- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 9, 2025 at 10:02 am #17400

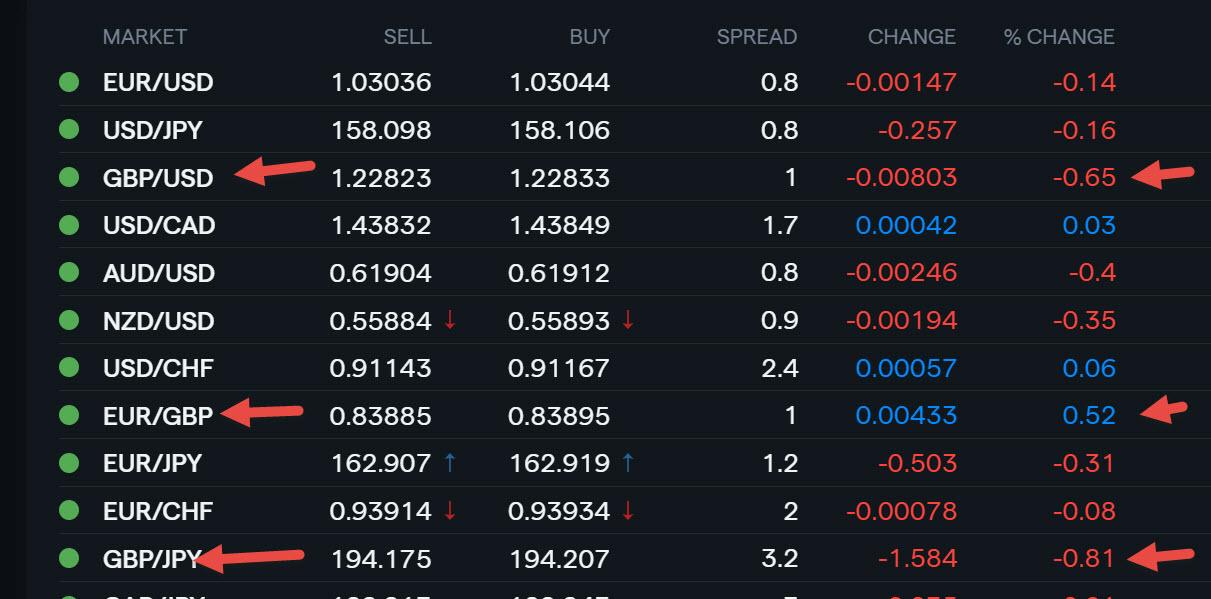

Using my platform as a HEATMAP

The attack on GBP continues although it has come off its lows. If I was the BOE, I would be in covertly to prevent a full-scale panic.

EURUSD continues to find support out of EURGBP but so far niot enough to get through 1.-320-25

…. And US jobs report is yet to come… NO US data today due to the Day of Mourning

Be aware that the start of a new year often sees false starts and choppy trading as markets slowly return to full

January 9, 2025 at 9:53 am #17399AnonymousActually European Equity Indexes are trading more alike the Chinese ever more – detaching, decoupling from the US ones.

Which is bad.Earlier German Inflation data, although holding the EURUSD little buoyed, surprised upwards. This is something that contradicts the latest ECBs Monetary tendencies.

All in all Central banks seem to loose credibility. There is no Monetary Policy!

All those speeches are more like a psychoanalytic therapy for the various investment funds and buy and holders.

Also most studies printed from the Think Tanks of sort are written by advertisers, more than professionals of once.If You see the GDP projection for 2025 of Europe Vs US it tells it all.

There are other things, but will not comment them – too long.Now upcoming are the retails sales in EU, which are a better indicator for the Eauity Markets.

Those are quite poor forecast, regardless of the number…if one reads in details it appears different to the average traders, investor or news writers that be..

e.g. 39.3% of the whole of the European Retail Sales is made up by Food Dings and Tobacco

So why be bullish European Equity Indexes

Sure there we were Months in some Harmonic Top in the making, now negated recently but this in very thin and small markets…. but european leaders are pushing inteventions as the chinese are…

but it the end as China falls so Its Europe…

Gonna see after Trump and after the German election all more clearly

for now its a game of very high level players that don’t print around over social media or elsewhere.Good Luck

January 9, 2025 at 8:58 am #17398January 9, 2025 at 8:49 am #17397January 9, 2025 at 8:22 am #17396January 9, 2025 at 7:06 am #17395AnonymousA ‘painful sequel’ to the Budget may be coming, Deutsche Bank warns

https://www.cityam.com/a-painful-sequel-to-the-budget-may-be-coming-deutsche-bank-warns/

January 9, 2025 at 5:03 am #17394AnonymousAs from https://www.eurointelligence.com/

Falling on ice in Greenland

With Greenland, Europe is running into a geopolitical disaster largely of its own making. It would have cost almost nothing for the EU to have made Greenland – and Iceland – an offer for membership, in return of which the EU would have obtained a foothold in one of the strategically most important regions.

