- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 10, 2024 at 3:49 pm #16012

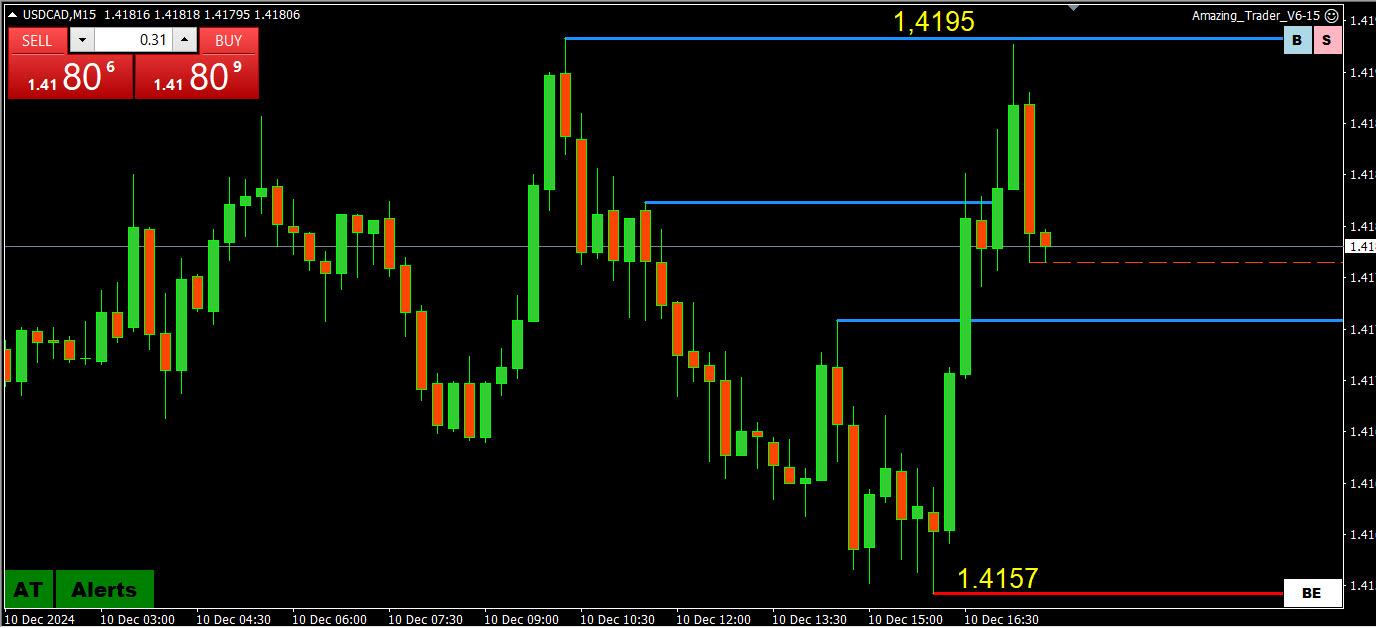

USDCAD 15 MINUTE – Defense?

This amazing Trader chart is too neat not to post it.

Double top at 1.4195 suggests there may be a defense oif the 1.42 (options?) level.

December 10, 2024 at 3:40 pm #16011An aspect of price behavior I am perpetually dialed in on is what kind of valuations the market is presenting in the US session. Some weeks there are very good price levels presented and other weeks the optimum levels are presented in the European session, and at times the Asian session.

Two weeks ago there were optimum valuations presented in the US session all week long and your precision could be near perfection. Last week the condition remained good but was not optimum. So far this week the levels presented are gone before the US session.

Your participation has to take that into consideration. How do you approach that? Patience.

December 10, 2024 at 3:36 pm #16010December 10, 2024 at 3:28 pm #16007The next near term cycle for Sterling, Yen, Aussie, Euro, Peso, and Franc futures should be the buy side. The level of conviction on that side I would not expect to be overly robust.

Yen is a bit different. The BOJ interest rate decision is on December 19th. Japanese 10yr rates are now sitting at early July highs and after attempting to go higher stalled at the same spot on November 11th.

So if it stalls here again that is three stalls. One might think this is the tail end of pricing in and reaction to the last action by the BOJ.

Therefore calling a bottom in Yen futures (buy side top of spot pairs) is a bit dicey since the rates could drop and Yen futures with it.

December 10, 2024 at 2:54 pm #16003December 10, 2024 at 2:51 pm #16002USDCAD 30 MINUTE – BID AHEAD OF BOC

With the BoC expected to cut rates by 50bps tomorrow, it should not be a surprise to see USDCAD trading with a bid.

