- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 10, 2025 at 11:22 am #17560January 10, 2025 at 11:00 am #17559January 10, 2025 at 10:36 am #17558January 10, 2025 at 10:29 am #17557January 10, 2025 at 10:19 am #17556Anonymous

Deutsche going all-in with “this time is different”, saying sell sterling vs a basket of EUR, USD, JPY, and CHF

Do remember some ago some NYC Economist labeled the UK as a new emerging market.

Yet, most forget the heritage of the actual UKs problem. What was that huge abnormal QE doing there at BOE.

There are limits to things, to theories, to economic models et all.

There are breakevens here and there, no matter how resilient they want to show up.

___________________

Btw Resilience is a term that psychoanalysis has stolen from mechanics!

It’s about the endurance of materials, not of people or else._________________

That said I don’t know what will happen. But seems clear the old Global model has come to an end.

Suspicion is we are witnessing sort of Neo-Colonial Era 2.0

But this time will be different, as It ever was.

January 10, 2025 at 10:14 am #17555Using my Platform as a HEATMAP shows

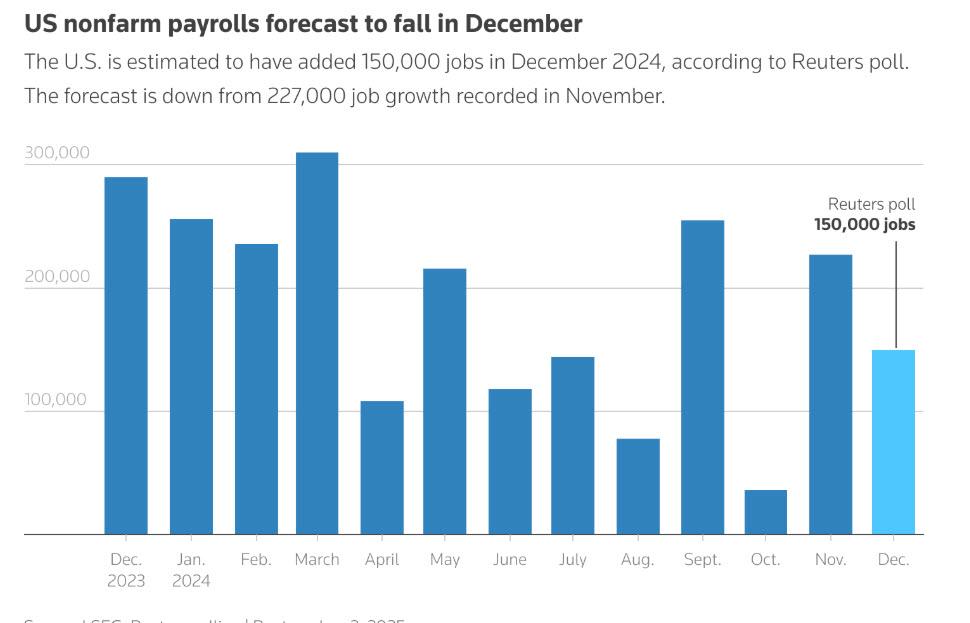

Markets on hold awaiting the US jobs report in 3+ hours

GS and Citi calling for a weaker report …

But not showing up in bonds, where yields have edged higher

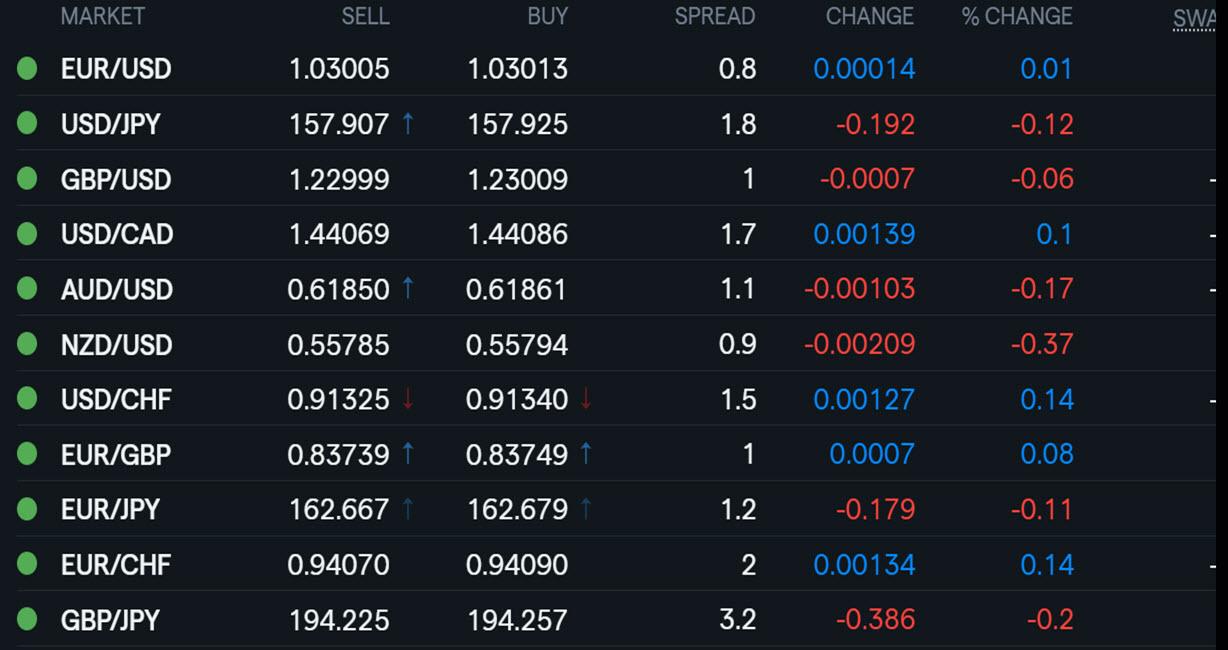

To keep it simple, watch big figures to guide the respective tones post-data

EURUSD 1.03

USDJPY 158** (traded 4 days in a row)

GBPUSD 1.23

USDCAD 1.44

AUDUSD .62**

**More significant big figures than the others

January 10, 2025 at 10:07 am #17554Anonymous10 January 2025

Tomorrow I shall be sober – French editionIn our lead story this morning, we write about a budget compromise in France – one that mostly ignores the fiscal trajectory agreed with the EU – the new stability is already dead on arrival; we also have stories on the logical fallacies behind Friedrich Merz’ economic strategy; on the fall of demand for electric cars in Germany; on the high degree of interconnectedness in the global gas markets; on Scholz’ veto of arms deliveries to Ukraine, and, below, on what appears to be an empty threat.

January 10, 2025 at 10:04 am #17553January 10, 2025 at 10:01 am #17552AnonymousJanuary 10, 2025 at 2:51 am #1755110-yr at 9:49 PM EST 4.683%