It’s long forgotten, but Greenland was a member of the EU once when it was part of Denmark. With the departure of Greenland and the UK, the EU lost its two most northern Atlantic members. People tend to forget that neither Finland nor Sweden have access to the Arctic coastline.

Greenland formally withdrew from the EU in 1985. Today, Greenland is still part part of the Danish crown, but the 2009 autonomy acts give Greenland the right to secession through a referendum. So the statement by Mette Frederiksen, the Danish prime minister, that Greenland is not for sale is bunk. This is up to the seller. The seller is not Denmark, but the 59,000 inhabitants of Greenland. Neither Denmark nor the EU can stop this.

Last year, Ursula von der Leyen and Frederiksen visited Greenland because they were alarmed by plans of Chinese investment in Greenlandic mining. Greenland has reservoirs of natural resources including rare earth metals – a market China is keen to dominate because of its importance for batteries and other high-tech equipment. The Greenland prime minister, Múte Bourup Egede, told them bluntly that Greenland is a poor country that welcomed foreign investment, including from China. After treating Greenland with contempt and neglect for so long, it is unsurprising that the country prioritises its narrow economic interests over European security concerns. And this, we think, is how Donald Trump might get them.

In 2009, Iceland considered joining the EU, which would have been a strategic coup for the EU, because it could have paved the way of Greenlandic accession. But the Iceland accession failed over fishing rights. It is astonishing how much political capital the EU has spent on this subject. The EU and Greenland only have a friendship treaty, with some tuppence worth of support for sustainable development. Iceland’s new government is planning on holding a referendum on EU membership by 2027.

The Arctic has become geostrategically increasingly important. Russia is the Arctic superpower. The region also hold economically because of raw materials and because melting sea ice could open up new trade routes. It is also unsurprising that Trumps prioritises the acquisition of Greenland, Canada, and the Panama canal, using the language of mergers and acquisitions.

It should also come as a reminder that the US does not share Europe’s priority of Ukraine as its number one geopolitical issue of our time. For Trump, the security policy priority is to push back China away from the US’s own geographic neighbourhood, and to secure a strong presence in supplies of critical raw materials.

We are where we are because the EU ended it path towards political integration with the introduction of the euro, deluding itself into believing that soft power, diplomatic grand-standing, and control over regulation would prevail in the end.

January 8, 2025 at 10:33 pm #17393January 8, 2025 at 9:16 pm #17380AMD – Advanced Micro Devices

AMD Faces AI Roadblocks: HSBC Slashes Price Target by Nearly 50%

Advanced Micro Devices’ AMD investors, brace yourselves. HSBC just hit the brakes on the chipmaker, downgrading the stock from Buy to Reduce and slashing its price target from $200 to $110 a move that signals a rocky road ahead.Weak demand for AMD’s MI325 GPU and delays in catching up with Nvidia’s NVDA market-dominating NVL rack platform.

Client revenue growth is expected to slow to 12% year-over-year in FY2025, a steep drop from the 44% growth forecast for FY2024.