The surprise was yesterday’s brief retracement that found supoport below 1.41.

The high set earlier at 1.4195 is key resistance although 1.42 is likely even more important with 1.4661, a 5-year high as the major level.

On the downside, 1.4150-57 needs hold to keep the bid.

December 10, 2024 at 2:11 pm #16001December 10, 2024 at 1:30 pm #16000December 10, 2024 at 12:28 pm #15997December 10, 2024 at 11:40 am #15996December 10, 2024 at 11:34 am #15994A look at the day ahead in U.S. and global markets from Mike Dolan

Helped by a backup in U.S. Treasury yields, the dollar has rediscovered its mojo ahead of a wave of overseas interest rate cuts this week, with China’s markets giving only a hesitant welcome to Beijing’s new policy orientation.

Morning Bid: Dollar reasserts strength, China fillip fades

December 10, 2024 at 11:26 am #15993NEWSQUAWK US OPEN

European equities tilt lower, USD gains & AUD lags after RBA’s dovish hold

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly on the backfoot; US futures trade indecisively around the unchanged mark.

USD outmuscles peers, AUD lags after the RBA delivered a dovish hold.

Choppy trade for European paper, US awaits 3yr supply.

Crude edges slightly lower and base metals pare back recent strength.

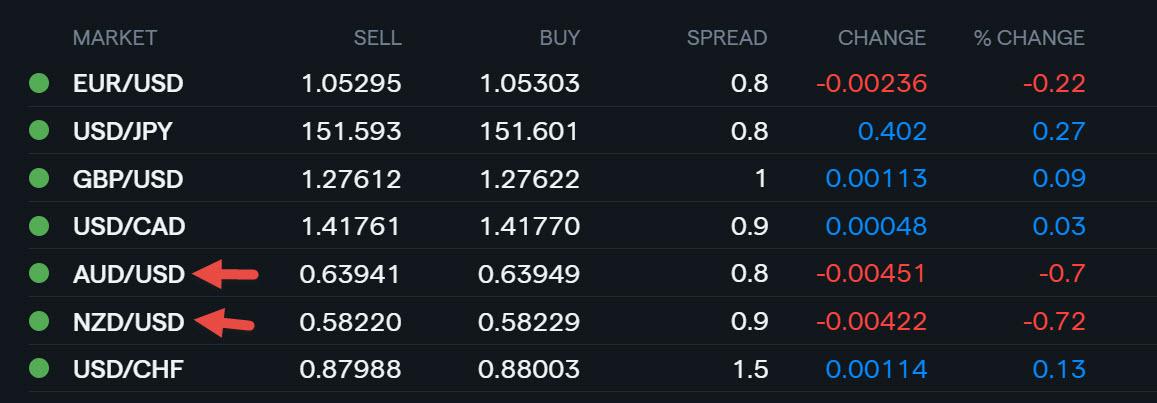

December 10, 2024 at 11:05 am #15991December 10, 2024 at 10:33 am #15989December 10, 2024 at 10:30 am #15988Using my platform as a heatmap

USD is up as market seems to be biding its time ahead of tomorrow’s US CPI

EURUSD still within 1.05-1.06 where Power of 1.0550 sets the bias

USDJPY found support above 150.77… needs to stay above 151.21 to keep a strong bid but t52 a potential obstacle

GBPUSD lagging… note weeaker EURGBP

USDCAD broke its 1.4178 key high but so far not following through

AUDUSD an underperformer (NZDUSD as well), falling after RBA but holding above Monday’s .6372 low

December 9, 2024 at 11:57 pm #15985

December 9, 2024 at 11:57 pm #15985As Holidays are approaching, we in Global view team have found a way to make the best of you very happy.

We are going to give away every week, for next three months FREE entry to Prop Challenge to those that perform the best in our Evaluation.

It is absolutely free and without any hidden fees !

December 9, 2024 at 9:31 pm #15969With EURUSD trading at 1.0550…

For those not familiar with this term or those who would like a reminder, see this popular articles in our blog

My Favorite Trading Secret: The Power of the “50” LevelDecember 9, 2024 at 9:30 pm #15968December 9, 2024 at 9:27 pm #15967EURUSD Daily

Supports : 1.05250 , 1.04600 & 1.04200

Resistances: 1.05950 , 1.06300 & 1.06950

Close tonight above 1.05550 would give another chance to EUR to push it Up.

Below 1.05400 things are going to start being quite unpleasant for EUR Bulls, but until 1.05250 taken out, it can still go back Up.

December 9, 2024 at 9:22 pm #15966

December 9, 2024 at 9:22 pm #15966 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View