- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 4 weeks ago by GVI Forex 2.

-

AuthorPosts

-

November 26, 2024 at 12:43 pm #15076

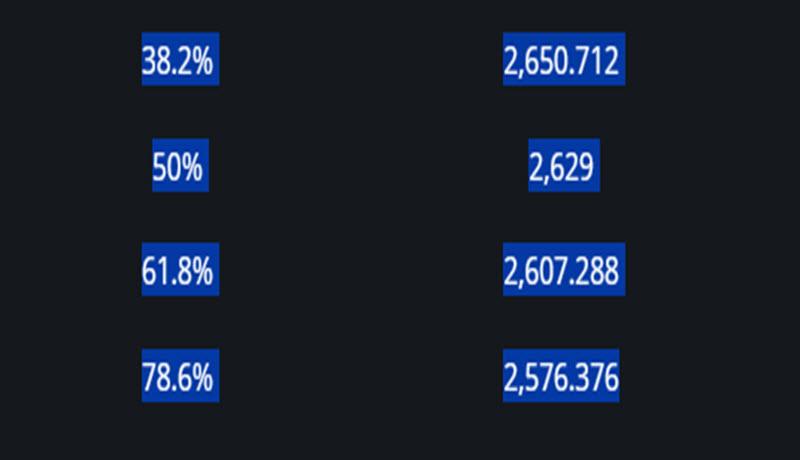

EURUSD Daily

Supports : 1.05100 , 1.04650 & 1.04250

Resistances : 1.05500 , 1.05700 & 1.06100

Pattern wise : this is a possible situation of sharp turn Up – 1.06100 separates us from declaring it.

In case it works, target is in 1.07800 area.

If it fails to overcome 1.06100 , based on previous move’s angle – 1.01350 is what we’ll be seeing .

November 26, 2024 at 12:14 pm #15075November 26, 2024 at 12:04 pm #15074

November 26, 2024 at 12:14 pm #15075November 26, 2024 at 12:04 pm #15074NEWSQUAWK US OPEN

CAD & MXN hit by Trump’s tariff announcement, US futures impacted but are back in the green; FOMC minutes ahead

Good morning USA traders, hope your day is off to a great start! Here are the top

5 things you need to know for today’s market.

Trump announced he is to charge Mexico and Canada a 25% tariff on all products and will charge China ‘an additional 10% Tariff, above any additional Tariffs’.

European bourses in the red on the above, US futures initially pressured but have since made their way back to unchanged/marginally firmer

USD began on the back foot but has since retreated markedly, JPY outperforms while CAD is the G10 laggard

Fixed benchmarks in the red pulling back from Monday’s gains though did see a shortlived move higher on the tariff announcement

Crude firmer but action modest after recent ceasefire related pressure; Israel’s Cabinet set to meet at 15:30GMT/10:30EST to discuss this

November 26, 2024 at 11:37 am #15073A look at the day ahead in U.S. and global markets from Mike Dolan

Any speculation that U.S. President-elect Donald Trump would adopt a ‘softly, softly’ approach to his trade and economic policies was jolted overnight as he warned of immediate tariff hikes on Canada, Mexico and China – hitting the currencies of all three.

Trump, who takes office on Jan. 20, said he would impose a 25% tariff on imports from Canada and Mexico on day one until these countries clamp down on drugs, particularly fentanyl, and undocumented migrants crossing the border. The move would appear to violate a free-trade deal with both countries that he negotiated during his first White House term.

Morning Bid: Trump tariff threat jolts Canadian dollar, peso, yuan

November 26, 2024 at 11:33 am #15072November 26, 2024 at 11:07 am #15067This is not a typical trading week as explained in the following

What to Expect in the Thanksgiving Day Trading Week

November 26, 2024 at 10:45 am #15064November 26, 2024 at 10:38 am #15063November 26, 2024 at 10:26 am #15062USDJPY 1 HOUR CHART – Tight range but for how long?

Range tightening to around 153.80-154.20 suggests 154 will be pivotal in setting its day tone.

While below 155 upside is likely limited but to suggest pressure building on the downside 153.55 and 153.23 would need to be broken.

Continue to keep an eye on US bond yields (lower this week to see if there is a correlation.

November 26, 2024 at 9:27 am #15058EURUSD 1 HOUR CHART – GAP FILLED

If you go strictly by the book, opening week gap filled and then a rebound

If you were trading in the heat of battle, the move back above 1.05 was a head scratcher.

In any case, 1.05 should continue to be the bias setter, only a break of 1.0530 would suggest more to this head scratching rebound.

Back below 1.0470 would shift risk back to 1.0425-50

November 26, 2024 at 12:38 am #15057November 26, 2024 at 12:31 am #15056November 26, 2024 at 12:30 am #15055I just closed sell side positions of EurJpy, EurUsd, AudUsd, UsdSingapore, and a buy side UsdChf right here, and a sell EurGbp all in the money. These levels as I type are areas where I believe there may be adjustment flows and so it is back to a game of patience. Prefer buy side of US Dollar and the sell side of everything else so a matter of waiting for these markets to rebalance a bit.

Had a sell USdPeso but did not fill, not confident we see decent re-entry levels until tomorrow.

Honor the Dollar.

November 25, 2024 at 11:56 pm #15042November 25, 2024 at 10:01 pm #15038This article is worth revisitimg during this US holiday thinned week

Time should be a factor you consider when trading and when ignored, it will leave you at the mercy of the market. What I mean by that is that you can put yourself in a position where your options are to take on more risk than you are willing to take if you ignore the time factor when trading.

November 25, 2024 at 9:21 pm #15037November 25, 2024 at 9:13 pm #15036November 25, 2024 at 9:01 pm #15035November 25, 2024 at 7:20 pm #15019November 25, 2024 at 7:14 pm #15018 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View