here is jeff again:

Friday’s jobs report could present a mixed view of the labor market. Here’s what to expect

January 9, 2025 at 10:25 pm #17550In our blog

While most (if not all) retail traders do not trade off monthly charts, it pays to keep an eye on them for the major trends. Only those with deep pockets or those who do not use leverage can ignore the noise and have the staying power to trade off these longer term charts.

January 9, 2025 at 9:53 pm #17537XAUUSD – Gold Daily

Supports : 2660.00, 2640.00 & 2620.00

Resistances : 2680.00, 2695.00 & 2735.00

As proven time and time again , my “Historical” trend lines and angles are working perfectly.

But what does it mean ???

Well, if Gold manages to go over 2735.00 in coming days, we should be seeing new Rally in which case Target is in 3.000 area.

But if not, it is going to be a prolonged correction, lading all the way to 2320.00

January 9, 2025 at 9:43 pm #17536

January 9, 2025 at 9:43 pm #17536EURUSD Daily

Downtrend is intact – so far so good.

Only thing that bothers me right now is a lack of a new low today – and it is easy to blame it on President Carters funeral ( he left us way too early…) , but I still don’t like it.

You might think that I am trying to find a needle in a haystack , but I know exactly what am I saying : Patterns are never wrong , and by current one we should see another test Up tomorrow – so be aware of that possibility!

Resistances : 1.03250, 1.03450 & 1.03850

Supports : 1.02850, 1.02500 & 1.02250

January 9, 2025 at 9:24 pm #17535

January 9, 2025 at 9:24 pm #17535Why is Crypto market in Red today?

Reasons are many, but one obvious jumps out – Overbought – Correction is not only necessary, but underway….

So let’s see how The Top Coin – Bitcoin looks on the daily chart

Fact that Upward Trend is broken cannot be denied, but for Bitcoin to continue Down is more important how it is going to close tonight – below that trend line or above it.

Be aware that Upward Angle is lost, and it suggest more losses to come.

In my opinion, for BTC to regain strength and be able to make renewed attempts Up , it must not lose 87.350.00.

As long as it manages to stay within the Upper Channel, it will be able to make new rally.

For more Crypto insights continue reading….

