- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 9, 2024 at 2:51 pm #15927December 9, 2024 at 2:44 pm #15926

This may sound a bit ridiculous to some but I largely operate on a sine wave basis since I have a military background using sine waves to tune weapons systems and have been able to (somewhat) redesign algorithms to reasonably match it. You would be surprised how similar markets move in that fashion.

At present Euro is right in the middle of an intermediate wave and so it would be a roll of the dice either direction here. And since the Eurozone is under reconstruction fundamentally I definitely prefer the sell side on pull ups.

December 9, 2024 at 2:33 pm #15925UsdSingapore and UsdHong Kong are laboring and I believe it is due to money flowing into US stocks and out of Bonds since institutions expectedly took their shot in that one last week. For now.

Although Usd is laboring against those cross pairs I am not seeing carryover into EurGbp or EurChf like there is in the majors and so am not yet enthused about the buy side there. Would need to see more. Money is flowing into those two but the horizon is under pressure.

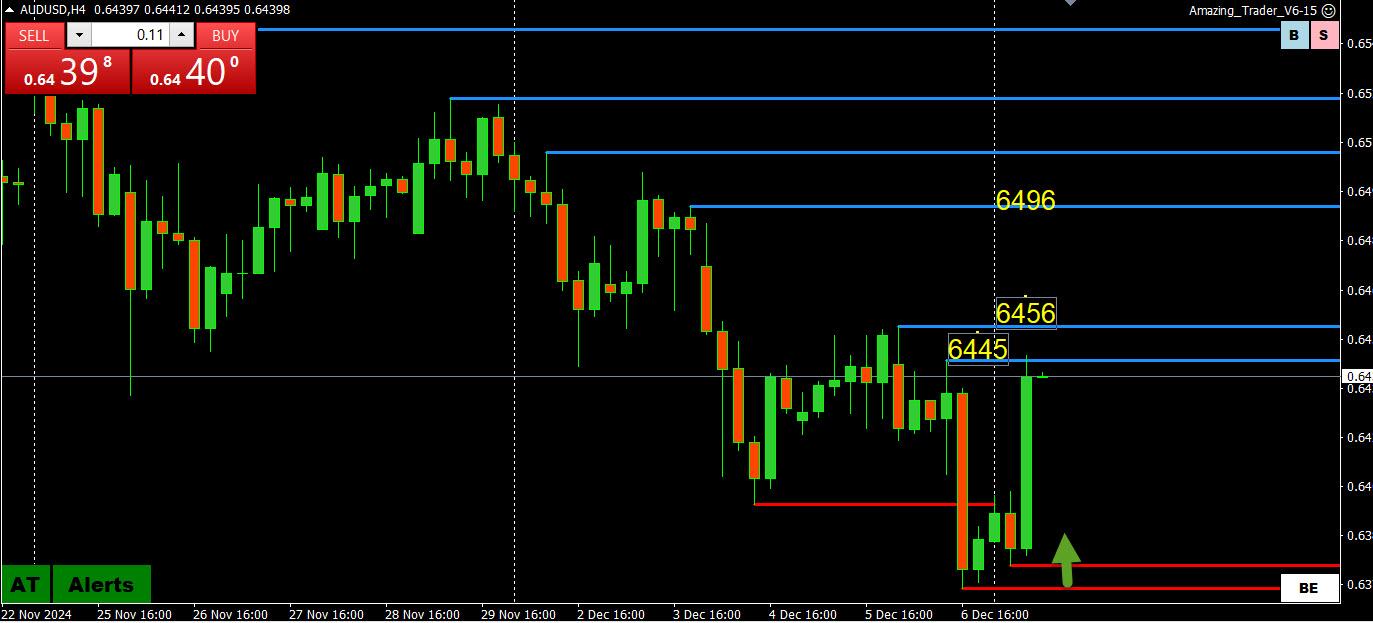

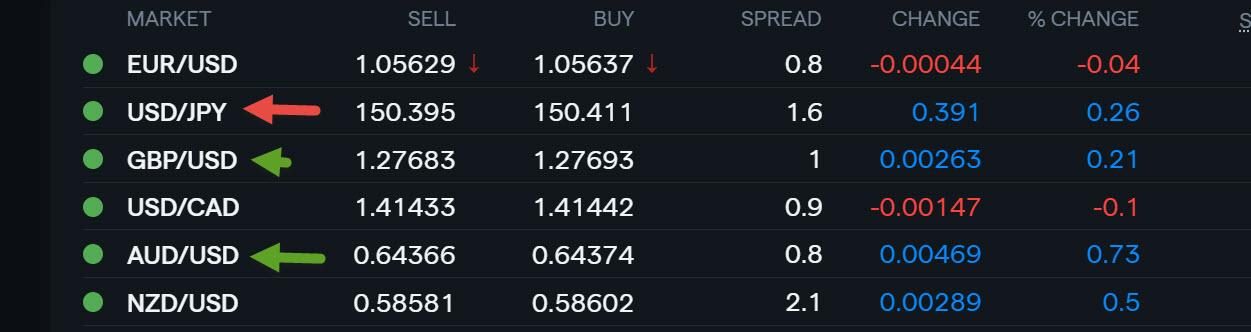

December 9, 2024 at 2:28 pm #15924December 9, 2024 at 2:21 pm #15923December 9, 2024 at 2:12 pm #15922SO FAR entering the week. I like Australian Dollar, Sterling, to a lesser extent Swiss Franc, and depending on a few things Euro on dips but my preferred side with that one still is the sell side. The buy side of Yen pairs is the best for me entering the week. UsdChf is bottoming in likelihood, but there could be another little stop run downhill prior from here.

December 9, 2024 at 1:54 pm #15921December 9, 2024 at 1:32 pm #15920December 9, 2024 at 1:07 pm #15918December 9, 2024 at 12:07 pm #15917EURUSD 5 MINUTE AMAZING TRADER CHART

You can see why EURUSD was sewtup to back dowqn… but in a range as long as 1.0561 holds as support (same support on a 15 minute chart)… below 1.0561 is 1.0556 and the 1,0550 magnet

December 9, 2024 at 11:48 am #15916A look at the day ahead in U.S. and global markets from Mike Dolan

A seemingly robust U.S. employment report did little to dissuade markets that another Federal Reserve interest rate is coming this month, and China added to the easy money mix on Monday in a historic change of monetary stance.

