- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

December 24, 2024 at 10:22 am #16743

NEWSQUAWK US OPEN

US futures modestly higher, USTs edge lower ahead of supply

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

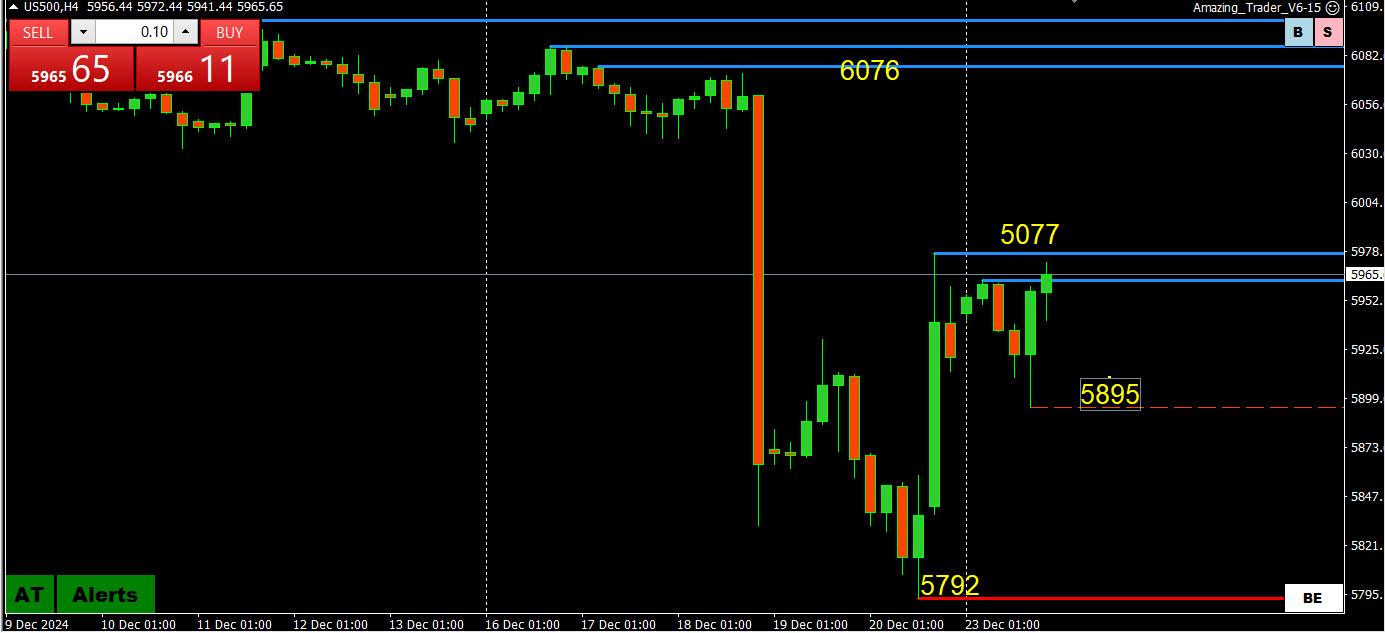

Stoxx 600 edges a little higher, US futures trade either side of the unchanged mark.

