- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 4, 2024 at 1:00 pm #15599December 4, 2024 at 12:36 pm #15598December 4, 2024 at 12:11 pm #15582

NEWSQUAWK US OPEN

US futures tilt higher ahead of Powell & European paper awaits French no confidence vote

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly trading in positive territory; US futures tilt higher ahead of Powell and a busy data slate.

USD is broadly firmer vs. peers, AUD lags post-GDP, and GBP was weighed on by commentary from BoE’s Bailey who said he sees four 25bps cuts in 2025; a move which has since pared.

European paper awaits French no confidence vote at 15:00 GMT.

Crude holds an upward bias, WSJ reports that Saudi aims to keep oil prices elevated rather than chase market share; XAU/base metals are subdued amid the slightly firmer dollar.

December 4, 2024 at 11:46 am #15581A look at the day ahead in U.S. and global markets from Mike Dolan

A bizarre 24-hour period in which the world’s 12th-biggest economy briefly introduced martial law left markets pondering geopolitical risks next year while awaiting a casting vote, or at least a steer, on whether the Federal Reserve eases this month.

As the French government faces a confidence vote in parliament on Wednesday, politics of a different sort took hold in South Korea yesterday – jarring local markets and briefly nudging safety trades in U.S. Treasuries and the dollar.

Morning Bid: Powell tees up after S.Korea jars, France waits</a>

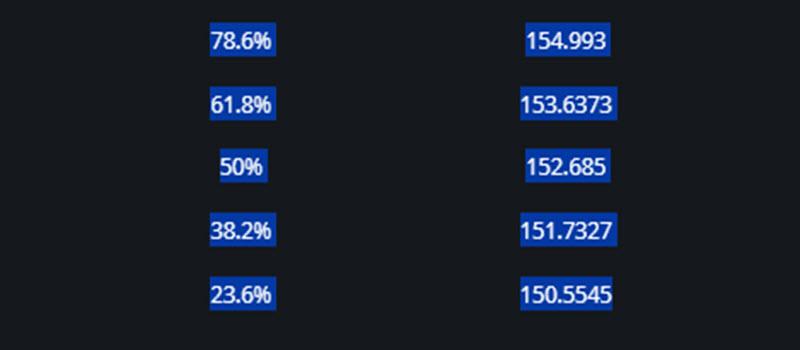

December 4, 2024 at 11:18 am #15580December 4, 2024 at 11:09 am #15579December 4, 2024 at 10:50 am #15578December 4, 2024 at 10:41 am #15577December 4, 2024 at 10:16 am #15576December 4, 2024 at 10:02 am #15575December 4, 2024 at 9:48 am #15574USDJPY 1 HOUR CHART – Reversal of fortune BUT

Wasn’t the market shooting for 148 yesterday?

Testing this week’s high at 150.74, so far holding

As this chart shows there is a void above it until 151.55-95, only exposed if 150.74-00 becomes support.

Note higher US yields, firmer USDJPY

As noted previously,

150, the bias setter, has printed 3 days in a row (now 4 days) so the jury is out until the pattern breaks and it becomes support or resistance.

December 4, 2024 at 9:19 am #15573December 3, 2024 at 11:48 pm #15572December 3, 2024 at 11:45 pm #15571US500 1 HOUR CHART – RETRACEMENT MODEAs

The snail’s pace move to another record high continues.

Normally it would suggest a tired trend but with the US economy humming and bond yields retreating, it is hard to fight the fundamentals. I will keep this thought on the backburner unless charts say otherwise.

In any case, keep an eye on 6045-50 as that level needs to become support to open the door for the run at 6080-00

December 3, 2024 at 11:38 pm #15570December 3, 2024 at 11:36 pm #15569December 3, 2024 at 10:38 pm #15553Nvidia – NVDA

Will NVIDIA Stock Continue Its Uptrend After Rallying 180% YTD?

With a market capitalization of $3.395 trillion, NVIDIA is now the second most valuable publicly traded U.S. company, trailing only Apple Inc. AAPL at $3.622 trillion.NVIDIA’s meteoric rise is anchored in its leadership in artificial intelligence (AI), particularly generative AI.

December 3, 2024 at 10:33 pm #15552December 3, 2024 at 10:28 pm #15551December 3, 2024 at 10:20 pm #15550

December 3, 2024 at 10:33 pm #15552December 3, 2024 at 10:28 pm #15551December 3, 2024 at 10:20 pm #15550Pork Cut out Futures – PRK1

I was asked some interesting questions in last few days on X – especially about forex and crypto – one stood out:

Why tho…does it have any actual useful utility….

Well I didn’t invent any of it, but got the point – so here is something for those in need of useful utility…

Lean Hogs Close Lower on Weaker Cutouts — Market Talk

Lean hog futures on the CME settle down 0.1% to 87.85 cents a pound. Today’s decline makes it three out of the past four trading sessions that the most-active lean hog contract closed lower — this after posting seven straight sessions with higher closes. Weighing on hogs was weaker cutout prices reported by the USDA in its midday report, including a $1.21 per hundredweight drop in carcass prices to $91.45 per cwt. Pork bellies have shed $5.32 per cwt, hams have dropped $4.02 per cwt, and ribs fell $2.81 per cwt. Live cattle finish up 0.6% to $1.89075 a pound.Happy now ?

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View