- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 6, 2025 at 12:27 pm #17219January 6, 2025 at 11:32 am #17214

USD spikes lower, stocks up, bond yields down…

US President elect Trum[‘s aides look at universal import duties but only on certain sectors, among first big moves of presidency, WoPo reports

Source: Newsquawk.com

January 6, 2025 at 11:23 am #17213January 6, 2025 at 10:43 am #17212January 6, 2025 at 10:33 am #17211

Using my platform as a Heatmap shows the USD lower vs all but the JPY, so you can see what cross flows are helping to drive the price action today.

To suggest anything more than typical start of year trading, EURUSD 1.0375 and/or GBPUSD 1.25+ would need to be regained.

USDJPY 158 remains pivotal as above it opens the door for 1.50.

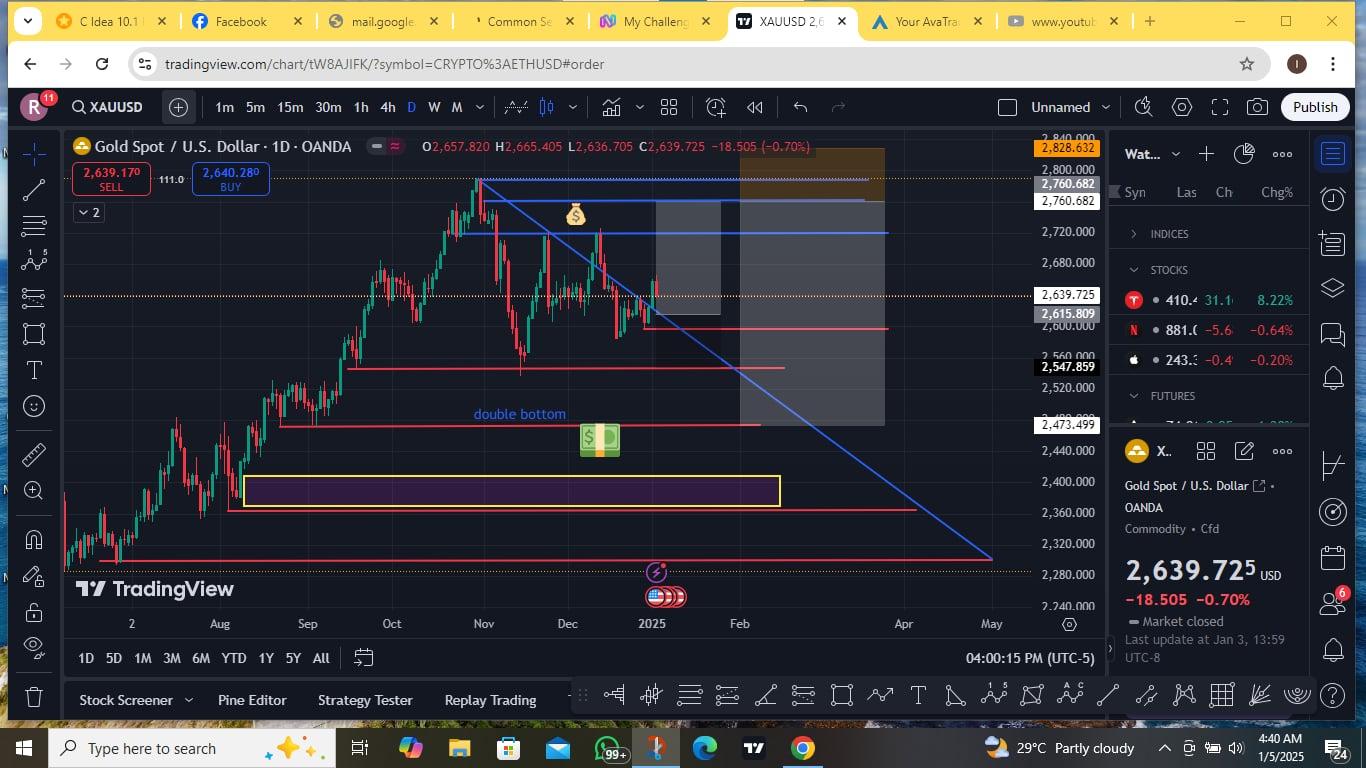

US stocks up, bond yields up (ust a few bps) , GOLD down

How markets end tge week will be more important than how they start out.

