- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

November 11, 2024 at 3:06 pm #14265November 11, 2024 at 2:59 pm #14264November 11, 2024 at 2:53 pm #14263November 11, 2024 at 1:55 pm #14262November 11, 2024 at 1:50 pm #14261November 11, 2024 at 1:03 pm #14258November 11, 2024 at 11:59 am #14256

A look at the day ahead in U.S. and global markets from Mike Dolan

The dollar continues to feed on a mix of post-election tariff and tax cut speculation, China’s struggle with deflation and Germany’s simmering political crisis – with the euro plumbing its lowest levels in almost five months.

Even with bond markets effectively shut on Monday for the Veteran’s Day holiday, the dollar built on last week’s election-related surge – spurred by Friday’s reports, later denied by other sources, that protectionist Robert Lighthizer had already been asked to be President-elect Donald Trump’s new trade chief.

Morning Bid: Post-Election Dollar Revs Up, China Battles Deflation

November 11, 2024 at 11:50 am #14254November 11, 2024 at 11:32 am #14253November 11, 2024 at 11:30 am #14252November 11, 2024 at 11:24 am #14251November 11, 2024 at 11:20 am #14249NEWSQUAWK US OPEN’

Equites gain & DXY bid with the Trump Trade still at play; Crude slumps amid constructive geopolitical updates

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

Equities are entirely in the green, with a strong European morning thus far; the RTY outperforms.\

DXY is on a firmer footing with the Trump Trade still in action, JPY underperforms following the BoJ SOO which highlighted the lack of urgency to hike.

Bonds are mixed, with Bunds firmer amid suggestions that Chancellor Scholz could bring forward a vote of no-confidence; Treasury cash trade is closed on account of US Veterans Day.

Crude slips on comments by Hezbollah that there are negotiations to stop the war; XAU/base metals are hampered by the stronger Dollar and softer-than-expected Chinese inflation metrics overnight.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 daysNovember 11, 2024 at 10:56 am #14247November 11, 2024 at 10:45 am #14246November 11, 2024 at 10:36 am #14245USDJPY 1 HOUR CHART – TESTING UPSIDE BUT…

Having held above 152 on Friday USDJPY has bounced to start the week,

One hour chart showing a risk to the upside that would need to take out 154.13 to expose the post-US election high at 154.71, g or this will be just a swing within the range.

Note, 153.98 is the remaining FIBO (78.6% of 154.71-151.28) , suggesting 154 may be pivotal.

On the downside, use short-term charts if looking for support with more meaningful levels not until the 152s.

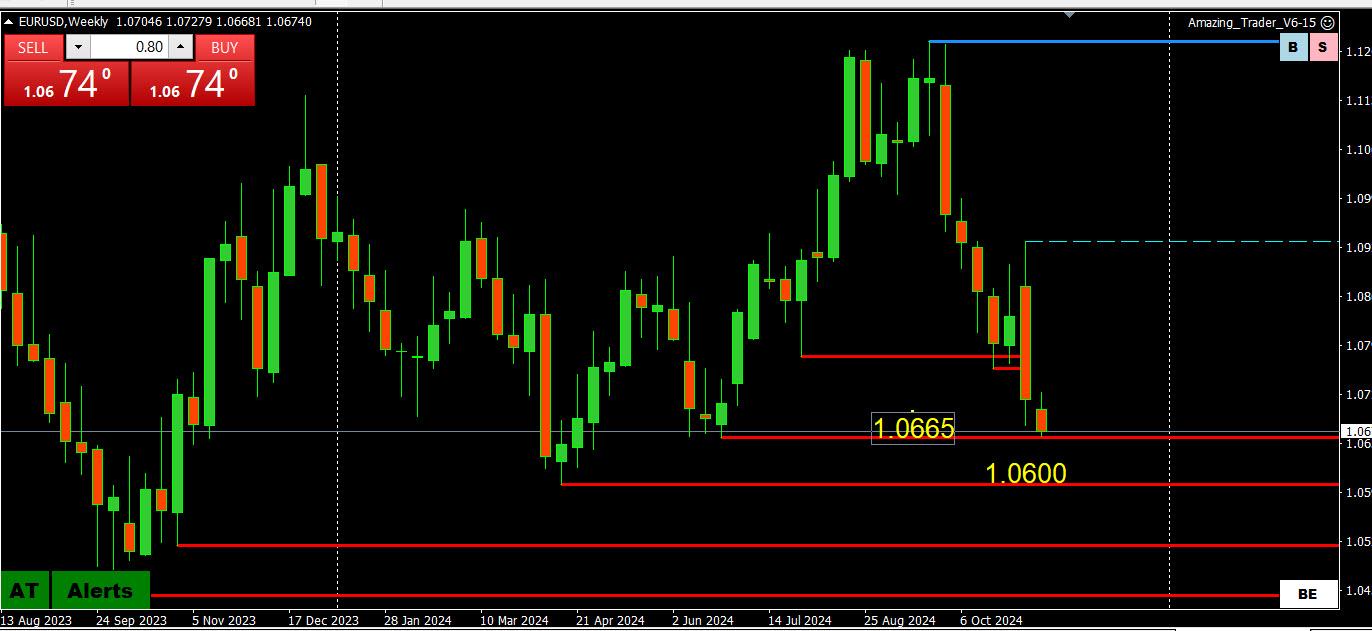

November 11, 2024 at 9:48 am #14244EURUSD WEEKLY CHART – EXTENDS LOW

As posted in our Weekly FX Chart Outlook

Most at risk is EURUSD, which found support below 1.06 on 2 days but failure to hold 1.08+ on the retracement keeps a risk on 1.0665 and 1.0600 should the 1.0682 be broken.

Extend low, pause so far just above 1.0665 (low 1.0668)

November 11, 2024 at 9:23 am #14242November 11, 2024 at 9:23 am #14243November 11, 2024 at 1:07 am #14241For the week ahead it is like digging out after what was not a normal trading week. So, use last week’s low/high as broad ranges (see below) that either have to narrow unless the USD highs are taken out.

Weekly FX Chart Outlook Nov 11-15

November 10, 2024 at 11:55 pm #14238 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View