January 8, 2025 at 9:06 pm #17379

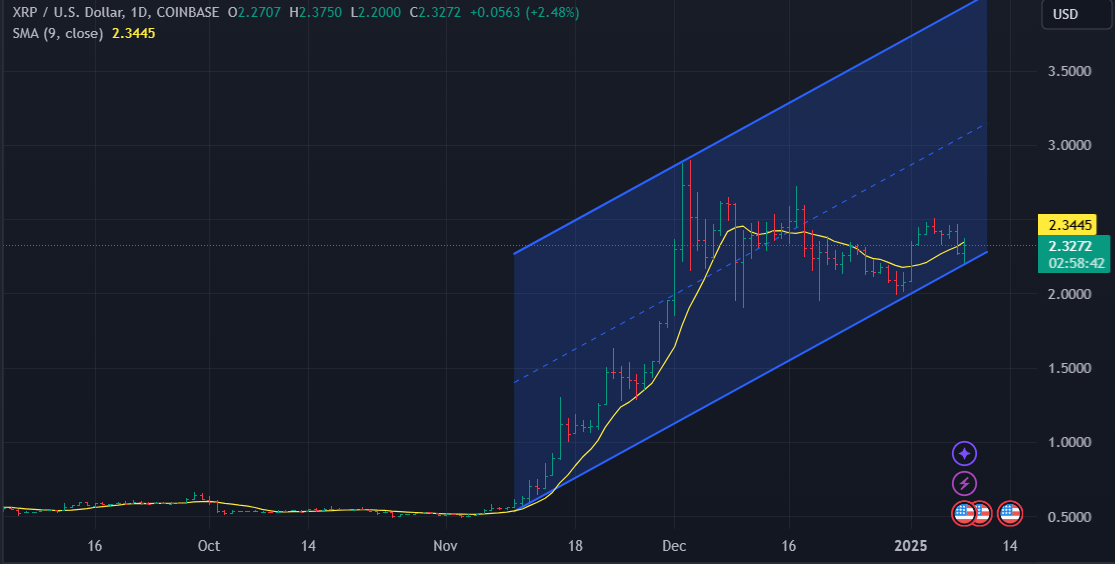

January 8, 2025 at 9:06 pm #17379XRPUSD

XRP Stronger Than Everyone: 2.2 Million Transactions

As the most successful cryptocurrency, XRP has maintained its position as the most reliable asset on a market that is prone to volatility. At $2.03, XRP has risen 10.6% in the last week, surpassing Bitcoin, Ethereum and Binance Coin, which are suffering losses ranging from 4% to more than 8%.

XRP is consolidating within a bullish triangle pattern, with resistance at $2.50 and immediate support at $2.20. Significant buying interest could be generated by a breakout above $2.50, which could lead to $3.00, a crucial psychological level.The downside is that a retracement toward $1.90 might occur if the $2.20 support is lost.

January 8, 2025 at 9:06 pm #17378Anonymous

January 8, 2025 at 9:06 pm #17378AnonymousHi Caribbean Rafe

No idea who created Bitcoin. 2nd Option – Eco-fi

If Robert Ludlum was still alive he would probably wrote upon. Probably, given the technological complexity as the high value of hardware and software employed, Ludlum would link to some a Cabal that is trying to destabilize all Nation-States, which is running the show between some dark segments of our Universities/Government and Corporations, NGOs.

Instability, the sickness of It not admitted by those sociopaths, as their source of Power.

Probably the wanna be New Global Order. The Sonnenkinders every nation has built out from the disgraced 20st century, wehre we had gone trough 3 World Wars, – the 1st, the 2nd and the Cold One.

But then the electric energy system collapsed, amid an extreme solar storm, and we were thrown back into the stone age.

As stupid as we were – if not more, without the possibility to consult our smartphones, the algorithm that tells us what to do next, so to be …someone..

a Robot?.Good Luck out there

@

(please mind the typos, my eyes are not those of once and am writing fast and the EDIT button then goes missing after a while GVI – so can’t edit the errors)

January 8, 2025 at 8:58 pm #17377Nvidia – NVDA

NVDA: Nvidia Stock Wipes Out $230 Billion Right After Touching Record. What Happened?

· Nvidia stock drops 6.2%

· Investors react to Huang’s speech

· Not much excitement in shares this year

Shares of the AI darling erased 6.2% as the company’s big Las Vegas event failed to spark enthusiasm among investors.

Nvidia stock NVDA was among the biggest losers in tech on Tuesday when the whole market tanked. Frankly, the 2% loss for the Nasdaq was largely a result of Nvidia’s fall, which erased about $230 billion from the chip giant’s valuation. Shares of Nvidia tumbled 6.2% a day after the company unveiled its next-gen gaming graphics cards at the CES tech trade show in Las Vegas (and just as shares hit an intraday record).

January 8, 2025 at 8:55 pm #17376January 8, 2025 at 8:46 pm #17375

January 8, 2025 at 8:55 pm #17376January 8, 2025 at 8:46 pm #17375NAS100 DAILY 4 HOUR CHART –Bounced off support

As noted yesterday, 20956 needs to hold to prevent a run at the 20616 low. … test of this level geld dead on… another example of the power of The Amazing Trader

Expect some chop waiting for Friday’s US jobs report.but needs 21212+ to negate the downside risk

Note cash market is closed on Thursday for a Day of Mourning for the passing of President Jimmy Carter.