January 6, 2025 at 9:59 am #17209EURUSD 4 HOUR CHART – Typical

Typical start to the year whipsaw (see Trading Tip: Beware of a New Year Whipsaw)_but to make it anything more than a retracement 1.0375 would need to be taken out.

Otherwise look for 1.0350 to set the tone while within 1.0300-1.0400.

January 6, 2025 at 8:52 am #17208AnonymousJanuary 6, 2025 at 1:12 am #17207January 5, 2025 at 11:15 pm #17185THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Starting off on Monday are the S&P PMI composite finals. The French PMI composite final for December is estimated to remain the same as the flash with the for composite final at 46.7 and services final at 48.2. The German PMI Composite Final is also expected to show no change from the flash at 47.8 for the composite final and 51.0 for services final. The Eurozone PMI is expected to post 49.5 for the composite final and no change from 51.4 for the services final. The UK PMI is estimated to be 50.5 and no revision in services at 51.4. The US PMI service final is estimated to post a robust 58.5 in the December flash and up from 56.1 in November.

Germany’s consumer price index is estimated to reach 2.4 percent on year in December, up from 2.2percent in November. On the month, the consensus looks for CPI up 0.3 percent after a decline of 0.2 percent in November.

On Tuesday, the Eurozone unemployment rate for November is expected to be 6.3 percent again in November after holding steady at 6.3 percent in October from September.

For the US international trade and goods service, the consensus looks for the trade deficit to widen to $77.6 billion after shrinking more than expected to $73.8 billion in October.

Wednesday, the US ADP employment report for December is expected to see private payrolls up 134,000 after a gain of 146,000 the month before.

Thursday, China’s producer price index is estimated to be a muted 0.1 percent rise on the year.

US jobless claims on the other hand are expected to rise to 216,000 after last week’s unexpected decline to 211,000 from 220,000 the week before.

On Friday, Japan’s real household spending is forecast to post a fourth straight drop in November, down 0.6 percent on year, as flat growth in real wages amid elevated costs for food and other daily necessities left consumers frugal, but the pace of decline is seen decelerating from the 1.3 percent drop in October. Lower temperatures replaced the lingering warm weather, boosting demand for autumn and winter clothing. On the month, real average expenditures by households with two or more people are expected to fall 0.9 percent after surging 2.9 percent in October and slumping 1.3 percent in September.

Canada’s labour force survey is also out on Friday, and is expected to rise a modest 20,000 in employment is the call but it’s not enough to prevent the jobless rate from ticking up to 6.9 percent from 6.8 percent in November.

The week’s finale will be the most watched of economic reports, the US Employment Situation. The consensus on December payrolls looks for a gain of 157,000 and for the jobless rate to stay steady at 4.2 percent. Private payrolls are seen up 130,000. These numbers would be consistent with a general cooling trend in the employment market after a few months of readings skewed by weather and strikes. Earnings are seen cooling to a 0.3 percent rise on the month after surging 0.4 percent in November.

Econoday

January 5, 2025 at 11:12 pm #17183January 5, 2025 at 10:42 pm #17181fiscal time bomb … ready to explode

