- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 4 weeks ago by GVI Forex 2.

-

AuthorPosts

-

November 25, 2024 at 1:14 pm #14987November 25, 2024 at 1:07 pm #14986

GBPUSD Weekly

– Major Support was violated last week, but pair closed above it

– To continue Down it has to decisively break below and stays below

– On the other hand – if this was a Correction , time wise it might be end of it

– Cable tends to have sharp turns – so be aware

Supports : 1.25350 , 1.24850 & 1.23850

Resistances : 1.26050 , 1.26500 & 1.27150

November 25, 2024 at 12:07 pm #14969

November 25, 2024 at 12:07 pm #14969A look at the day ahead in U.S. and global markets from Mike Dolan

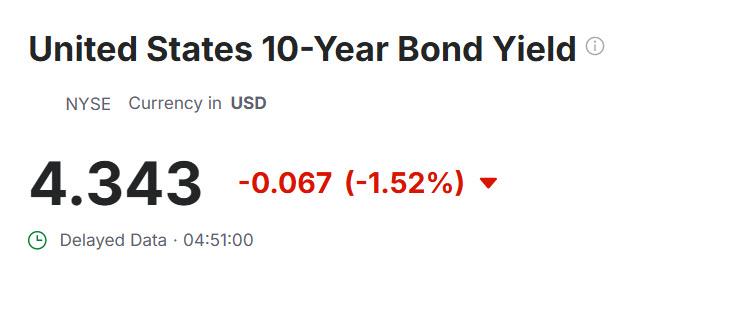

U.S. Treasury yields slipped back on Monday after Wall Street money manager Scott Bessent got the nod to be the next Treasury Secretary, with markets hoping his take on tax cuts and tariffs may at least be sensitive to edgy investor concerns.

Ahead of the Thanksgiving holiday week, President-elect Donald Trump ended intense speculation over the Treasury pick late on Friday and put Bessent forward for the job.

Morning Bid: Treasuries rally on Bessent pick, dollar retreats

November 25, 2024 at 12:00 pm #14968NEWSQUAWK US OPEN

Stocks firm, USD pressured & USTs bid on Trump’s Treasury appointment

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses & US futures begin the week on the front-foot, as markets welcome the nomination of Scott Bessent as Trump’s Treasury Secretary.

USD pressured and USTs bid following this, with the DXY sub-107.00 and the US yield curve bull-flattening FX peers generally benefit from the USD pressure, JPY outperformed overnight on favourable yield action and approval of Japanese stimulus

Crude in the red on Bessent, Israel-Lebanon and Iranian updates, Gas outperforms. XAU slipped below USD 2700/oz before recovering while base metals follow the tone though China performance capped

Try Newsquawk for 7 Days Free

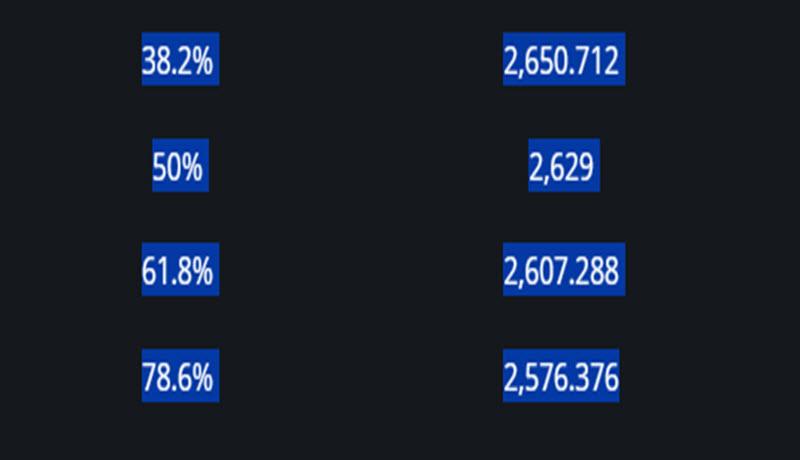

November 25, 2024 at 11:00 am #14964November 25, 2024 at 10:31 am #14963November 25, 2024 at 10:23 am #14962XAUUSD 4 HOUR CHART FIBOS

XAUUSD upside stalling as a better risk tone has eased some of the upside pressure.

