- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 4 weeks ago by GVI Forex 2.

-

AuthorPosts

-

November 21, 2024 at 9:24 am #14786November 21, 2024 at 7:34 am #14785November 21, 2024 at 7:27 am #14783November 21, 2024 at 7:27 am #14784November 21, 2024 at 1:19 am #14781November 20, 2024 at 11:47 pm #14779

Thursda’s calendar

THU: CBRT & SARB Policy Announcements; UK PSNB (Oct), US Initial Jobless Claims (w/e 16th Nov), Philadelphia Fed (Nov), Existing Home Sales (Oct), EZ Consumer Confidence Flash (Nov), Japanese CPI (Oct), Australian Flash PMIs (Nov)

November 20, 2024 at 11:44 pm #14778November 20, 2024 at 11:33 pm #14777November 20, 2024 at 9:48 pm #14774November 20, 2024 at 9:13 pm #14760November 20, 2024 at 9:04 pm #14759Forte Biosciences – FBRX

Forte Biosciences soars; company says private placement of $53 mln shares oversubscribed

If we had some inside info 😀

** Shares of drug developer Forte Biosciences FBRX rise 132.4% to $13.77** Company says private placement of its shares, worth $53 mln, oversubscribed

** Funds to support development of company’s experimental drug, FB102, to treat autoimmune diseases – FBRX

** Received support from new and existing investors, including OrbiMed, Janus Henderson Investors and Tybourne Capital Management – CEO Paul Wagner

** Despite session’s gains, stock down 34.2% YTD

November 20, 2024 at 9:02 pm #14758November 20, 2024 at 8:58 pm #14757

November 20, 2024 at 9:02 pm #14758November 20, 2024 at 8:58 pm #14757Target Corporation – TGT

Target Margins And Inventory Issues Raise Analyst Caution After Weak Q3 Performance

Target took a dive and is within the biggest losers of the day.

Target Corporation TGT shares are trading lower on Wednesday after it reported weak third-quarter results and slashed FY24 outlook.The company reported third-quarter adjusted earnings per share of $1.85, missing the street view of $2.30.

For FY24, the company now forecasts adjusted EPS between $8.30 and $8.90, down from the previous guidance of $9.00 to $9.70. The revised FY24 EPS outlook is also below the consensus estimate of $9.55.

November 20, 2024 at 8:52 pm #14756

November 20, 2024 at 8:52 pm #14756NIO Inc.

On the edge of breaking Up ?

Nio’s stock dives as earnings, outlook disappoint despite record deliveries

The U.S.-listed shares of Nio Inc. took a dive in early Wednesday trading, after the China-based battery electric-vehicle maker reported disappointing third-quarter results, as they missed expectations despite record deliveries.The company (NIO) also provided a revenue outlook for the current quarter that was below Wall Street forecasts, while deliveries were seen rising to another record.

November 20, 2024 at 8:47 pm #14755

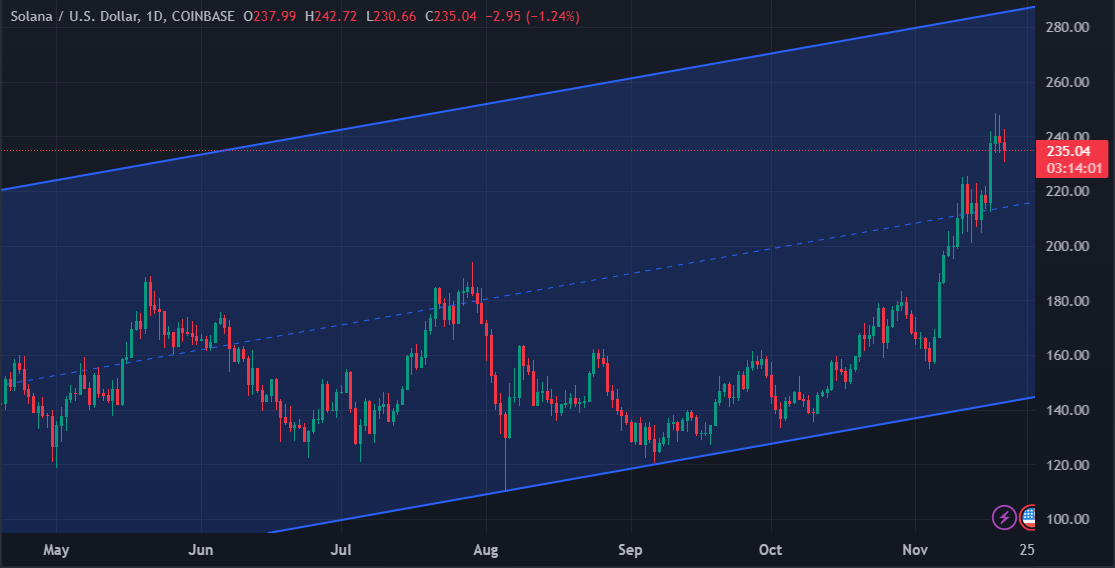

November 20, 2024 at 8:47 pm #14755SOLUSD – Solana

Solana (SOL) Price Pattern Points to Brief Dip, $260 Target Next

Sol value could face a setback before its potential rise toward $260. At press time, SOL’s value is $237.88, representing a 15% hike in the last seven days.While SOL holders would expect the rally to continue, several technical indicators suggest that they might need to wait a little longer.

Solana Uptrend Pulls Back

November 20, 2024 at 8:45 pm #14754November 20, 2024 at 8:40 pm #14753

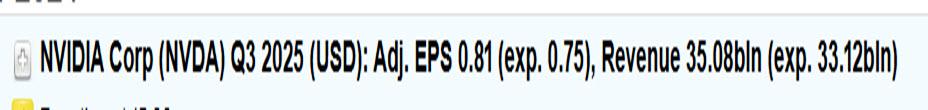

November 20, 2024 at 8:45 pm #14754November 20, 2024 at 8:40 pm #14753Nvidia – NVDA

PREVIEW: Nvidia shares ease – results due after the bell

Shares of Nvidia NVDA down 1.4% in afternoon trading ahead of the key AI chipmaker’s quarterly results due after the closing bell

** Analysts expect the co to report a rise in quarterly rev to $33.16 bln vs $18.12 bln in the yr-ago qtr, and EPS of 75c/shr vs 40c a yr ago, according to LSEG

** Analyst recommendations on the stock include 57 “strong buy” or “buy” ratings, six “hold” ratings and no “sell” or “strong sell” ratings, based on LSEG data

** Including the session move, the stock is up 193% for the YTD

November 20, 2024 at 8:25 pm #14752November 20, 2024 at 7:03 pm #14751November 20, 2024 at 6:45 pm #14750

November 20, 2024 at 8:25 pm #14752November 20, 2024 at 7:03 pm #14751November 20, 2024 at 6:45 pm #14750 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View