–

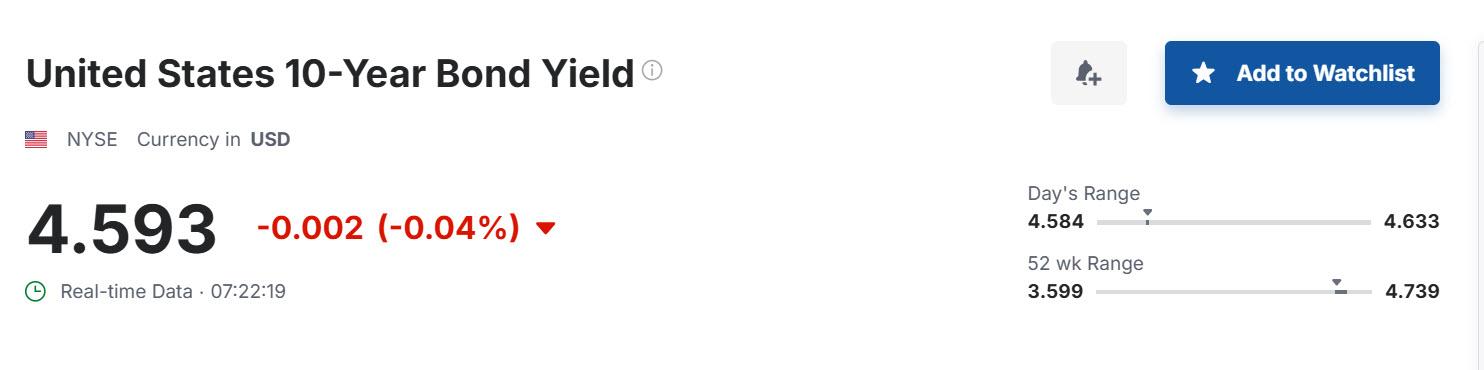

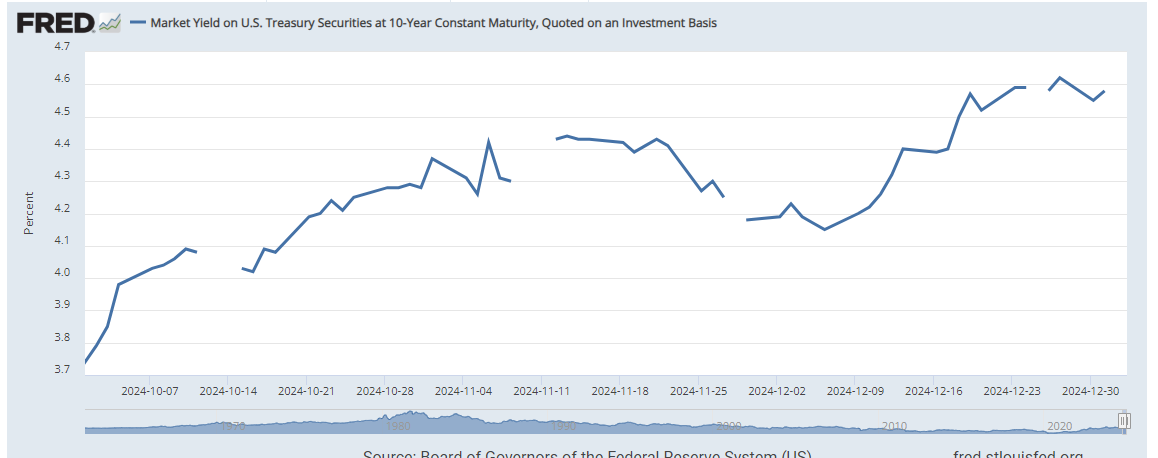

yes yeS YES !! helllooooo Jerome: 10-yr sept 16th was 2024’s low at 3.1618 vs today’s near 100 points uP at 4.601% VS your FED overnite sept 24’s 5.33% cut down to …. 4.33 rofl . what is going on buddy ? better yet what will be going over the next month to 6 months out ?are we going to see who is bigger: the bond market OR the market meddling FED gang ?

I know who I side withJanuary 5, 2025 at 10:21 pm #17178January 5, 2025 at 9:12 pm #17176January 5, 2025 at 9:35 am #17117This article is worth reading

As evidence keeps building that the hapless Biden administration couldn’t end fast enough, there’s also evidence that the first Trump presidency of strong growth and low inflation pre-COVID won’t return immediately.

That’s the signal we’re getting from the bond market: The possibility that the fiscal time bomb of nonstop spending that Joe Biden and his minions have planted is ready to explode just in time for Trump to take office.

Joe Biden’s fiscal time bomb is set to explode just in time time for Trump to take office

January 4, 2025 at 10:16 pm #17100Trading Tip: Beware of a New Year Whipsaw

While this year may turn out to be different given the new U.S. president and policies (e,g, tariffs, tax cuts, etc) could impact the bond and global markets, I would be remiss not to give a warning to beware of start of a New Year whipsaws.

January 4, 2025 at 2:51 pm #17096Newsquawk Highlights Week Ahead 6-10th January 2025

January 3, 2025 at 9:09 pm #17073AnonymousRabobank Research –

EUR/USD – parity watch

3 January 2025 12:45 RaboResearchEUR/USD has plunged from a high near 1.1214 in late September to a low yesterday around 1.0226.

https://www.rabobank.com/knowledge/q011461983-eur-usd-parity-watch

January 3, 2025 at 9:00 pm #17070January 3, 2025 at 8:01 pm #17066January 3, 2025 at 4:36 pm #17061 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View