- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 5, 2024 at 12:28 pm #15690

Newsquawk US Open

US Market Open: Bitcoin pushes past 100k & USD remains on the backfoot

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.4 Things You Need to Know

European bourses opened flat but started grinding higher shortly after the open despite relatively quiet newsflow; France’s CAC 40 shrugged off the vote of no confidence which played out as expected.

USD remains on the backfoot vs. peers following yesterday’s ISM-induced move in yields; EUR on a firmer footing vs. the USD with not much in the way of follow-through selling from the collapse of the French government.

Crude futures holding a modest upward bias after selling off in the US afternoon on Wednesday, which was later attributed to a bank offloading a large volume of US oil futures contracts ahead of today’s OPEC+ meeting.

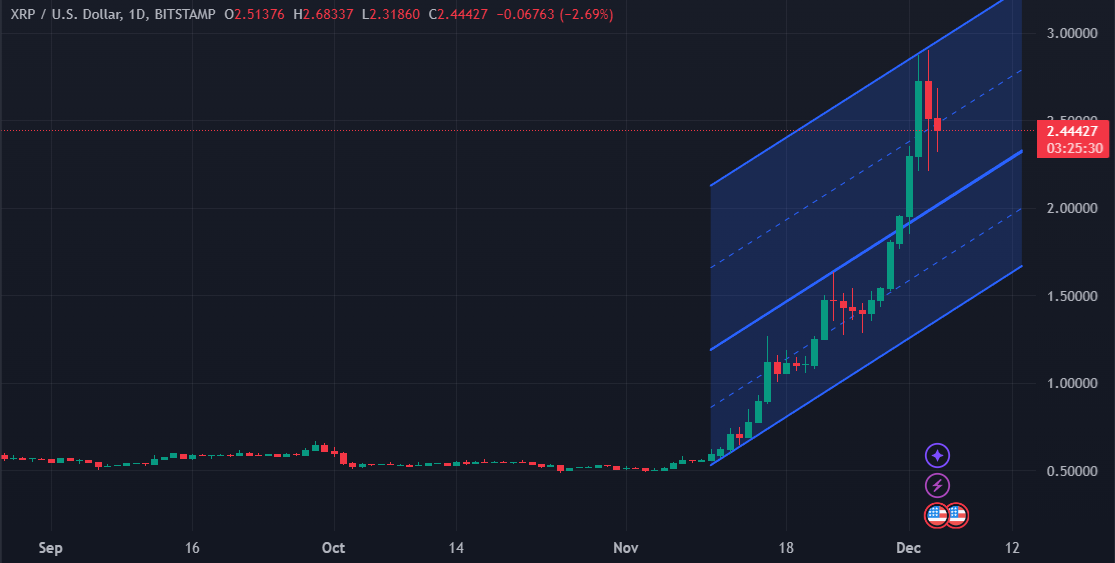

Bitcoin climbed above the psychological USD 100k level for the first time ever and continued to advance with prices underpinned after US President-elect Trump picked crypto-backer Paul Atkins to lead the SEC.

December 5, 2024 at 12:10 pm #15687December 5, 2024 at 12:05 pm #15685December 5, 2024 at 11:49 am #15682I am not sure how to even react to this…

Ether has risen by 65% in the last month too, but typically, it is the super-volatile memecoins that have scored big. Peanut Squirrel coins, named for an Instragramming squirrel whose death reportedly caught Trump’s interest, has gained nearly 2,500%, while Moo Deng tokens, named after the baby hippo and social media sensation in a Thai zoo, have gained 200%.

Maybe we should launch a GVICoin?

December 5, 2024 at 11:37 am #15681(Reuters) – A look at the day ahead in U.S. and global markets by Amanda Cooper.

It’s been exactly a month since the U.S. presidential election delivered victory for Republican Donald Trump and his proposed “America First” agenda.

Markets have been driven in large part by the so-called “Trump trade” for the past couple of months – a dynamic that has boosted assets likely to benefit from his pledge to slap tariffs on the imports of major trading partners and slash spending and regulation, with particular emphasis on crypto.

December 5, 2024 at 11:04 am #15679Online trading may look like playing a video game but let me assure you that it is far from it. If it was just a video game then the new generation of traders would be the most skillful on the planet. Instead, and I apologize for being so blunt, those who treat trading like a video game are creating the next generation of suckers and losers.