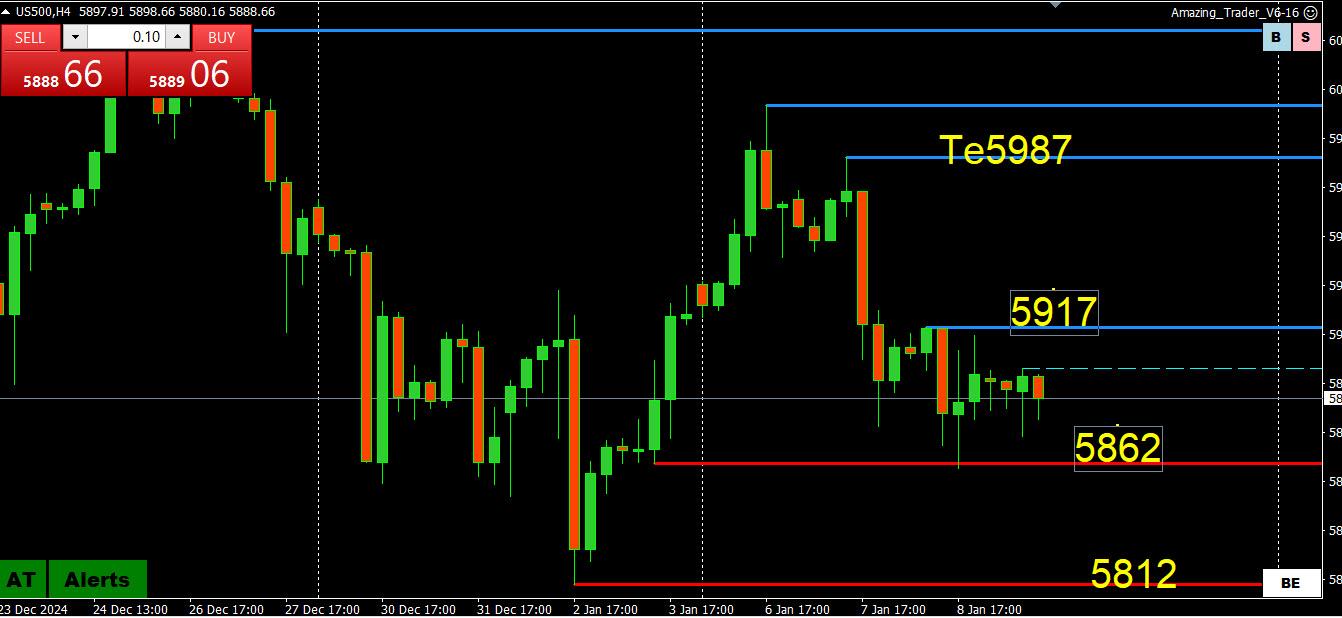

January 9, 2025 at 9:13 pm #17533January 9, 2025 at 9:04 pm #17530US500 4 HOUR CHART – NO CHANGE

No change from yesterday except we are one day closer to the Dec jobs report.

to prevent another run at 5800, 5862 needs to hold…. 5862 was tested and held dead on… yet another example of the power of The Amazing Trader_

Otherwise, no change…while within 5800-6000, look for 5900 to set the tone but needs 5917+ to negate the downside risk

January 9, 2025 at 7:47 pm #17529AnonymousThe cost of French debt reaches new heights

The rate reached 3.4% and the risk premium continued to widen close to 90 basis points and move closer to Italy’s. This is a movement that is part of a general context of rising long-term rates.

It’s a movement that won’t simplify the government’s fiscal equation. The yield of the ten-year French sovereign bond reached 3.40% in the morning on Thursday, January 9 – highest since 2011 – before returning to 3.38%. The yield has increased by 20 basis points since the beginning of the year.

January 9, 2025 at 7:44 pm #17528AnonymousFrance

Bankruptness: the EPP time bomb

With a bleak economic context, some small businesses find it more difficult to repay their state-guaranteed loans. This will fuel the 2025 defaults, which are expected to peak.66.422. This is the number of company failures in France in 2024. An increase of 28% compared to the pre-Covid period, according to BPCE figures The Observatory published on Wednesday.

The State-guaranteed lending scheme helped companies, the majority of which were SMEs and SMEs, to hold the shock during the COVID-19 pandemic.

January 9, 2025 at 6:16 pm #1752710 days and 22hrs …

–

Microsoft contributes $1 million to Trump’s inauguration fund

Google donates $1 million to Trump’s inauguration fund, joining other tech giantshahaha, and they dont feel one once worth of shame or embarrassment

the grifters that they aredid you see zooki’s watch the other day as he was “getting new religion” ?

January 9, 2025 at 6:07 pm #17526 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View