- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

November 10, 2024 at 11:32 pm #14237November 10, 2024 at 10:39 pm #14236

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The week ahead brings key economic data, highlighting inflation pressures and growth challenges. In Germany, October CPI is expected to rise 0.4% monthly and 2.0% annually, while the UK labor market may see unemployment edge up to 4.1%. US inflation remains a focus, with forecasts for October showing a 0.2% rise in headline CPI and 0.3% in core, pushing annual CPI up to 2.6%. Japan’s producer inflation may reach 3.0%, driven by energy costs amid geopolitical tensions.

Growth remains sluggish in Japan and the UK. Japan’s Q3 GDP is forecast to increase just 0.2%, a sharp slowdown due to weak consumer spending and business investment. The UK is also expected to post modest Q3 growth of 0.2%.

In the US, retail sales for October could see a boost from hurricane recovery and Amazon’s Prime Day event, with strong demand for vehicles and household goods. This week’s data will provide key insights into inflation trends, growth momentum, and consumer behavior across major economies.

Econoday

November 10, 2024 at 10:05 pm #14235November 10, 2024 at 9:52 pm #14232November 10, 2024 at 9:52 pm #14231November 10, 2024 at 10:12 am #14217JEROME POWELL’S TERSE SQUEALINGS

10-yr 4.308 last

after 50pt rate cut AND a 25bps followup rate cut trying to force-feed lower interest rate, players have sharply pushed up Treasury yields since the central bank cut rates in September. essentially telling powell F-U

Asked by a reporter whether he would resign if incoming President Donald Trump were to ask, Fed Chair Jerome Powell said no. Powell added that Trump would not have the authority to demote him or any other governor. “Not permitted under the law,” Powell said.

cnbc

Elon Musk endorses plan to let presidents meddle with the Federal Reserve after Trump election winRegardless of jerome’s emphatic insistence this dem’s and harris supporter’s days appear to be made unpleasant. I can see at least one way. If jerome has any sence he will POOF! before monday 20th “25

November 10, 2024 at 1:53 am #14216Newsquawk Week Ahead Highlights Nov 11-15

Newsquawk Highlights include US and China CPI, US Retail Sales, UK and Australian Jobs

November 8, 2024 at 8:46 pm #14200Good finish for the dollar but…

EURUSD found support again below 1.07, with a higher low

AUDUSD found support just below .6562 support (cited earlier)

EURGBP tested just below .8295, thus the GBPUSD lag

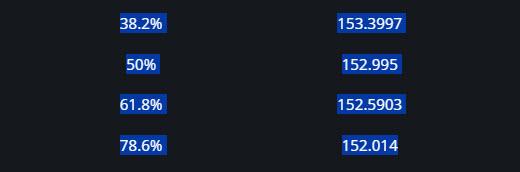

USDJPY did not join the buy USD party although it bounced from a 152.14 double bottom

US500 traded above 6000, watch the close vs. this pivotal target

‘

November 8, 2024 at 4:57 pm #14197November 8, 2024 at 4:19 pm #14196November 8, 2024 at 4:03 pm #14193November 8, 2024 at 2:52 pm #14190November 8, 2024 at 1:55 pm #14189November 8, 2024 at 1:14 pm #14188November 8, 2024 at 12:05 pm #14177November 8, 2024 at 11:26 am #14171NEWSQUAWK US OPEN

China-related assets slide as MOFCOM disappoints

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are entirely in the red, with sentiment hit after China’s NPC press conference disappointed markets; US futures remain flat.

DXY is slightly firmer, with the JPY strong whilst the Antipodeans lag given the lack of fresh stimulus measures from China.

Bonds are on a firmer footing, with modest outperformance in Gilts and as USTs await Fed speak from Bowman & Musalem.

Crude oil, XAU and base metals are all on the backfoot, following the underwhelming Chinese NPC press conference.

November 8, 2024 at 11:12 am #14170Markets often assume the worst and then take a breath to assess the situation. This appears to be the case with the Trump Trade, where bond yields have backed off, the dollar has given back some of its post-election gains and today stocks finally seem to be taking a breather.

I posted this last night for US500

Are stocks the outlier in the Trump Trade as they continue to rise while the other components retrace some of the post-election moves?

NOTE US GOVERNMENT OFFICES ARE CLOSED MONDAY FOR VETERANS DAY. BOND MARKETS AND BANKS ARE CLOSED BUT STOCK MARKETS ARE OPEN. CANADA IS CLOSED FOR A HOLIDAY AS WELL.

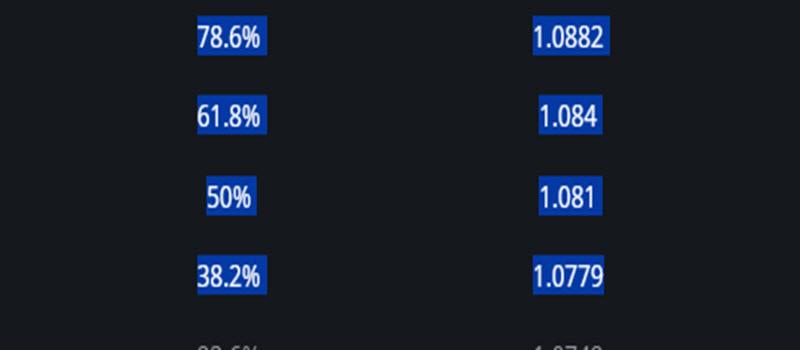

November 8, 2024 at 11:05 am #14169EURUSD 1 HOUR CHART – KEEP IT SIMPLE

To keep it simple, 1.08 is the buy/sell; bias indicator that will dictate whether the retracement has legs or the downside stays at risk.

To negate this retracement attempt and shift the focus back to the lows, 1.0746 would need to be broken.

On the upside, a move above the 61,8% level (1.0840) would be needed to shift the focus back to 1.09

Note the 2 blue Amazing Trader lines drawn off 1.0824, which indicated a change in the directional risk (back to the downside) has so far paused above 1.0746.

Current intra-day range 1.0760-90, too tight to last.

November 8, 2024 at 10:31 am #14168November 8, 2024 at 10:19 am #14167

November 8, 2024 at 10:31 am #14168November 8, 2024 at 10:19 am #14167 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View