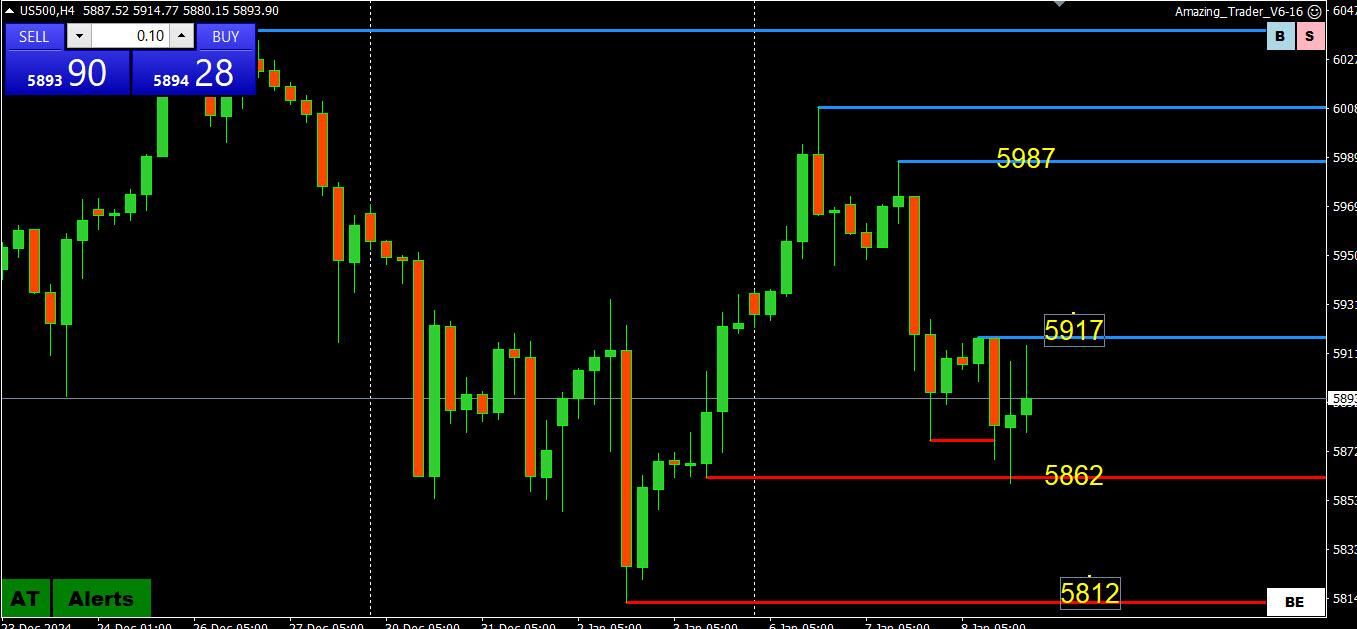

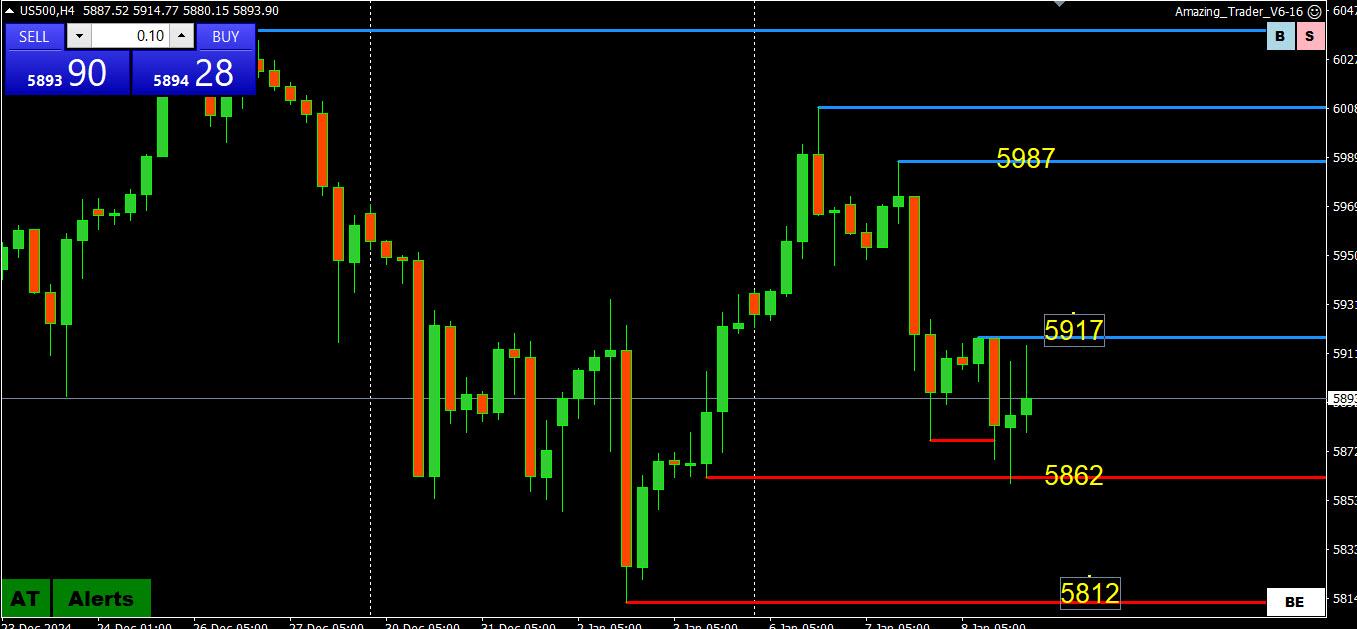

January 8, 2025 at 8:43 pm #17374US500 4 HOUR Chart –Held support

As noted yesterday, to prevent another run at 5800, 5862 needs to hold…. 5862 was tested and held dead on… yet another example of the power of The Amazing Trader_

Otherwise, no change…while within 5800-6000, look for 5900 to set the tone but needs 5917+ to negate the downside risk

Note cash market is closed on Thursday for a Day of Mourning for the passing of President Jimmy Carter.

January 8, 2025 at 8:06 pm #17373AnonymousHi Caribbean Rafe

No idea who created Bitcoin.

Will have to go trough that book one day, for what am culturally more traditional and was against system that would jeopardize our fiat system (sure with many limits but its that what makes our society functioning now couple centuries).

7 transactions per second was not what the original developers thought – the book says -, that is not feasible as a substitute for anything financial/monetary if not pushing the value higher, but not a positive evolution of cryptos for sure.

Technically Bitcoin has all the traits of a Ponzi scheme. Do You remember that Plane Money Game from the 80s – somehow so its Crypto.

Briefly sow some from the book already and apparently the original creators of Bitcoin where taken off somewhere in the 2009.

Then there were huge problems back in the 2017 as the Open source code of Bitcoin was about to be taken out too, so they created a fork, that of the Bitcoin Cash (that is apart quoted) to resemble the original one.

