- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 8, 2025 at 1:19 pm #17344January 8, 2025 at 12:59 pm #17343January 8, 2025 at 12:26 pm #17342January 8, 2025 at 12:19 pm #17340Anonymous

COL. Douglas Macgregor : Will Germany leave NATO? Will Israel Invade Egypt?

The New Neo Colonial World is next?

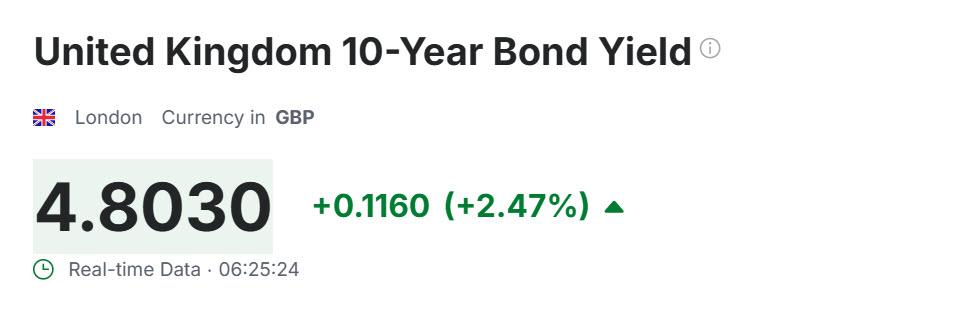

January 8, 2025 at 12:11 pm #17339January 8, 2025 at 12:07 pm #17337What is a bond vigilante?

A bond vigilante is a fixed-income trader who sells bonds or threatens to sell them to influence the policies of the issuer. The term was coined by Ed Yardeni in the 1980s.

Bond vigilantes can:Drive down prices and increase yields

When bond vigilantes sell large amounts of bonds, the price of bonds decreases and the yield increases. This makes it more expensive for the issuer to borrow money.

Discipline excessive government spending

Bond vigilantes can demand higher sovereign debt yields to discipline excessive government spending.

Bring attention to the bond market’s reaction

The term can be used as a rhetorical device to highlight how the bond market would react if a policy isn’t changed. (AI Overview)

January 8, 2025 at 11:42 am #17335January 8, 2025 at 11:40 am #17334January 8, 2025 at 11:38 am #17333January 8, 2025 at 11:31 am #17332A look at the day ahead in U.S. and global markets from Mike Dolan

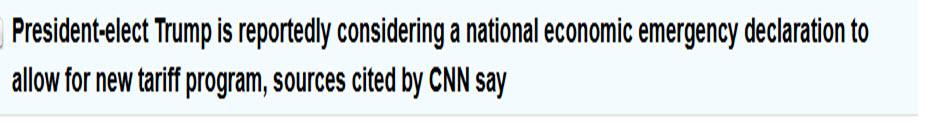

Dragging up government borrowing costs across the world, the new year spike in long-term U.S. Treasury yields is flashing red as a long-absent risk premium in debt markets re-builds alarmingly amid fiscal policy and interest rate fears.

The New York Federal Reserve’s estimate of the 10-year ‘term premium’ – seen as the compensation investors seek for holding long-term Treasuries to maturity instead of rolling over short-term debt holdings – topped 50 basis points this week for the first time since 2014.

January 8, 2025 at 11:26 am #17331January 8, 2025 at 11:24 am #17330January 8, 2025 at 11:16 am #17329USDJPY WEEKLY CHART0- Bumpy ride but up..

The 6-week rally, which has been a bumpy ride, from 148.65 continues…

As you can see by this chart there is nothing of note until the 161.91 high

This increases the significance of key big figures 158 and 160, 158 needing to become support for 160 to become an attraction.

January 8, 2025 at 10:48 am #17328January 8, 2025 at 10:38 am #17327This kinda injustice against the US govt just bothers and bugs me like anything. I mean what have they done to deserve such kind of injustice. I mean literally the whole of California is on fire and everybody is just least bothered. We don’t see wildfires breaking out in other parts of the world in that way meaning it’s happening only in the USA or simply the States. I wouldn’t use America anymore because using just America by itself indicates something like a wild west type of civil environment.

Why don’t they simply allow agricultural farming in those areas at least the dirt/ground/earth and greenhouses will remain cool in summers. The people would create jobs and taxable income and save the government and insurance companies from having to pay billion’s of dollars in compensation for the reason of plain negligence. What a paradox. A coastal state has a problem with drought when they can easily pump desalinated water into those forests, it costs only about 2 billion per year but would save the government and insurance companies from paying 12 billion per year and even more over longer periods of time. They collect taxes in one state and have to pay their tax collections over to another state. Now what exactly is the use of doing that!

fwiw…They can rename the Gulf of Mexico into the Gulf of the Unites States.

January 8, 2025 at 10:29 am #17326AnonymousEUROPE – Very Strange

The German Dax is rising, but there is no economic-funamental reason there, except a DEXIT risk upon the upcoming German Election on February 23d.

In case of DEXIT it is said the EURO might loose 40% sharp, there will be problems in devalued assets all over and those not market to market might require huge capital inflows.

The New Deutsche Mark would rise 40%. So probably some German Equities are now considered partly a safe have. Just partly and just some.

All other EUROPEAN INDEXES WOULD CRASH

January 8, 2025 at 10:12 am #17325EURUSD 4 HOUR CHART – ON THE DEFENSIVE AGAIN

As I have been saying, how markets end the week is more important than how they start out.

In this regard, EURUSD failure to hold 1.04 has put last week’s 1,0224 low back on the table.

Two support levels stand in the way, 1.0307 (use 1.03 as well) and 1.0272 so damage not yet fatal.

In any case, expect a sell on blips while below 1.0360-80, stronger bias as long as 1.0350+ is not regained.

‘

January 8, 2025 at 9:52 am #17323Using my platform as a HEATMAP:

What a difference a day makes… at this time yesterday the dollar was down across-the-board, which, to state the obvious, did not last… watch US bond yields, which have been a driver

As markets reliquefy, economic data continues to be a driver…

Today sees

ADP employment (not a good indicator of NFP but can cause some volatility)

US jobless claims (released today due to tomorrow’s day if mourning)

January 8, 2025 at 9:45 am #17322AnonymousDEXIT – EUROPE

In view of the upcoming elections to the European Parliament, the President of the European Commission Ursula von der Leyen had clear words on the German AfD’s plans to leave the European Union. During a speech at the CDU federal party conference on May 8, 2024, von der Leyen said about the right-wing populist party: “A Dexit like the one the AfD chooses would mean a loss of prosperity of 400 to 500 billion euros per year for Germany. In Germany as an exporting country, an AfD Dexit would be associated with an immediate loss of 2.2 million jobs.” These claims are backed by studies.

January 8, 2025 at 9:28 am #17321Thursday, January 9 will a Day of mourning for the passing of President Jimmy Carter

On Dec. 30, President Biden ordered that “all executive departments and agencies of the Federal Government shall be closed on Jan. 9,” except those necessary for “national security, defense, or other public need.” Federal employees will still be paid for the day.

The Postal Service will suspend mail delivery and close post offices, but there will still be limited package delivery service, a spokesman said.

National parks will generally be open, but their administrative offices will be closed.

The New York Stock Exchange and Nasdaq will also be closed, as will the United States Supreme Court and other federal courts, along with the Library of Congress.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View