- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 19, 2024 at 11:54 am #16489

A look at the day ahead in U.S. and global markets from Mike Dolan

Although the Federal Reserve’s “hawkish cut” on Thursday had been broadly expected, markets now fear 4% policy rates will be the floor for the coming year at least – and no further easing until midyear or later.

The picture painted by the Fed removes monetary easing as tailwind from the stock market for months and has seen the dollar rocket (.DXY), opens new tab to its highest in more than two years – bowling over emerging, developed and crypto currencies alike.

December 19, 2024 at 11:16 am #16487NEWSQUAWK US OPEN

US equity futures gain, DXY gives back some of post-FOMC strength, JPY hit post-Ueda

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European stocks tumble post-FOMC, MU -15% pre-market weighing on chip peers in Europe; US futures attempting to recoup yesterday’s losses.

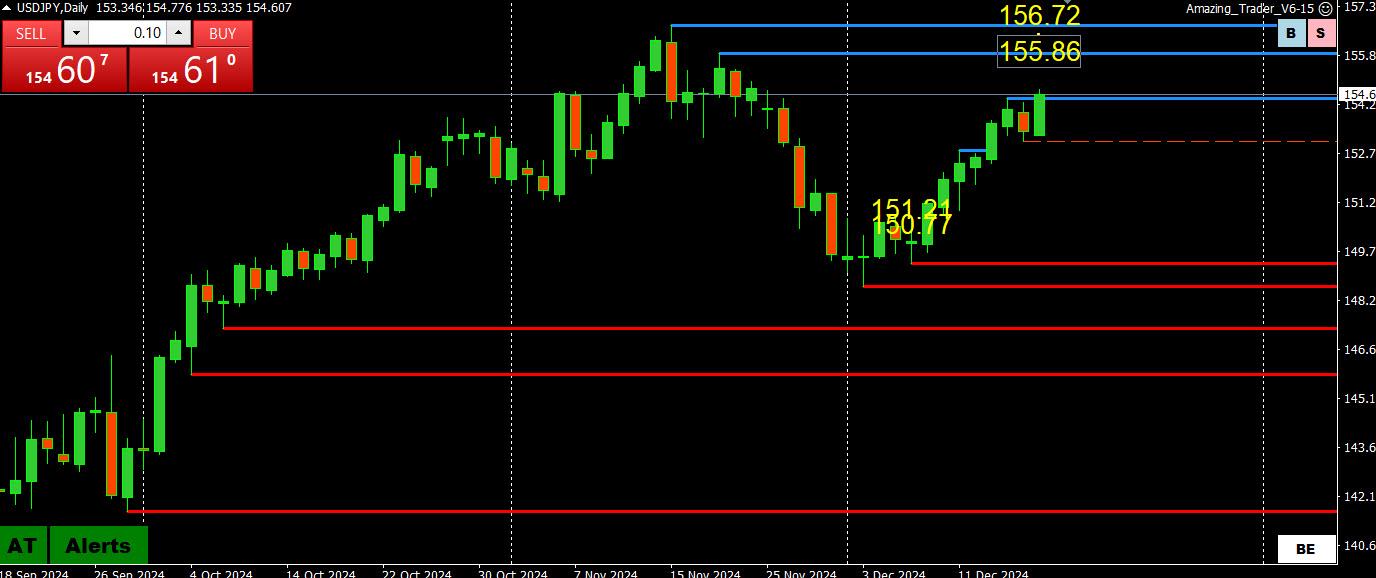

USD gives back some of yesterday’s post-FOMC gains, JPY hit after BoJ Governor Ueda’s press conference.

US yield curve steepens, JGBs outperform post-Ueda, Gilts lag pre-BoE.

Crude lifts incrementally off Wednesday’s lows, XAU fares better as the USD pauses for breath.

December 19, 2024 at 11:04 am #16485December 19, 2024 at 10:01 am #16483December 19, 2024 at 9:15 am #16477December 19, 2024 at 9:06 am #16476While the BoJ may be lurking pressure on the USDJPY upside is coming out of its crosses…

WHICH ARE WEIGHING ON THE USD ELSEWHERE, LED BY GBP, WHICH IS BID AHEAD OF THE NO CHANGE IN RATES EXPECTED FROM THE BOE IN A FEW HOURS (GBPJPY IS +2% ON THE DAY)… Note EURJPY is up 2% as well (helps explain the EURUSD rebound)

Hint: When you see a big move in USDJPY there is generally a cross flow(S) helping to drive the move.

Hint: When you see two currencies moving in opposite directions vs. the dollar it is a sign of real money order flow buying/selling a cross.

December 19, 2024 at 7:40 am #16472December 19, 2024 at 7:33 am #16471December 19, 2024 at 7:28 am #16470December 19, 2024 at 12:15 am #16467December 19, 2024 at 12:04 am #16466December 18, 2024 at 9:29 pm #16449This triggered the earthquake

The Federal Reserve on Wednesday projected only two quarter-point rate cuts in 2025, fewer than previously forecast, according to the central bank’s medium projection for interest rates.

The so-called dot-plot, which indicates individual members’ expectations for rates, showed officials see their benchmark lending rate falling to 3.9% by the end of 2025, equivalent to a target range of 3.75% to 4%.The Fed had previously projected four quarter-point cuts, or a full percentage point reduction, in 2025, at a meeting in September… truncated (CNBC)

December 18, 2024 at 9:24 pm #16448December 18, 2024 at 9:21 pm #16446December 18, 2024 at 9:10 pm #16445December 18, 2024 at 9:03 pm #16443US500 DAILY CHART – Reaction to news…

The old adage “it is the reaction to news that matters” proved true once again following the HAWKISH FZOMC.

I have been pointing out for some time that the failure to follow the NAS to a new record high was a red flag that left it vulnerable.

The break of the trendline indicates the uptrend is over but to suggest more scope on the downside 5834 and 5800 would need to be broken.

Only back above the trendline and 6000 would put the high back in play.

December 18, 2024 at 9:02 pm #16442The 10 year yield took off like a rocket on the announcement, which is the opposite of what it should do with a rate cut. Bitcoin fell off a cliff with stocks. I actually do not see the activity going out of bounds in percents of movement. This is about ongoing Dollar strength largely and I do not think the selling in stocks will stick for any significant duration.

December 18, 2024 at 8:51 pm #16441December 18, 2024 at 8:46 pm #16440December 18, 2024 at 8:29 pm #16439 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View