- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 23, 2024 at 3:23 pm #16696

JP – December 23, 2024 at 2:09 pm

I ran Fortune 500 programs coast to coast and multi state association in banking and related. I really like what Musk is doing, and other than some personalities I find deplorable this team is overdue for the USA economy. The way things have been run is the most absurd, disgusting example of garbage I have ever seen. I would have fired almost everyone, and I am know as the last one who would fire anyone.

Running lofty things is not a beauty contest. Although it does run much better when the morals and values are not fake and the people are actually caring and not fake.

December 23, 2024 at 3:12 pm #16695December 23, 2024 at 3:03 pm #16694December 23, 2024 at 2:48 pm #16693December 23, 2024 at 2:31 pm #16691Trading Tip of the Week posted in the Global Traders Association (GTA)

If you are not a member of GTA

December 23, 2024 at 2:09 pm #16690yes yeS yES YESS !

setting up friction of not outright fight between jerome’s gang and trump’s w/hBloomberg news › articles › 2024-12-23 ›

elon-musk-makes-overstaffed-fed-target-in-quest-for-efficiency

Elon Musk Makes ‘Overstaffed’ Fed Target in Quest for Efficiency …The central bank in charge of protecting the world’s largest economy is “absurdly overstaffed,” Musk wrote on social-media platform

December 23, 2024 at 1:58 pm #16689December 23, 2024 at 1:28 pm #16688December 23, 2024 at 12:56 pm #16686December 23, 2024 at 12:22 pm #16671USD catching A BID…FOCUS OF US data out today is Conference Board Consumer Confidence, expectrd to show a rise

December 23, 2024 at 11:31 am #16668December 23, 2024 at 11:07 am #16667NEWSQUAWK US OPEN

European equities mostly lower while US futures gain, USD firmer ahead of data

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly lower, US futures higher with modest outperformance in the NQ.

Dollar is firmer and holding around 108.00, GBP little changed after UK shows no growth in Q3.

Bunds & Gilts pressured in thin trade, USTs flat into data.

Gas heats up on updates out of Qatar and Russia; Crude/XAU flat.

December 23, 2024 at 10:29 am #16665December 23, 2024 at 10:05 am #16664EURUSD 1 HOUR CHART – THAT TIM,E OF YEAR

Technical analysis works because others follow the same indicators, patterns, levels, etc. When no one is playing the game, such as now ahead of Xmas, you can’t count on technical to follow through.

With that said, what caught my eye is EURUSD’s pause below 1.0450, which keeps thoughts of 1.05 at bay and the downside more at risk.

December 22, 2024 at 9:49 pm #16658THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Starting off the week on Monday is Canada’s monthly GDP. After a muted 1.4 percent year on year rise in October, forecasters expect November to go up a bit more at 1.8 percent on year.

US consumer confidence is forecast to show another increase in December, from 111.7 to 113.0.

On Tuesday, US new home sales are seen recovering to a 664,000 annual rate in November after plunging to 610,000 in October from a strong 738,000 in September. Weather depressed sales in October. That’s not seen as a factor in November but rising mortgage rates are.

Thursday, US job claims are seen rising to 223,000 this week, not far off the four-week moving average of 225,500 after an unexpected drop of 22,000 to 220,000 last week.

On Friday, Japanese payrolls are expected to post their 28th straight rise on year in November amid widespread labor shortages. Japan’s unemployment rate is forecast at 2.5 percent after ticking up to 2.5 percent in October and improving to an eight-month low of 2.4 percent in September from 2.5 percent in August. The government continues to describe employment conditions as “showing signs of improvement” in its latest monthly economic report.

Meanwhile, Japan’s industrial production is forecast to post its first drop in three months in November, down 3.5 percent on the month.

Econoday

December 22, 2024 at 6:55 pm #16651December 22, 2024 at 2:11 pm #16649Those trading the past few days should have noticed a series of one way moves

This suggests an end-of-year holiday market dominated by real money flows driven by position adjustments/book squaring rather than fresh positioning that are harder to absorb as participation tends to fall with each passing day… READ HOW, CLICK BELOW.

How to Trade in a Holiday Market

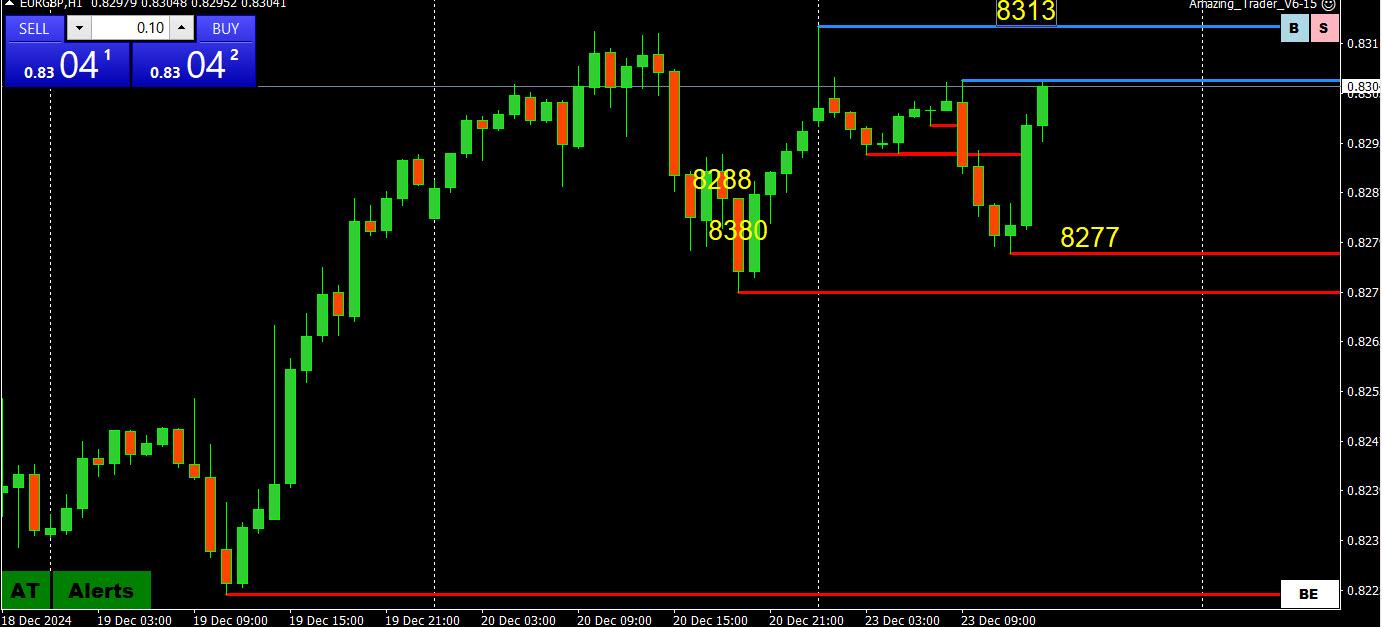

December 22, 2024 at 2:01 pm #16646December 22, 2024 at 1:44 pm #16645December 21, 2024 at 4:37 pm #16615It is no coincidence when a pattern repeats itself twice in a month with 2 different currencies.

]

The Magic Levels Trading Pattern Strikes Again -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View