- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 25, 2025 at 9:02 am #21339

Here it is 10am in Nigeria and gold (xau/usd) is looking up. it started from the price 3010.13 which was the lowest point as at yesterday and has slowly climbed up since then. Price is currently at 3021.74 and it is looking up for a further buy to the area at price 3025.91

Gold is a buy metal itself and has since being going long since 1996. I don’t think it is ready to stop buying as i see a further buying pressure. Let us use tight TP/SL and exit at the price 3025.91 as predicted. A 1-5% risk/reward ration of 1:2 should be used. A word is enough for the wise.

Thanks,

TOPNINE.March 25, 2025 at 8:32 am #21338March 25, 2025 at 8:16 am #21337March 25, 2025 at 8:08 am #21336March 25, 2025 at 7:56 am #21335March 25, 2025 at 7:45 am #21334March 24, 2025 at 8:48 pm #21331March 24, 2025 at 8:26 pm #21330US500 4 HOUR = Weekly down pattern broken

Last week, the 4 week down pattern was broken with an inside week… this week has started out with a higher high but as this chart shows, there are layers of resistance to get through from 5749-5871… at a minimum a solid 5800+ and then 5871+ would be needed to shift focus back to 6000.

On the downside, as pointed out last week, there is a double bottom at 5597 and only through there would shift the risk back to the low…. Keeps a bid if 5749 becomes support

March 24, 2025 at 7:10 pm #21329March 24, 2025 at 6:45 pm #21324Here we go again… Dollar dips on this glimmer of hope but note comment about more tariffs

March 24, 2025 at 6:30 pm #21323March 24, 2025 at 6:21 pm #21322March 24, 2025 at 6:13 pm #21321

March 24, 2025 at 6:30 pm #21323March 24, 2025 at 6:21 pm #21322March 24, 2025 at 6:13 pm #21321XAUUSD 4 HOUR CHART – Retracement risk

I always say that AT (The Amazing Trader) doesn’t lie so pay attention to what its chart shows.

3 blue lines indicate a risk on the downside unless 3038 is broken.

Support at 2999 blocks 2978.

Much will depend on whether buyers step in around 3000.

March 24, 2025 at 6:13 pm #21320USDJPY Daily

For Monday we have a Bullish Pattern, but USDJPY has to take out 149.650 for any significant move Up.

If successful, opens a road for attack at 151 zone.

Happened – so what next?

Supports: 150.150, 149.650 & 149.150

Resistances: 150.750, 151.000 & 151.350

This is Yen and it can just continue Up, but I expect it to at least pull back till around 150.150 if not a full move to 149.650

March 24, 2025 at 6:06 pm #21319March 24, 2025 at 4:39 pm #21318

March 24, 2025 at 6:06 pm #21319March 24, 2025 at 4:39 pm #21318This is a good time to revisit this blog article

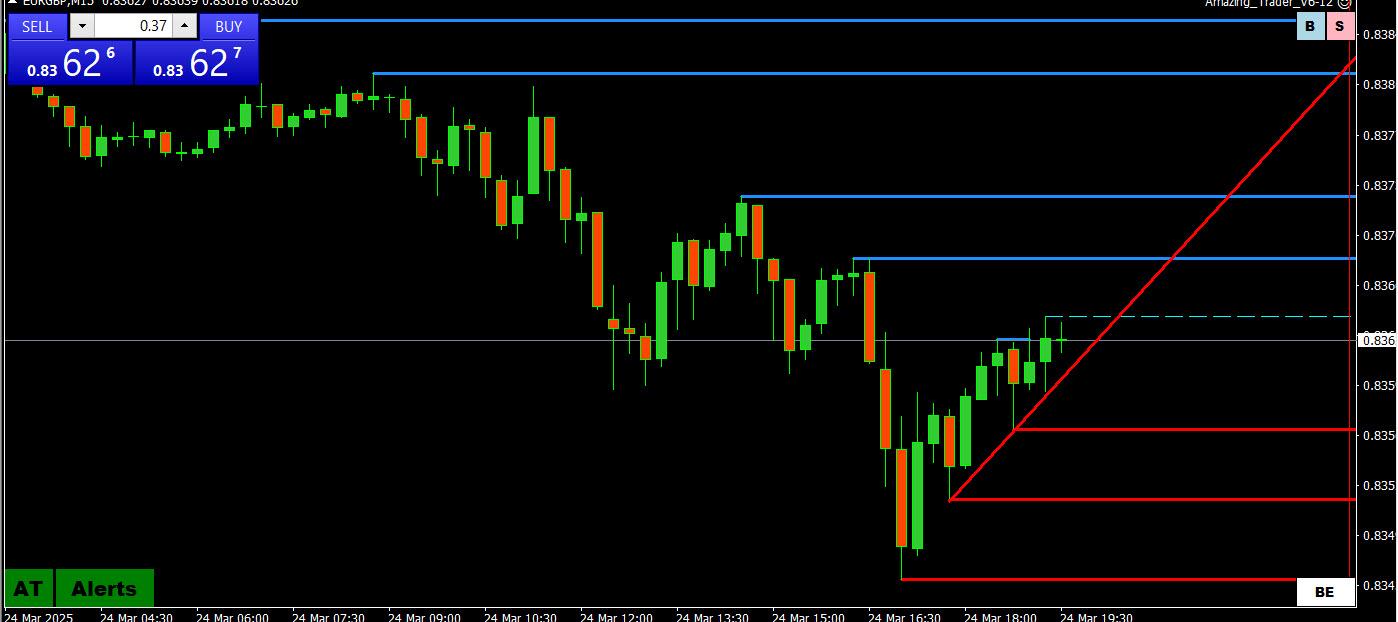

Note in the chart posted below how EURGBP found support, bounced and how GBPUSD, initially boosted by this selling of this cross, lost its bid.

March 24, 2025 at 3:37 pm #21312Notice how GBPUSD lost its bid after a sell order in EURGBP was filled.

EURUSD initially bounced on the bounce in EURGBP (last .8362 vs an .8345 low).

EURUSD has since followed GBPUSD lower with a lag, moving back below 1-08 so far holding above the earlier 1-0790 low.

Sojeep an eye on this crossw as you can see how crosses can give a clkue to what isa driving the spot market.

March 24, 2025 at 3:25 pm #21311March 24, 2025 at 2:31 pm #21306March 24, 2025 at 2:07 pm #21301Futures buoyant ahead of data-driven week

S&P 500 futures rise over 1%

Traders brace for news on tariff barrage

PMIs, US PCE, China earnings in focus

Wall Street shares looked set to open higher on Monday and the dollar firmed at the start of a data-driven week, while the threat of U.S. tariff hikes made investors cautious in Europe.

S&P 500 futures ES1! were up about 1.2% and Nasdaq 100 futures NQ1! were 1% higher at 1218 GMT.

U.S. President Donald Trump’s administration is likely to exclude a set of sector-specific tariffs while applying reciprocal levies on April 2, according to media reports over the weekend that helped sentiment in early trading.

The pan-European STOXX 600 SXXP ticked down 0.1%, with most of the region’s indexes lower except for Germany’s DAX, which rose 0.2% after data showed manufacturing output there increased for the first time in almost two years.

This week’s data releases include global purchasing managers’ surveys, the U.S. Federal Reserve’s preferred inflation reading, inflation data in Australia and Japan, a budget update in Britain, and major earnings in China.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View