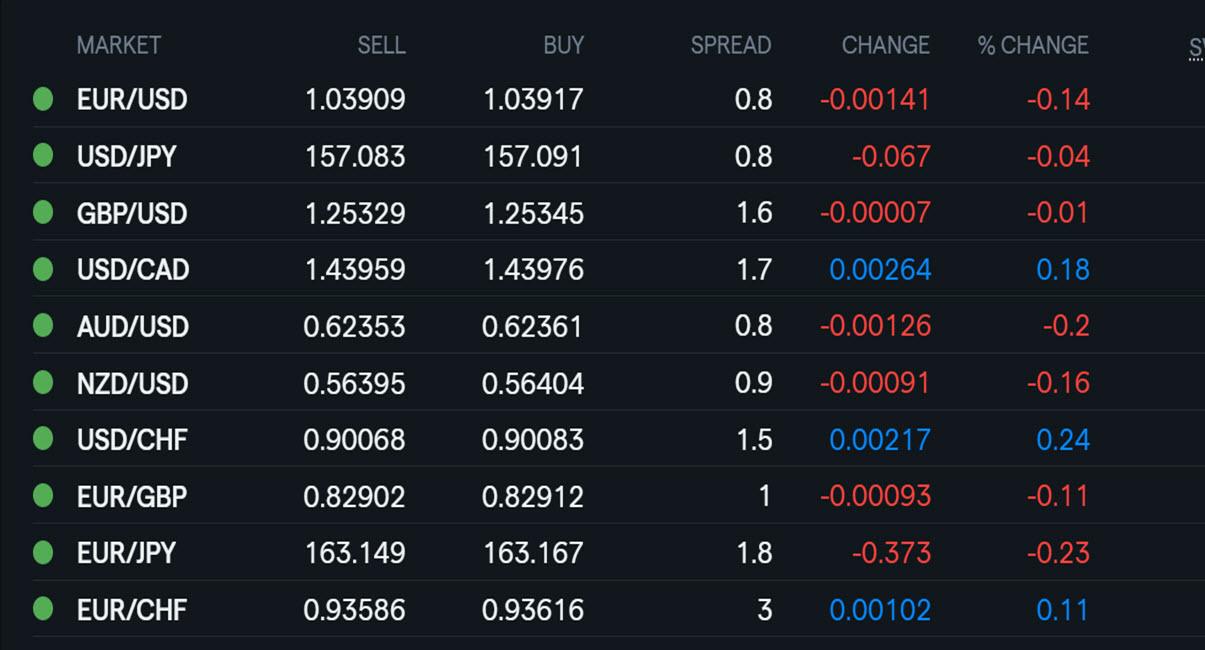

DXY is essentially flat with price action ultimately rangebound in quiet newsflow.

USTs are slightly softer ahead of US supply; Bunds are closed for trade.

Crude oil holds an upward bias, base metals are modestly firmer.

December 24, 2024 at 10:09 am #16742Using my platform as a HEATMAP shows narrow ranges with the dollar a touch firmer.

EURUSD pattern: Extended its trade around 1.04 to 5 days in a row, currently below it…downside stays at risk as long as it trades below 1.0450\

Another round of verbal intervention in Japan

EURGBP ticking down after failing yesterday at .8313

US bond yields remain firm, 10-year just below 4.60%

Early closures today, including US stocks

Xmas tomorrow, most countries closed on Thursday, US markets open Thursday but likely with skeletal staffing

December 24, 2024 at 1:37 am #16741AnonymousDecember 24, 2024 at 12:21 am #16739Trading Tip of the Week posted in the Global Traders Association (GTA)

If you are not a member of GTA

December 23, 2024 at 9:58 pm #16723December 23, 2024 at 9:42 pm #16722December 23, 2024 at 9:38 pm #16721December 23, 2024 at 9:22 pm #16719December 17, 2024 at 9:18 pm

In reply to December 17, 2024 at 9:18 pm

Belgrade Bobby

Keymaster

(178.222.190.16)

BTCUSD Daily

It has finally reached 108K , and now might be the time for another correction…

Yeah – probably the only one with cojones to go out on the limb and declare it openly….

Supports : 92.100.00, 86.600.00 & 85.400.00

Resistances : 96.450.00, 98.150.00 & 100K

What we have now is not any more extremely Bullish – we can reach close to previous high on another attempt, but we need a solid and long ( time wise) correction.

Think of it now as a Range between 70K and 110K

December 23, 2024 at 9:11 pm #16718December 23, 2024 at 9:00 pm #16717December 23, 2024 at 8:53 pm #16716December 23, 2024 at 5:50 pm #16713December 23, 2024 at 5:50 pm #16712December 23, 2024 at 5:47 pm #16711

December 23, 2024 at 9:11 pm #16718December 23, 2024 at 9:00 pm #16717December 23, 2024 at 8:53 pm #16716December 23, 2024 at 5:50 pm #16713December 23, 2024 at 5:50 pm #16712December 23, 2024 at 5:47 pm #16711JP – Concur. One would think that is how to approach things. Largely out of curiosity and gymnastics I tend to pay attention to the other things somewhat. But if we are not involved in some way then it is only for perception of the overall mood I believe. Which at times is very valuable I have found.

December 23, 2024 at 5:35 pm #16710SF Monedge / all that I am looking for, from playing FX, is a personal reward in the form of posi-pips from my betting on the aggregate market sentiment / reaction to situations in society that may be non-balanced, extreme, radical or otherwise unsettling to the market.

The moral or vindictive or acerbic personal view aspect of a situation is an emotion I try to sideline and isolate from my trading.