That to say that is quite simple to build as many different cryptos with the same open source code. How much is Linux worth e.g. How much an Open Source could be valued. As I understand Open Source falls into the Non Profit segment of technology.

That said, past year, heard Tucker Carlson say Bitcoin was created by the ZIA.

Many bad articles been printed around about mafias, secret services bad agents, military and other linked figures laundering money trough various cryptos.

From a more broader Economic/Fiscal/Monetary point of view, of which am more interested in general, Bitcoin is both inflationary as well as a destabilizator of the US Dollar.

Beside that that huge energy consumption in times of a developing energy crisis is a bad idea, in my opinion.

Yet I know almost nothing about – just remember long ago – some 15 and more years been little curious and took couple balance sheets from the various Bitcoin and linked society. If was the SEC I would prosecute them all.

There were strange tricks and balance abnormal numbers that did not fit… some of the tricks were e.g. particularly evident between the miners expenditures and the value of the assets.

So ..my 2cents

Strange times indeed

Best wishes in 2025January 8, 2025 at 7:50 pm #17372AnonymousFOMC Minutes from Nick

Nick Timiraos

The Fed turns cautious: “Recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process [of bringing inflation to target] could take longer than previously estimated.” http://www.federalreserve.gov/monetarypoli…

January 8, 2025 at 7:38 pm #17371January 8, 2025 at 7:33 pm #17370January 8, 2025 at 7:08 pm #17369 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View