- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 4 weeks ago by GVI Forex 2.

-

AuthorPosts

-

November 26, 2024 at 4:10 pm #15110November 26, 2024 at 3:37 pm #15106November 26, 2024 at 3:37 pm #15105November 26, 2024 at 3:32 pm #15104

I would not make a big thing out of the tariff threat. Trump is just setting the table to negotiate for more balanced terms because at present there are imbalances. I don’t believe global trade will be disrupted significantly other than how the import/export supply chain is managed and some carry over strength in USD.

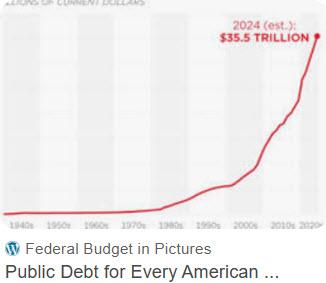

November 26, 2024 at 3:22 pm #15103November 26, 2024 at 3:22 pm #15102November 26, 2024 at 3:18 pm #15101US public debt per capita

It is doubtful this trend will change under the new administration… risk is that it could accelerate

As of October 31, 2024, the US public debt per capita is $103,410, which is a 7.17% increase from the previous year. This is a moderate increase from the previous month, when the per capita debt was $102,810.

The total US debt has been increasing at an average rate of 5% per year since 2001. In 2023, the total federal debt was $34 trillion.

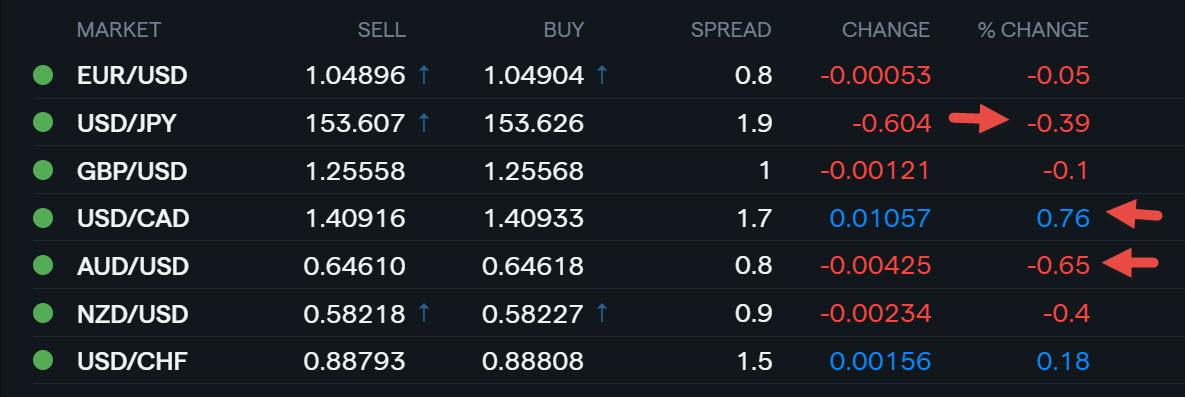

(AI Overview)November 26, 2024 at 3:12 pm #15100November 26, 2024 at 3:02 pm #15097November 26, 2024 at 2:58 pm #15096November 26, 2024 at 2:53 pm #15093Yen futures are pulling back and rebalancing, the dominant flows are uphill. There is another good sell side UsdJpy trade coming up and especially EurJpy due to its clear fundamental weakness that is growing in economic terms. Futures 6500 is an area where larger orders are to rebalance uphill in Yen futures. If flows remain consistent it may get there in about 90 minutes. Hopefully.

November 26, 2024 at 2:44 pm #15092Part of what is transpiring is there is enthusiasm and a risk on tone which is largely carrying out in stocks, which is putting pressure on the Dollar. Bearing in mind that is not a constant, it often simply goes that way. The next cycle is likely to be related to pre-holiday hedging and Dollar strength again due to this condition and others, partly related to statements on tariffs. This also eases pressure on the FED to continue lowering rates without the same level of concern over inflation.

So Dollar should remain strong overall and temper inflation concerns and retain attraction at the same time. It will move in cycles.

November 26, 2024 at 2:34 pm #15088Trading in a Holiday Season

Lots have been said on this issue, and all of it was more or less right.

Trying to guess the next move on any given pair can be at least difficult if not impossible.

There are many reasons behind it, and I am going to highlight the most important ones :

End of Year positions squaring

Lack of interest to establish new positions

Low liquidity

Traders going places

But I want to give you another angle of trading at the very end of the year…November 26, 2024 at 2:31 pm #15087Nothing has changed in the dominant US Dollar dynamic. The market is simply rebalancing after yesterday’s run. There are good buy side trades coming up if you are patient. Use USDSgd 1.3430 as a reference point of where larger sized entities maybe. And if you do not trade UsdChf (Franc) you can use it as a guage as well with an eye on 8830. On a fundamental basis, yesterday’s run was fundamental news driven but without proof, hence the rebalancing. In time markets will reconsider and make the “what if” adjustment right back up. Give it time. I scored/booked 295 points since Sunday in multiple currency pairs, I am fairly precise right now.

November 26, 2024 at 2:21 pm #15083November 26, 2024 at 1:50 pm #15081Position adjustments rather than adding to risk is still the way of iy during this weeek. There was hope for more after Trump’s tariff comments and in this regard CAD and MXN remai the biggest losers.

There is some US data due out at 15:00 GMT

Richmond Fed, CB Consumer Confidencde, New Home Sales

November 26, 2024 at 1:17 pm #15080November 26, 2024 at 1:02 pm #15079November 26, 2024 at 1:01 pm #15078November 26, 2024 at 12:56 pm #15077 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View