- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 9, 2025 at 5:49 pm #17525

JP// unemployed people esp peasants have no option but to join the army to serve… What we want is for them to remain employed but demanding higher pay… considering that things are so cheap in China but which will become expensive because rather than spending on the welfare programs for their people they will have to instead spend on infrastructure they built and which requires excessive funds which can only be financed by treasury sales and if we pay heed to the fact that tax evasion in china is just too prevalent and might cause the pretty ladies in the government to have many sleepless nights.

January 9, 2025 at 5:48 pm #17524January 9, 2025 at 5:42 pm #17523January 9, 2025 at 5:37 pm #17520January 9, 2025 at 4:16 pm #17516January 9, 2025 at 3:47 pm #17515January 9, 2025 at 3:28 pm #17510AnonymousJanuary 9, 2025 at 3:02 pm #17468January 9, 2025 at 2:35 pm #17418Normally the real 2025 would start after the US jobs report dustsettles as trends become clearer but this year is different.

The focus then shifts to January 20, inauguration day and a likely barrage of executive orders from President Trump. Of most interest to currency traders will be anything to do with tariffs..

January 9, 2025 at 2:11 pm #17413AnonymousEU Equities – Its the French guys under steroids

They were just waiting another small liquidity day to make the big again.

Yet what I’ve heard its not french the french traders, but a bunch of english traders that escacped from london…

that probably ate too much fromage… the CAC 40 is back to 7500

this while another government is about to fall and a 6 or 7% deficit is happily running on…

the time will come this game will not go on

not today … Its Jimmmy Carter’s day

so relax.. let them play

January 9, 2025 at 1:32 pm #17412January 9, 2025 at 1:14 pm #17411January 9, 2025 at 11:57 am #17410U.S. Treasury yields fell on Thursday ahead of a shortened trading session as the bonds market will close early in honor of the late former U.S. President Jimmy Carter.

At 4:33 a.m. ET, the 10-year Treasury yield was more than two basis points lower to 4.67%, while the 2-year Treasury yield was more than one basis point lower at 4.27%. On Wednesday, Treasury yields topped 4.7%, its highest level since April.

Bond market trading will end early at 2 p.m. ET.

January 9, 2025 at 11:34 am #17409January 9, 2025 at 11:27 am #17408NEWSQUAWK US OPEN

USD maintains strength ahead of Fed speak, Gilts briefly touched 89.00 but quickly pared

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mixed whilst US is away amid the National Day of Mourning in honour of President Jimmy Carter.

Pound under pressure as Cable hangs by a thread; DXY broadly firmer vs peers (ex-JPY).

Gilts gap lower and hit 89.00 but have since pared into an imminent parliamentary question, hefty European supply well received.

Subdued trade in energy but base metals tilt higher.

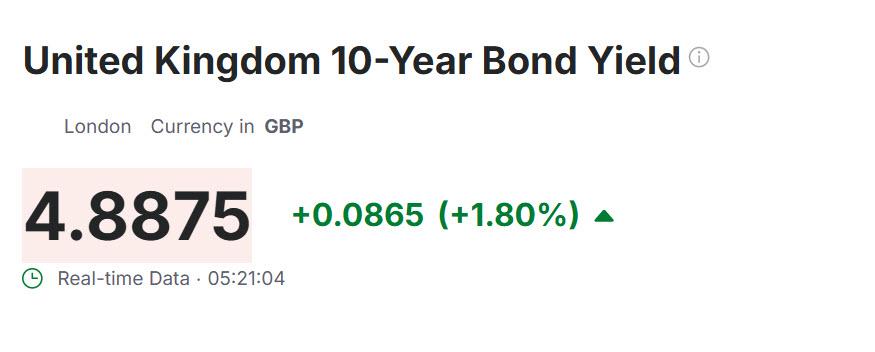

January 9, 2025 at 10:45 am #17405LONDON, Jan 8 (Reuters) – Britain’s government borrowing costs have leapt this week, adding to the challenges facing finance minister Rachel Reeves who is planning to sell hundreds of billions of pounds’ worth of bonds this year to fund public services and growth-boosting investments.

January 9, 2025 at 10:27 am #17404January 9, 2025 at 10:19 am #17403January 9, 2025 at 10:12 am #17402GBPUSD MONTHLY CHART – IS THE BOE IN

If I was the BOE I would be looking to slow the bond inspired sell-off by covertly intervening in GBPUSD.

The key level to defend is 1.2232 (and 1.22) as a firm break would expose 1.20

Low 1.2238… back above 1.23 is needed to slow the risk

Watch UK bonds nd EURGBP for clues

January 9, 2025 at 10:10 am #17401AnonymousEuropean Retail Sales come poor and below expectations

0.1% M/M (forecast 0.4%)

1.2 Y/Y(that, by the books of analysis, It is said Equities bearish)

It is very clear this market is manipulated by algos and capital players in accordance with the central banks.

And it is quite clear the liquidity is very poor there.

Most of the algorithmic liquidity trades is actually virtual, It is made by complex netting digital strategies. Generally in the old times this was called noise. Nowadays seem most don’t know…it appears as a narrative of it all, of the chart from yesterdays.. as to be news, as to be information.. its again just redundancy, a way to manipulate the reality that be

Its another algo program we follow as atomized goats…

there are no humans anymore making the pricing of markets.. Its the machines, and those don’t think

What will come with AI i don’t know… but bet will be very different, probably it already is

even in financial markets…

Not sure being in social media is a good idea then

It appears as a Technological Era, that of the first Internet culture has come to an end

Best wishes in this New Cosmo

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View