(Trader Alert) Trading is NOT a Video Game

December 5, 2024 at 10:21 am #15672

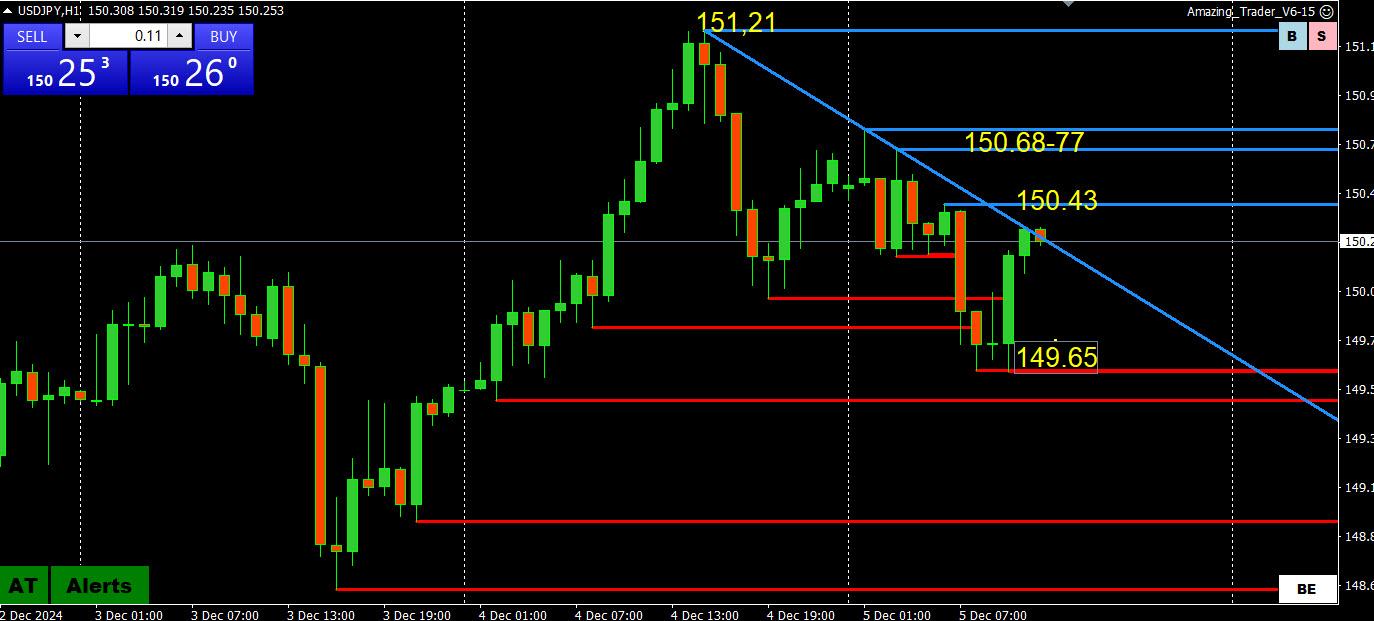

December 5, 2024 at 10:21 am #15672USDJPY 1 HOUR CHART – Watching 150

USDJPY 150 has now traded 5 days in a row. The longer this pattern goes on the greater the risk of a directional move once it is broken.

In the meantime, focus on short-term charts as the odds of a breakout are small ahead of tomorrow’s US jobs report.

If there is any momentum, it is tilted slightly down while below 150.43 but only a break of 149.65 would build on it.

Wide range 148.65-151.21.

December 5, 2024 at 10:10 am #15671December 5, 2024 at 9:20 am #15670One HF under water in this major is trying to use the old infamous tactic of buy 10k when in reality you just want to create the upswing and liquidity to sell 30kThe numbers are just for an example to show the concept

I dont know but suspect there is an option involved as well where below 149 they would get a margin call

December 5, 2024 at 8:35 am #15669December 4, 2024 at 8:54 pm #15637US500 4 HOUR CHART – Another record high

What stands out on this chart?

All you see are red Amazing Trader support lines, indicating that any attempt at a retracement is being met with buying.

Until this pattern changes, look for the upside to continue to be exposed.

December 4, 2024 at 8:51 pm #15636USDJPY 1 HOUR CHART – Watch 150

I wrote this yesterday and repeated it this morning

150, the bias setter, has printed 3 days in a row (now 4 days) so the jury is out until the pattern breaks and it becomes support or resistance.

A break of this pattern, should it occur, would be bullish but would then need to take out 151.21 to increase the risk of a retracement.

Otherwise,150 stays the focus, wide range 148.65-151.21.

To keep the retracement risk alive, 149.85 needs to hold.

December 4, 2024 at 8:49 pm #15635December 4, 2024 at 8:44 pm #15634December 4, 2024 at 8:39 pm #15633December 4, 2024 at 8:32 pm #15632December 4, 2024 at 8:26 pm #15631December 4, 2024 at 8:19 pm #15630December 4, 2024 at 8:14 pm #15629December 4, 2024 at 7:34 pm #15626 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View