTs are a touch firmer awaiting today’s FOMC meeting, Bunds are the clear underperformer after the German coalition collapses.

Crude is modestly weaker, paring back some of gains seen in the prior session; XAU benefits from the softer Dollar and base metals gain amid positive price action in China overnight.

November 7, 2024 at 11:10 am #14119November 7, 2024 at 11:06 am #14118November 7, 2024 at 10:55 am #14117November 7, 2024 at 10:35 am #14116November 7, 2024 at 9:49 am #14115November 7, 2024 at 9:12 am #14114USDJPY 1 HOUR CHART – MODEST RETRACEMENT

As noted last night, Key target cited here many times is back on the table at 155.20… this is a level the BoJ should not want to see trade.

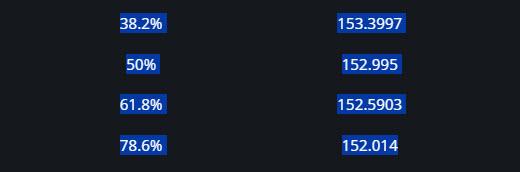

Whether a hidden hand or some verbal intervention, USDJPY has backed away from 155 but as the table below shows, it is still just a modest retracement, To suggest more than this, 153.40 would need to be taken out.

FIBOS 151.28 – 154.71

November 7, 2024 at 8:59 am #14113

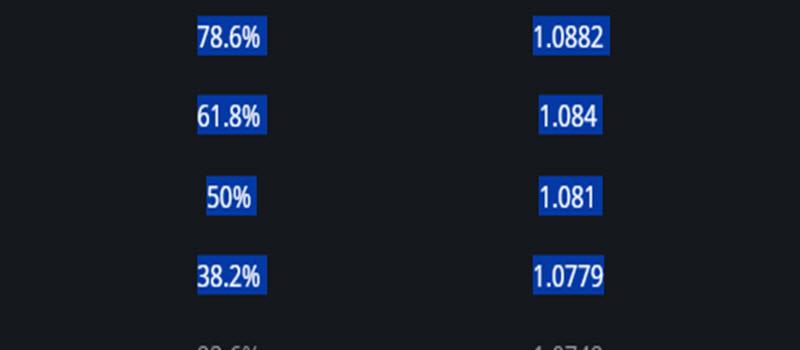

November 7, 2024 at 8:59 am #14113EURUSD 1 HOUR CHART – RETRACING

What caught my eye is the 1.0781 resistance a it coincides with a 38.2% retracement, which blocks the 1.0794 level.

Expect a limited upside unless 1.0800-10 is regained.

Given the straight line move down, use FIBOS as potential levels of resistance.

FIBOS 1.0937-1.0682

November 7, 2024 at 8:18 am #14108November 7, 2024 at 12:01 am #14107November 6, 2024 at 11:34 pm #14106

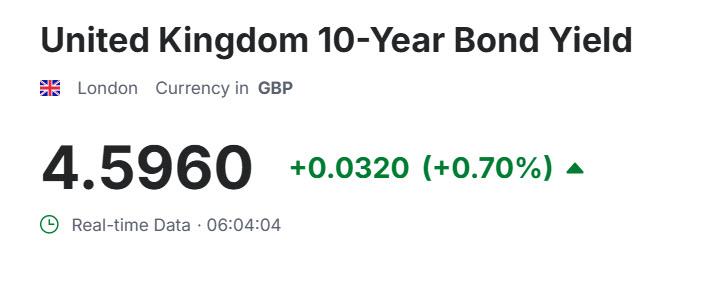

November 7, 2024 at 8:18 am #14108November 7, 2024 at 12:01 am #14107November 6, 2024 at 11:34 pm #14106Is There a Chance the Fed Will Not Cut Interest Rates?

Attention will now shift to Thursday’s FOMC decision where a 25bps rate cut is widely expected. So, the surprise would be no change by the Fed, which cannot be ruled out following the resounding win by President-elect Trump.

November 6, 2024 at 11:25 pm #14104USDJPY DAILY CHART – 155 LOOMS

Even without the US elections, higher US yield = firmer USDJPY

Key target cited here many times is back on the table at 155.20… this is a level the BoJ should not want to see trade.

Otherwise, as the chart shows, there is a void on the upside above 155.20

Expect support on dips, especially if it trades above the former high at 153.86.

November 6, 2024 at 10:40 pm #14103BTC DAILY CHART – NEW RECORD HIGH

With a new record high set just above 75K, look for this level to now become pivotal. To suggest a further move into unchartered territory, 75K would need to become support.

Look for support on dips as long as it trades above 70K, stronger bid while above the former 73636 high..

November 6, 2024 at 10:38 pm #14102November 6, 2024 at 10:36 pm #14101November 6, 2024 at 8:59 pm #14085Trump Media – DJT

DJT Stock Slides Back After Election Surge

Trump Media & Technology Group stock gave up the vast majority of a gain seen in early trading in response to Donald Trump’s election victory.The shares, which trade under the ticker DJT, were up 3.3% to $35.08 on Wednesday afternoon, a fraction of the 35% surge seen at the intraday high, according to Dow Jones Market Data.

Trump’s 57% stake in the company was valued at $3.9 billion at Tuesday’s close, according to FactSet data. With a 3.3% jump, the value of his stake would be $4.03 billion.

November 6, 2024 at 8:55 pm #14084

November 6, 2024 at 8:55 pm #14084 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View