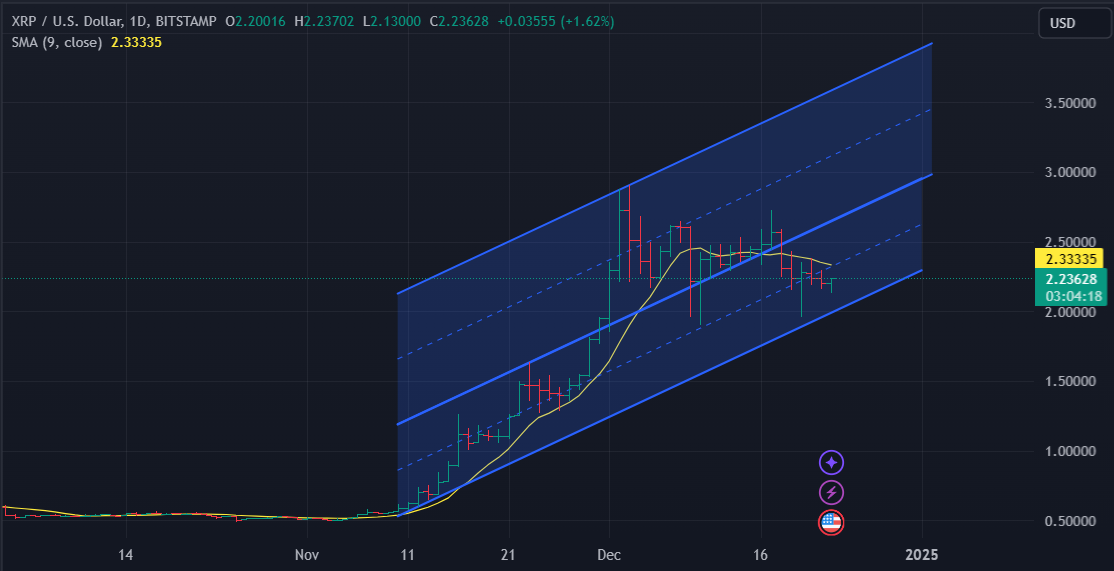

December 23, 2024 at 5:28 pm #16708December 23, 2024 at 5:15 pm #16706December 23, 2024 at 4:25 pm #16699BTCUSD DAILY – LIFE IN CRYPTOWORLD

If it wasn’t BTCUSD falling 15% from its high, I would be shaken but this is like in Cryptoworld.

This is a classic case, though, of pre-Xmas trading dominated by position adjustments and book squaring rather than taking on more risk by adding to positions.

Otherwise, only a break of 90K would shake more bulls from the trees.

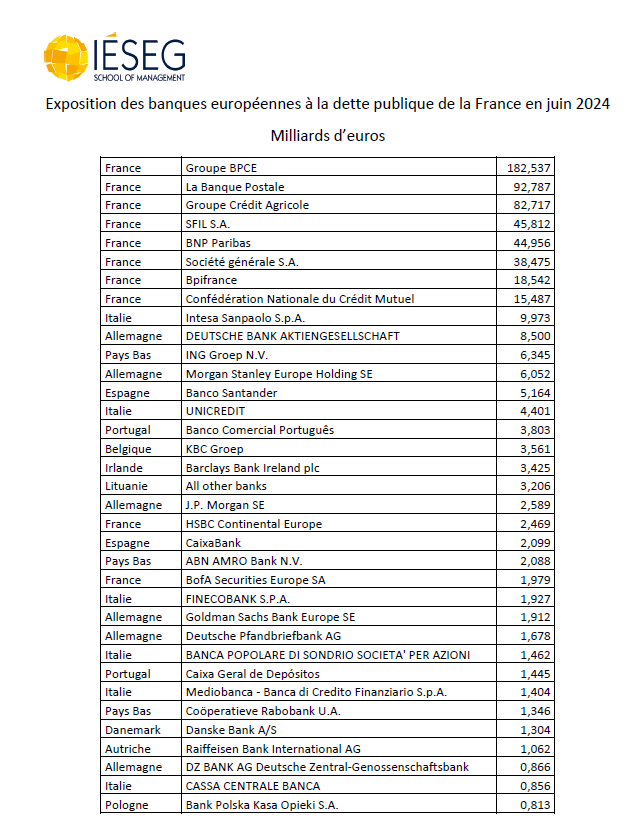

December 23, 2024 at 4:15 pm #16698AnonymousThe fate of Macron depends on what happens with Francois Bayrou. If Bayrou fails, France will be on the brink of a constitutional crisis. The country is in a situation similar to the end of the Fourth Republic, when political instability was the result of parties dominating the scene with their improvisations and partisan bargaining. It is the reason why the Fifth Republic gave so much more power to the president. And yet even despite, or maybe because of, the president’s extensive powers, France finds itself in the same situation again.

There are still many unknowns of what to expect in 2025. What we know, however, is not very encouraging. Bayrou wanted to enlarge the majority, but he ended up with the same crowd as Michel Barnier. He promised to break the political deadlock with a new method but the only concrete proposals he put forward promise more deadlock instead.

Bayrou also rejected the idea of foregoing the use of Art. 49.3 to push the budget through without a vote in parliament. He may now have neither the Greens nor the Socialists ready to support him with a no-censureship agreement in parliament. MPs are already wishing back Barnier, even those who ousted him in the censure vote. Will the mood shift in the new year? Nothing is more uncertain.

December 23, 2024 at 3:40 pm #16697One of the few officials of the outgoing regime I would not fire is Mary Daly, San Francisco Fed President. Understanding some have valid reasons to disagree with me, I find her to be truly considerate in every way and able to visualize things in a smooth, broad, pinpointed and decent fashion. She is able to make progress without it being a ridiculous dog fight. And she is one of a handful of them that is not corrupted both mentally and otherwise.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View