Treating the retreat from the high as a retracement, here are FIBOS for 2537-2721 (note 38.2% is also the “:50” level) USING OUR fIBONACCI cALCULATOR

November 25, 2024 at 10:06 am #14960November 25, 2024 at 10:00 am #14959

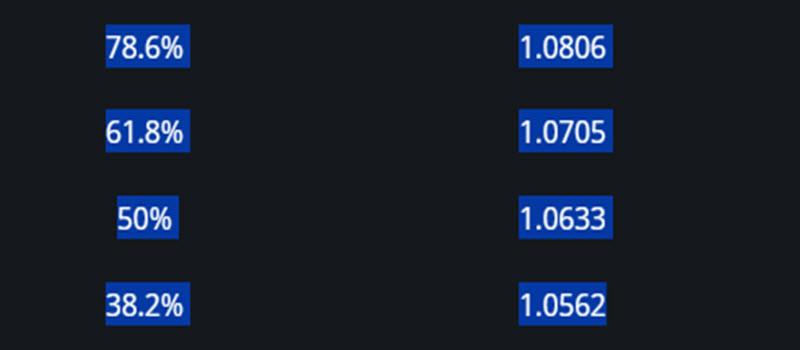

November 25, 2024 at 10:06 am #14960November 25, 2024 at 10:00 am #14959EURUSD 1 HOUR CHART MIND THE GAP

As I noted in this article

Markets tend to factor in the worst and hope for the best. This is certainly true for tariffs as what shape they turn out to be will have an impact on the dollar, bonds and other markets as well.

This was the case to start what is not a normal week due to the upcoming US Thanksgiving Day holiday as seen by the opening week gap higher.

Levels to watch are clear, 1.0449-1.0551.

This suggests a firm break oof 1.0450 would be need to expose the gap while a firm break of 1.0500 would suggest a greater squeeze on shorts.

Looking at this as a retracement, here are FIBOS for 1.0935=1.0332 USING OUR fIBONACCI cALCULATOR

November 25, 2024 at 1:20 am #14958November 25, 2024 at 12:46 am #14957November 24, 2024 at 11:26 pm #14956November 24, 2024 at 11:26 pm #14955November 24, 2024 at 11:18 pm #14954November 24, 2024 at 11:18 pm #14953November 24, 2024 at 10:27 pm #14949November 24, 2024 at 10:27 pm #14948November 24, 2024 at 10:21 pm #14947

November 25, 2024 at 1:20 am #14958November 25, 2024 at 12:46 am #14957November 24, 2024 at 11:26 pm #14956November 24, 2024 at 11:26 pm #14955November 24, 2024 at 11:18 pm #14954November 24, 2024 at 11:18 pm #14953November 24, 2024 at 10:27 pm #14949November 24, 2024 at 10:27 pm #14948November 24, 2024 at 10:21 pm #14947THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Germany’s Ifo business climate index is expected to decline slightly to 86.0 in November from 86.5 in October, indicating a modest drop in business morale. In the U.S., the S&P Case-Shiller house price index may show a slowdown in annual home price inflation, decreasing to 5.2% from 5.9%, while the FHFA house price index is projected to rise by 0.2% month-on-month. Consumer confidence is anticipated to improve in November, but new home sales are forecasted to decrease to an annual rate of 725,000 in October due to higher mortgage rates.

New Zealand’s Reserve Bank is likely to cut the official cash rate by 50 basis points to 4.25% amid lower inflation and an economic slowdown. In the U.S., pending home sales are expected to drop by 1.8%, and Germany’s consumer price index is estimated to rise by 0.2% monthly and 2.3% annually in November.

In Japan, payrolls are projected to rise for the 27th consecutive month, with unemployment steady at 2.4%. Industrial production is forecasted to increase by 3.9% month-on-month and 2.1% year-on-year. The Eurozone’s Harmonized Index of Consumer Prices flash estimate for November is expected to show headline inflation at 2.3% and core inflation at 2.8%, up from the previous month.

Econoday

November 24, 2024 at 10:10 pm #14946November 24, 2024 at 10:10 pm #14944 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View