With the European Central Bank, Swiss National Bank and Bank of Canada among the major central banks expected to ease policy again this week, markets remain buoyant and Wall Street futures hover near their latest records.

Morning Bid: Fed cut gets baked in, China shifts monetary stance

December 9, 2024 at 11:45 am #15915NEWSQUAWK US OPEN

China’s Politburo sparks risk-on sentiment, but gains in equities have faded

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses initially gained, taking impetus from positive commentary via the Chinese Politburo; upside which has since faded. US equity futures are mixed.

China’s Politburo says next year must seek progress while maintaining stability; China’s fiscal policy to be more proactive next year. Monetary policy is to be moderately loose, via Xinhua.

Dollar is at incremental session lows; Antipodeans benefit from the positive sentiment, whilst havens lag.

Bonds were initially weighed on from the Politburo read-out, but now off worst levels; USTs a touch lower whilst European paper is slightly higher.

Commodities benefit from the risk tone sparked by the positive commentary from the Chinese Politburo.

December 9, 2024 at 11:06 am #15914December 9, 2024 at 10:56 am #15913December 9, 2024 at 10:11 am #15911December 9, 2024 at 10:04 am #15910December 9, 2024 at 10:00 am #15909December 9, 2024 at 3:49 am #15908December 9, 2024 at 3:47 am #15907December 8, 2024 at 10:54 pm #15891THIS WEEK’S MARKET-MOVING EVENTS (all days local)

On Tuesday, Australia’s RBA is expected to hold rates steady, with no changes likely until February or May. Germany’s CPI is forecast unchanged at -0.2% monthly and +2.2% annually, with HICP at -0.7% monthly and +2.4% annually.

Wednesday, US CPI is projected at +0.3% monthly and +2.7% annually, with core CPI steady at +0.3% and +3.3% annually. This keeps Fed expectations split between a 25 bp cut and no action. Canada’s BOC is expected to cut rates, likely by 50 bp, reflecting weak data and rising unemployment.

Japan’s PPI is estimated at +3.4% annually, driven by rice shortages and reduced utility subsidies. The BOJ may raise its overnight rate to 0.5% at its Dec. meeting.

Thursday, Australia’s labor report forecasts a 25K job gain, with unemployment ticking to 4.2%. UK GDP is expected at +0.2% in October. The ECB is likely to cut rates by 25 bp amid downside risks, while US PPI is forecast at +0.3% monthly and +2.6% annually.

Econoday

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View